Denied Insurance Claim Lawyer: Baltimore’s Homeland | 21212

TL;DR – Homeland 21212 insurance claim denial lawyer

- Homeland’s 21212 zip code is defined by historic, well-maintained homes, high property values, and complex coverage questions involving aging systems, stormwater, and tree damage—conditions that often drive homeowners insurance claim denied disputes.

- If your homeowners insurance claim denied letter cites “wear and tear,” “pre-existing damage,” or “water exclusion,” that is not the end of the road; it is the start of a step-by-step challenge with an experienced insurance claim denial lawyer.

- A Baltimore homeowners insurance attorney familiar with homeland’s covenants, steep lots, mature trees, and basement water issues can analyze your policy, gather evidence, and litigate when an insurer refuses to pay what the policy actually promises.

- Residents seeking a home insurance claim lawyer in homeland 21212 frequently face disputes over water damage claim denied, roof damage claim denied, and frozen pipe / burst pipe claim denied after winter storms and nor’easters.

- In summary: if you live in homeland 21212 and your homeowners claim denied letter does not match the damage you see in your house, a Baltimore insurance dispute lawyer can challenge the decision, negotiate, or sue to enforce your rights under Maryland law.

Estimated reading time: 20 minutes

Denied Insurance Claim Lawyer: Baltimore’s Homeland | 21212

Baltimore’s homeland neighborhood in the 21212 zip code is one of the city’s most distinctive, covenant-protected communities. Tree-lined boulevards, stone and brick houses from the 1920s and 1930s, and carefully maintained landscaping make homeland look picture-perfect on the surface. But behind the postcard images are very real insurance problems: aging slate roofs that leak under wind-driven rain, stone foundations that allow seepage into finished basements, clay sewer lines that back up, and mature trees that can bring down power lines or crush a slate porch in a single storm.

Video Transcript: Insurance Claim Denials in Homeland, Baltimore (21212)

The following is a verbatim transcript of a video in which Baltimore insurance claim denial lawyer Eric T. Kirk explains why homeowners insurance claims are denied in Homeland (21212), how insurers evaluate storm and roof damage, and why Maryland insurance policy language controls these disputes.

Why Insurance Adjusters Claim Roof Damage Is “Pre-Existing” After Storms

Why do Baltimore claims adjusters frequently say that roof damage is pre-existing after a known storm? My name is Eric Kirk. I am an attorney herein Baltimore and I’ve been practicing law for 30 years. During that time, I’ve litigated consistently against the nation’s major insurance companies to get them to do one simple thing, to pay just and fair compensation to my clients who are entitled to that just and fair compensation.

How Insurance Adjusters Are Trained to Minimize or Deny Storm Claims

It’s a rare situation indeed that a roof sustaining damage in a storm was previously in a pristine condition. Any roof that has been on abuilding for a few months or a few years is not in its perfect original condition.

Why Maryland Insurance Policy Language Controls These Disputes

Insurance adjusters are trained to identify potential unrelated, uncovered causes and then argue that the entirety of the loss is in fact due to those uncovered events.

This transcript is provided for educational purposes and reflects a general discussion of denied homeowners insurance claims under Maryland law.

When a homeowners insurance claim denied letter arrives in homeland, it often follows months of back-and-forth with adjusters, roof “inspections,” engineering reports, and arguments about whether the loss is “wear and tear” or “sudden and accidental.” Those are legal distinctions, not just technical ones. A seasoned insurance claim denial lawyer who routinely litigates against insurers in Baltimore courts understands how policy exclusions, water-damage endorsements, and anti-concurrent-cause clauses are used to reduce or avoid payment.

For a homeowner in homeland 21212, retaining an insurance claim denial lawyer rooted in Baltimore practice means putting someone in your corner who knows the difference between a legitimate limitation and an overreaching denial. A Baltimore insurance dispute attorney who has battled insurers for decades can interpret your insuring agreement, reconstruct the loss, apply Maryland law, and—when necessary—file suit to compel payment. Homeland residents searching for a homeowners insurance claim denial attorney are not looking for theory; they are looking for practical, trial-tested advocacy that turns a one-page denial letter into a contested case the insurer can no longer control on its own terms.

Throughout this page, you will see how a Baltimore insurance claim lawyer approaches denied claims in homeland, how local housing stock and geography affect coverage disputes, and what step-by-step actions you can take after your insurer says “no.”

Where is Homeland in Baltimore, Maryland?

Homeland sits in North Baltimore, within the 21212 zip code, directly south of Lutherville-Timonium and just north of Govans. Bounded generally by Homeland Avenue, Charles Street, and Northern Parkway, the neighborhood spreads across gently rolling terrain with a network of small lakes and landscaped circles that make it one of the most carefully planned communities in the city. Many streets radiate from or frame the Homeland “lakes” and formal gardens that are maintained by the Homeland Association, a covenant-enforcing body that plays a daily role in how homes look and, indirectly, how insurers view risk here. Wikipedia+1

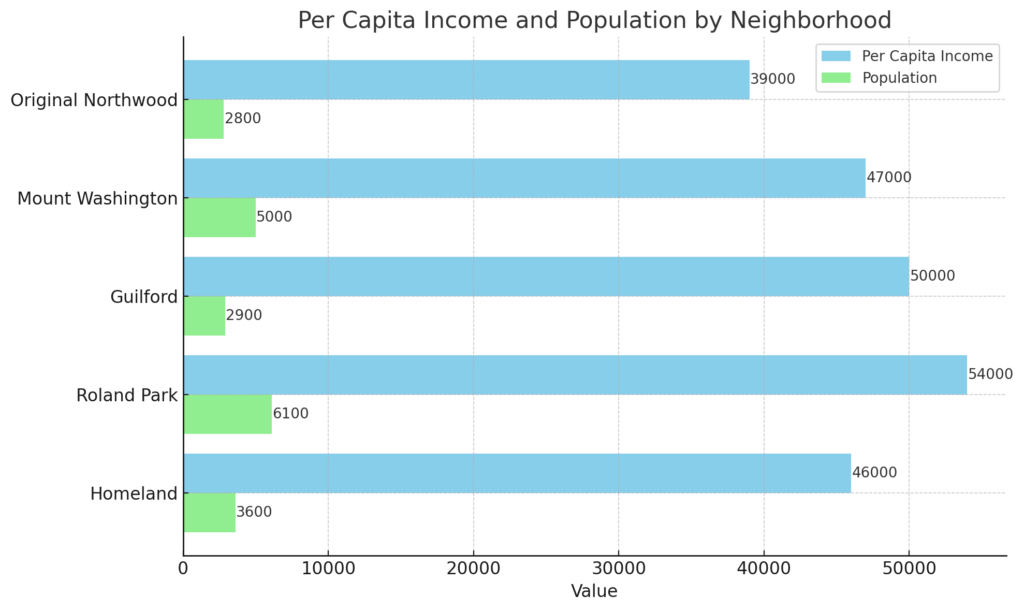

The houses in homeland are overwhelmingly detached stone, brick, or stucco structures built mainly between the 1920s and 1950s, with steep slate or tile roofs, masonry chimneys, and original plaster interiors. According to neighborhood housing data, the average home in homeland was built in the late 1940s, placing a large share of the housing stock well over 70 years old. Proximitii+1 That kind of age matters when a homeowners insurance claim denied letter cites “deterioration” or “long-term seepage.” Insurers know these are older houses; they use that fact to argue that damage is “progressive,” and therefore outside the sudden-loss coverage promised in the insuring agreement.

Homeland’s location also creates specific exposure patterns. To the west, traffic along Charles Street and around Loyola University Maryland and Notre Dame of Maryland University increases the risk of vehicle strikes to stone walls, corner fences, and parked cars. Census Reporter To the east, slopes leading down toward York Road can funnel water toward basements and garages when storm sewers back up or when unusually intense rainfall overwhelms surface drainage.

From an insurance standpoint, homeland is a classic example of a high-value, older neighborhood where coverage disputes are shaped by building age, complex roofs, mature trees, and basement living space. A homeowners insurance attorney assessing a burst-pipe or storm-loss claim in homeland 21212 will look not only at the obvious damage, but also at:

- Whether the carrier is trying to recast a sudden roof failure as “long-term deferred maintenance.”

- Whether an adjuster has ignored the effect of topography and grading when denying a water damage claim denied as “groundwater” rather than rain intrusion.

- Whether a denial letter misreads local building codes or neighborhood-specific requirements that affect repair cost, like slate replacement or masonry restoration.

Because homeland is covered by recorded covenants administered by the Homeland Association, many owners are required to repair in-kind with similar materials. That can dramatically raise the true replacement cost of a slate roof, stone porch, or decorative ironwork. When an insurer insists on cheap asphalt shingles or incomplete masonry repointing, a home insurance claim lawyer familiar with homeland can argue that local covenants and code-upgrade coverage must be honored in full.

Homeland’s proximity to institutions like Loyola University Maryland and Notre Dame of Maryland University, plus easy access to York Road retail and Northern Parkway, means residents often juggle busy professional lives with complex claims. Census Reporter+1 When a homeowners claim denied letter arrives, the last thing a homeowner needs is to decode policy language alone. A Baltimore insurance claim denial lawyer who routinely handles disputes in homeland 21212 can step in, analyze the denial, and prepare the case for negotiation and trial if needed. In summary, homeland is more than a beautiful North Baltimore neighborhood—it is a place where high-value properties, old infrastructure, and aggressive claims practices routinely collide.

Local streets like Charles Street, Homeland Avenue, and Springlake Way wind through varied topography, which can push stormwater across foundations. Even though Homeland is not a major FEMA flood-zone problem area, older basements, clay soil, and legacy drainage reveal higher risk for seepage and backup — often followed by denials. These property characteristics, combined with mature tree canopy, increase limb-strike and roof-shingle claims. The most important takeaway: Homeland’s housing character creates localized insurance challenges that can be disputed with documentation, engineering, and legal pressure.

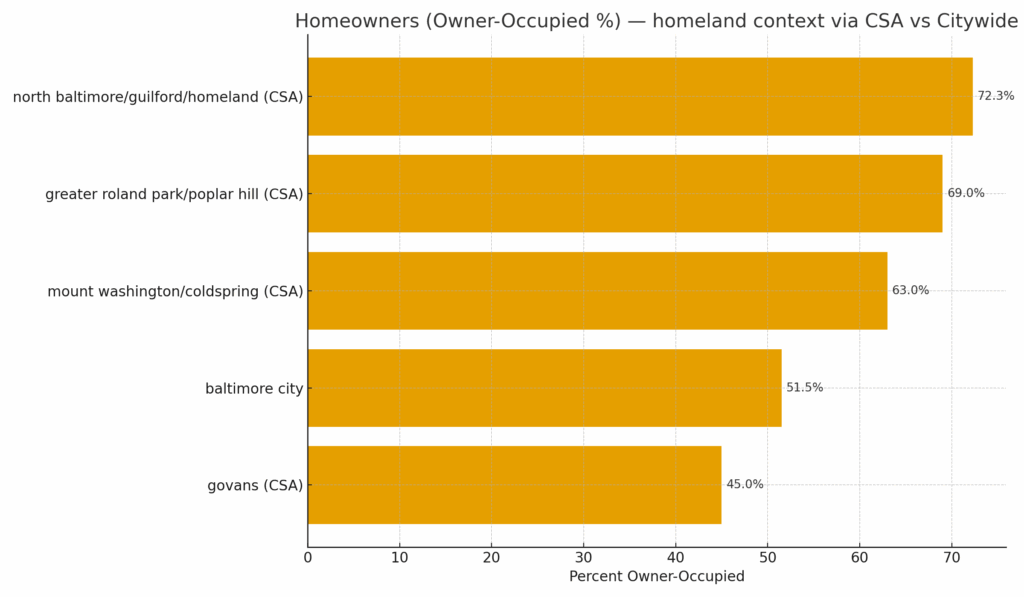

You can find neighbor governance + service structure through Baltimore City’s core portal at baltimorecity.gov (permits; DPW requests; water line repairs), and neighborhood statistical context at BNIA Vital Signs via bniajfi.org under the Greater Roland Park/Poplar Hill community statistical area — the CSA where Homeland sits geographically and culturally.

✅ Nearby Neighborhoods

Homeowners near

Govans,

Cedarcroft,

and Homeland

often face similar coverage disputes and can find guidance on those dedicated pages.

In summary, Homeland’s exact location, century-old architecture, and protected landscape create a distinctive risk environment — and insurers lean heavily on maintenance-based and cosmetic-damage denials. Matching these tactics requires detailed claim-file review and structured escalation.

Time needed: 365 days

How to Move Forward After A Denied Insurance Claim in Homeland.

- Interview, Consult, then hire A Baltimore insurance coverage dispute attorney

The full answer: not every claim needs litigation. However, once your homeowners insurance claim denied letter is issued, the insurer has locked in its official position. Insurance companies are governed by Maryland law. At that point, the adjuster is not simply “evaluating”; they are defending a decision they made. Legal rights flow.

Read the Law: Section 1-101 of Maryland Insurance Article - An analysis of the legal and factual basis of denial is required

A homeland insurance claim denial lawyer looks at that same letter very differently. Instead of asking, “What is the company willing to pay?” the first question becomes, “Can this denial be challenged under the policy and Maryland law?” For a homeowner in Homeland 21212, where replacement costs and code-driven repair requirements can be high, even a modest underpayment or partial denial can mean tens of thousands of dollars in out-of-pocket loss.

- Compare the language of the insuring agreement, exclusions, and endorsements against the actual facts at your Homeland residence.

A Baltimore insurance coverage dispute attorney can compare the language of the insuring agreement, exclusions, and endorsements and spot where the adjuster has over-extended an exclusion—especially on storm damage claims or roof damage claim denied disputes.

Preserve evidence through photos, expert inspections, and, when needed, invasive testing to prove water pathways, structural movement, or fire patterns.

Homeland Insurance Law 101: The insurance company has to prove the exclusionary language [1] exits [typically not hard] and 2] that is actually excludes your claim [this is the battleground in insurance litigation]. - Preserve evidence through photos, documents, videos et al.

Where needed, expert inspections, and, when necessary, invasive testing to prove water pathways, structural movement, or fire patterns.

Homeland Insurance Lawyer’s Tip #6. Few things will frustrate the victim of a wrongly denied claim more than hearing their insurance company stating they did not protect, or document, the condition of their home

Why Was My Homeland Homeowners Insurance Claim Denied?

Common Reasons for Homeland Homeowners Insurance Claim Denials.

- “Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.”

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Homeland neighborhood

Homeownership defines homeland’s character. The neighborhood’s covenants and its active Homeland Association require property owners to maintain front yards, architectural details, and exterior finishes to a high standard. That sense of order and stability is reflected in the data: homeland has a relatively small residential population (roughly 3,300 residents) in a geographically compact area, with a large share of homes owner-occupied and valued well above the city average.

Homeland Factors

| Local Factor | Why This Matters for Insurance |

| Historic slate and tile roofing | Older, high-end roofing systems are expensive to repair; insurers may label storm damage as “wear and tear” to deny or reduce roof claims. |

| Stone foundations and finished basements | Stone walls and finished lower levels are vulnerable to hydrostatic pressure and seepage, leading to water damage claim denied disputes over how the water entered and whether exclusions apply. |

Most homeland houses are single-family, detached dwellings rather than rowhomes. They include slate roofs, dormers, stone chimneys, wood windows, and finished basements that were never designed with today’s intense rainfall patterns in mind. That combination—older construction, high finishes, and high values—makes homeland a neighborhood where homeowners insurance claim denied disputes frequently arise over relatively small but expensive failures:

- A frozen pipe in a rarely used third-floor bath that bursts and ruins original plaster ceilings and hardwood floors.

- A frozen pipe / burst pipe claim denied on grounds that the house was “not properly heated,” even when the homeowner can show thermostat records or electric bills.

- A water damage claim denied when stormwater pushes through foundation walls or under basement doors during cloudbursts, and the carrier insists on labeling it “groundwater” or “drain backup” excluded by policy language.

Because homeland’s homes are older but valuable, insurers scrutinize every claim for hints of “wear and tear,” “repeated leakage,” or “long-term seepage.” A Baltimore insurance claim denial lawyer handling a homeland case will often start with a detailed inspection of roofing, flashing, gutters, and grading, then compare those facts against the policy’s exclusions and any water-damage endorsement.

1: Why can Homeland homeowners see so many water-related insurance disputes?

A: Homeland’s older stone foundations, finished basements, and sloped lots can make it vulnerable to heavy-rain events and stormwater intrusion. Insurers can classify these losses as excluded “groundwater” or “seepage.” A Baltimore insurance dispute lawyer can review the facts and policy language to see if the loss should instead be treated as covered storm damage.

A: Yes. You need to familiarize yourself with process. Covenants and standards enforced by a Homeland association may mean many repairs must be done with comparable materials, like slate, stone, and high-quality windows. When a carrier estimates cheaper replacements, a homeowners insurance attorney can argue that your policy and ordinance-and-law coverage or applicable coverages require repairs consistent with neighborhood standards.

A: They can be, especially in older homes with third-floor bathrooms, crawl spaces, or partially heated additions. Insurers sometimes deny frozen pipe / burst pipe claim denied cases by alleging inadequate heat. A detailed investigation of thermostat settings, utility usage, and weather data can help a home insurance claim lawyer in homeland challenge that conclusion.

Homeland Insurance Lawyer’s Tip #567. This is a frequent insurance defense tactic- talking about a claim in terms of “these claims” which are routinely, always, or commonly denied. Every claim has unique facts that must be measured by the policy.

A: Proximity to Loyola University Maryland and Notre Dame of Maryland University increases traffic, parking congestion, and occasional student-related incidents, if for no other reason than their presence. For landlords or owners with rental units, that can potentially mean more liability claims, tenant issues, or property-damage disputes.

Homeland Insurance Lawyer’s Tip #55. A Baltimore insurance claim denial lawyer may provide guidance and help assess whether a denied liability or property claim arising from those circumstances should be revisited.

A: Yes. Insurance company appraisals and engineering reports are not infallible. If an insurer’s engineer minimizes roof, foundation, or structural damage to your Homeland property, you must obtain competing opinions and challenge that evidence through negotiation or in court.

Homeland Insurance Law 101: This is what we do. I am a lawyer, not an engineer. But we can retain our own engineer, plumber, contractor other professional to give an unbiased, independent opinion.

A: Once the denial is issued, deadlines begin to run, and evidence can be lost. Consulting a Homeland insurance claim denial lawyer early gives you a better chance to protect your rights and build a complete record. The safest time is as soon as you receive a denial or partial-denial letter—or earlier if you sense the carrier is looking for reasons not to pay.

Homeland Insurance Lawyer’s Tip #919. “If you sense the carrier is looking for reasons not to pay.”…… your senses do not deceive- your insurance company is not paying, not denying, but your home is still wrecked. This scenario occurs with frequency, and I like to call this legal/insurance limbo a “soft denial”.

From a homeownership perspective, homeland residents have a great deal at stake. Many have long-term equity in their houses, and a denied claim can jeopardize that equity if major repairs must be funded out of pocket. An insurance claim denial lawyer who knows homeland 21212 will emphasize the policy’s promise to restore the property to its pre-loss condition, push the insurer to honor code-upgrade and matching requirements, and, where needed, file a lawsuit to enforce those contractual obligations.

Homeland Resources

Loyola University Maryland – major local institution affecting rental demand, student housing, and certain liability risks.

Homeland Association – neighborhood covenants, architectural review, and community governance.

Baltimore City Department of Planning – Neighborhood Profiles – official planning and demographic context for homeland and nearby communities.

Baltimore City Health Department – North Baltimore/Guilford/Homeland Health Profile – public-health and housing-related data for the broader homeland area.

Baltimore City Open Data – Neighborhood Statistics – property, permits, and code-enforcement data that often intersect with insurance disputes.

Notre Dame of Maryland University – nearby campus influencing local traffic, parking, and off-campus housing patterns.

Proximity to Notre Dame of Maryland University at ndm.edu and Johns Hopkins University at jhu.edu has long influenced regional contractor activity; many Homeland homeowners rely on licensed contractors familiar with local code. These connections matter when insurers doubt workmanship, delay reinspection, or request repeated documentation. Routine interaction with Baltimore City regulatory infrastructure (permits, DPW, 311) through baltimorecity.gov can generate helpful paper trails.

Chimney leaks, ice-dam damage, and slate failures are common winter claims. Insurers tend to assert “age-related decline,” requiring precise causation analysis — often with a roofer or engineer. Similarly, pipe failures behind plaster walls or radiators get blamed on “freezing” or “deterioration” exclusions without proper review. A Homeland homeowner benefits from an evidence-forward plan:

• timestamped photos,

• receipts,

• weather-pattern documentation, and

• sworn proof of loss.

In summary, Homeland’s architecture and governing covenants make it one of Baltimore’s most distinctive neighborhoods — but also create recurring friction points when carriers see expensive homes and try to avoid paying full reconstruction cost. When an insurance claim denial lawyer documents, litigates, and pushes for trial, the balance shifts.

For residents facing insurance claim denials, understanding the neighborhood’s unique characteristics is essential. Collaborating with an insurance claim denial lawyer familiar with Homeland’s specific context can provide invaluable assistance in addressing and resolving such disputes.

Homeland Resources

Here are some resources for Homeland residents:

- Homeland Association: The official governing organization of the Homeland neighborhood, offering community news, events, and resources.

- Greater Homeland Historic District – National Park Service: Information about Homeland’s designation as a historic district and its significance.Baltimore City

- Baltimore City Department of Planning – Homeland Historic District: Details on the neighborhood’s historical and architectural preservation efforts.

- The Three Arts Club of Homeland: A nonprofit organization promoting appreciation for music, literature, and arts within the community.t

- Homeland Association Contact Information:

Next Steps After a Homeland Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,—known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—as covering a leaking roof with a giant blue tarp).

- Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

- Comply with Policy Conditions & Your Duty to Cooperate

- Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. In my role as a denied Insurance Claim Lawyer serving Baltimore’s Homeland 21212, I advise all my clients these duties are mandatory.

- Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications

- Your insurance company is required to give a written reason for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking. Statute of limitations.

- Keep all correspondence, including emails and letters, in a dedicated file.

The Denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

How Attorney Eric T. Kirk Can Help with Your Denied Homeland Homeowners Insurance Claim

Your Chosen Insurance Chose Not to Pay You. Choose Me.Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Homeland denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not—

✔ File a lawsuit. I sue insurance companies.

✔ Take your case to trial. I try cases against insurance companies. I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.