Denied Insurance Claim Lawyer: Baltimore’s Guilford

TL;DR

If you live in **Guilford (21218) — Baltimore’s premier neighborhood for historic homes and lush streetscapes — and your homeowners insurance claim has been denied, you need a sharp, seasoned attorney on your side. As a trial lawyer with over 30 years of experience fighting the nation’s largest insurers, I know how to navigate complex denials in Guilford, where older houses, high values, steep repair costs and unique risks can make a claim denial even more costly. If your insurer says “no,” you still have rights — and I will make sure they honour them.

Estimated reading time: 16 minutes

Denied Insurance Claim Lawyer: Baltimore’s Guilford | 21218

Introduction

For homeowners in Guilford, an upscale and architecturally rich enclave of Baltimore, the phrase “Denied Insurance Claim Lawyer | Baltimore’s Guilford” is not just a tagline—it’s a promise of rigorous representation when your insurer refuses to pay. This neighbourhood, defined by grand historic homes, mature tree-lined boulevards and near-campus proximity to institutions like Johns Hopkins University, also carries unique risks: older homes built in the early 20th century, high replacement costs, potential drainage or storm-water issues, and high-value contents. When insurance companies attempt to deny or lowball claims, a seasoned attorney who knows Guilford’s specific circumstances and the tactics insurers use in Baltimore can make all the difference. For over three decades, Baltimore attorney Eric T. Kirk has been a unrelenting advocate for homeowners facing unjust insurance claim denials. In the revered, distinguished neighborhood of Guilford (ZIP 21210), where historic charm meets modern living, residents often encounter unique challenges when dealing with insurance companies.

As an experienced insurance claim denial lawyer, I’m dedicated to ensuring that Guilford homeowners receive the compensation they rightfully deserve.

Eric t. kirk

Guilford’s rich architectural heritage, characterized by early 20th-century homes and meticulously planned landscapes, adds to its allure. However, this historical significance can also lead to specific insurance issues, such as disputes over coverage for aging infrastructure or restoration costs. Understanding the intricacies of insurance policies is a key role of any Denied Insurance Claim Lawyer serving Baltimore’s Guilford and the methods of denial and minimization employed by insurers is crucial. Eric T. Kirk’s extensive experience in challenging denied claims positions him as a valuable resource for Guilford residents seeking justice.

Where is Guilford in Baltimore?

Guilford is a historic neighborhood located in the northern part of Baltimore, Maryland. Bounded by University Parkway to the south, North Charles Street and Linkwood Road to the west, Cold Spring Lane to the north, and York Road to the east, Guilford is renowned for its picturesque streets and stately homes. The neighborhood’s design, influenced by the Olmsted Brothers, features curving streets, pocket parks, and a harmonious blend of architectural styles. One of Guilford’s most cherished landmarks is Sherwood Gardens, a six-acre park renowned for its spectacular spring tulip displays. Located near Johns Hopkins University and Loyola University Maryland, the neighborhood benefits from strong educational and cultural anchors. However, Guilford’s predominately mid-20th-century homes—many constructed around 1946—can create complex insurance situations related to aging infrastructure, deferred maintenance, and preservation constraints.

A Denied Insurance Claim Lawyer for Baltimore’s Guilford well knows residents may face issues such as disputes over policy exclusions, especially concerning damage from aging infrastructure or weather-related events. Given Guilford’s unique characteristics, it’s essential for homeowners to have knowledgeable legal representation when confronting insurance claim denials.

Why Was My Guilford Homeowners Insurance Claim Denied? Common Reasons for Guilford Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company. Duty to Cooperate. EUO.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Guilford Neighborhood

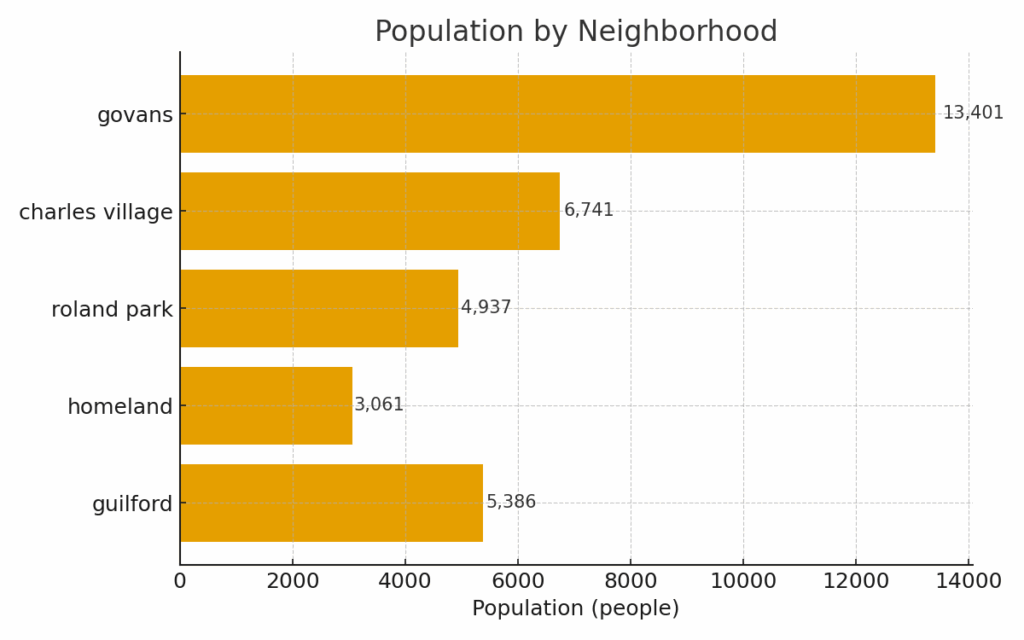

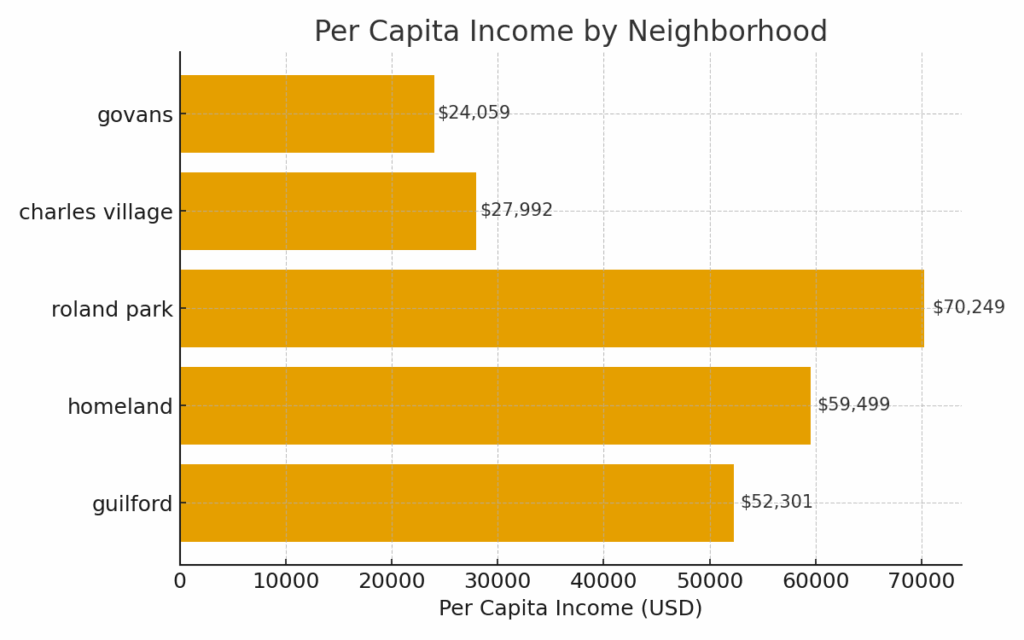

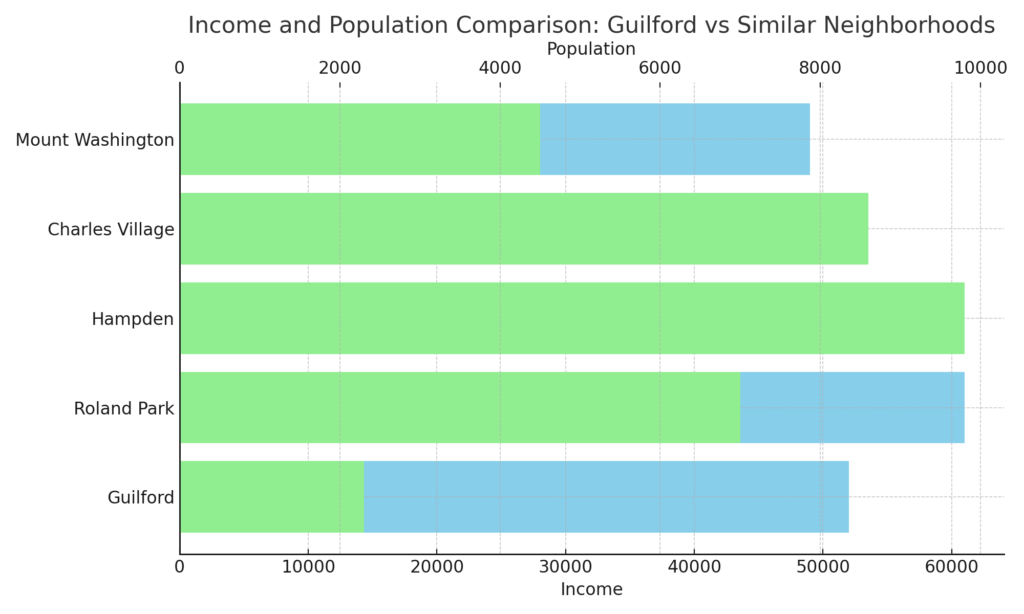

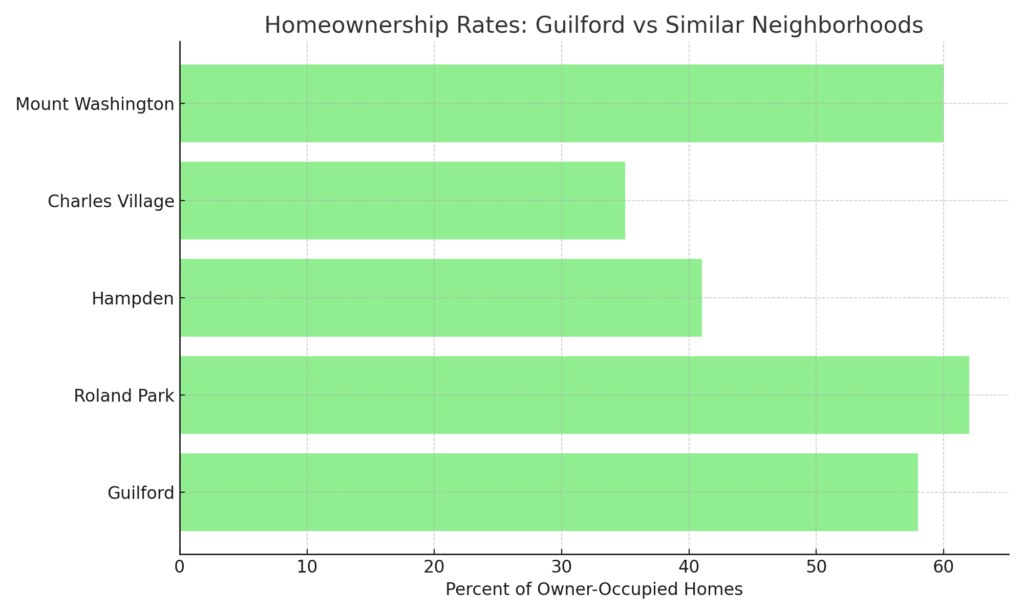

Guilford is home to approximately 2,184 occupied housing units, with a nearly even split between homeowners and renters. The neighborhood’s median home value stands at $375,400, reflecting its status as one of Baltimore’s more affluent areas. The architectural diversity, from Colonial Revival to Tudor styles, adds to its charm.

As your “Insurance claim denial lawyer” for Guilford (21218), I understand homeowners here often expect a level of protection and representation. Their homes are unique; so must be the legal strategy when facing a denial

However, the age of these homes can lead to specific insurance challenges. Issues such as outdated plumbing, aging roofs, and historical preservation requirements can complicate claims. Additionally, while Guilford has a minor flood risk, certain areas may still be susceptible to water damage, especially during heavy rains. Homeowners should be vigilant in understanding their policies and ensuring adequate coverage.

Homeownership in Baltimore’s Guilford Neighborhood

Homeowners in Guilford (21218) benefit from some of Baltimore’s most prestigious properties, significant architectural character and long-standing community identity. The subdivision was planned beginning in 1911 and development followed shortly thereafter. Heritage Preservation The historic character means that many homes were constructed in the early to mid-20th century, built with high-quality masonry, generous lot sizes, and elaborate architectural details. Guilford Association+1 Because many structures are older, maintaining original features and complying with historic-district guidelines (the Guilford Historic District is listed on the National Register of Historic Places) is a reality for owners. Wikipedia+1

In practical terms, this translates into several insurance-related implications:

- Replacement costs are often higher — so damage to historic elements like leaded glass, custom moldings or slate roofs can trigger higher claims and more insurer scrutiny.

- Older homes may have deferred maintenance or infrastructure risks (old chimneys, aging drainage systems, tree-roots in foundations), which insurers may cite when denying claims for deterioration or wear.

- Neighborhood trees and mature landscaping pose storm-damage risks: heavy limbs, large sized trees near houses, older utility lines. Insurers may argue the damage stems from lack of maintenance rather than a covered event.

- Given the high value of properties, homeowners commonly carry higher limits and sometimes specialized policies (historic or high-value homeowner’s coverage). Denials in this class of policy frequently revolve around appraisal, scope of damage or cause-of-loss disputes.

For Guilford owners, choosing the correct policy wording and maintaining thorough documentation is the most important step in the process of filing a claim. When a denial comes, having a lawyer familiar with how insurers treat historic-home claims in Baltimore City makes a major difference.

Hyper-local community resources in Guilford include the Guilford Association, Inc., which regulates architectural covenants and maintains common areas; the adjacent park Sherwood Gardens with its famous tulip display each spring; and the long-standing residential base of Guilford. Live Baltimore+1.

Guilford Resources

- Guilford Association, Inc. – community home site with history and documents.

- City of Baltimore Historic Districts – Guilford – historic-district overview.

- Sherwood Gardens – celebrated public garden in Guilford.

- Live Baltimore – Guilford neighbourhood guide – overview of Guilford’s residential profile.

- Maryland Real Estate historic home development of Guilford – historic estate-to-neighborhood background.

Why Hire a Guilford Insurance Claim Lawyer After a Denied Claim?

When an insurer denies a homeowners insurance claim in Guilford, it’s not just any neighborhood denial—it’s a high-stakes dispute involving valuable real estate, high replacement costs and often historic features.

As your dedicated lawyer, I bring a deep understanding of how insurers operate in Guilford, including common tactics:

Shifting blame to maintenance issues

Disputing causation,

Relying on vague exclusions, or

Arguing that the damage was gradual rather than sudden.

My job is to cut through the fine print, review the policy in detail, evaluate the loss, and hold the insurer to account when they’re wrong.

Time needed: 365 days

How to Challenge A Guilford Insurance Claim Denial — My Steps:

- Step 1: Initial Assessment & Responsiveness

I assess your unique Guilford situation, obtain your policy and denial letter, and clarify the timeline of the loss and your insurer’s actions.

- Step 2: Clear Communication & Evidence Gathering

I analyze and explain in plain language what your policy covers, what the insurer is claiming, and the next steps. I assemble the proof- the documentation, photos, expert evaluations, contractor bids—and keep you updated regularly.

Guilford Insurance Lawyer’s Tip #667: Documentation is vital, especially in a high-value home in Guilford - Step 3: Subject Matter Experience & Advocacy

Drawing on over 30 years of experience, I identify the insurer’s weak points (e.g., they mis-applied an exclusion, or failed to explain causation) and press for full payment. My background means the insurer knows they are facing a lawyer who will take it to court if needed.

- Step 4: Settlement or Litigation Strategy

If the insurer won’t settle fairly, I prepare to file a lawsuit—compile damages, deposition strategy, trial plan—and to keep the process efficient.

Guilford Insurance Law 101: Your insurance company knows litigation is expensive. They will use this against you in every conceivable way. I attempt to counter costs, so you obtain the best result with minimal delay. My focus is always results-driven for Guilford homeowners whose stakes are high.

Next Steps After a Guilford Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

- Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

- Comply with Policy Conditions & Your Duty to Cooperate

- Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

- Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications

- Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations.

- Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney. Do not accept the denial at face value—Not all insurance claim denials are misplaced. Many are. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial? An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

A1: Many Guilford homeowners are in older single-family homes with aging roofs, plumbing, and foundations. Insurers can deny claims by arguing that damage came from “wear and tear” or long-term deterioration rather than a covered event.

Guilford Insurance Lawyer’s Tip #856: Insurance companies look for reasons to deny claims, limit claims, and limit payment on claims. Always. When adjusters see prior repairs, patchwork, or deferred maintenance. Storm, water, or collapse claims in Guilford may be more likely to trigger policy-exclusion arguments.

A2: Guilford 21210 combines many higher-value homes with mature trees, sloped yards, with older infrastructure. While that mix cannot increase the chance of wind damage, falling limbs, sewer backups, and basement water intrusion, Insurers may rate Guilford 21210 differently from denser rowhouse areas,

Guilford Insurance Lawyer’s Tip #6: What you paid in premiums really does not matter after a loss- although it is supremely galling to have the company you paid those premiums to not honor your meritorious claim. Insurers may scrutinize foundation, drainage, and roof issues more aggressively before agreeing to pay.

A3: The most commonly disputed claims in Guilford tend to be roof leaks, interior water damage, mold, and foundation or wall cracking tied to soil and drainage conditions. Because many homes were built decades ago, carriers can often insist these losses are gradual or pre-existing. That dispute over “sudden and accidental” vs. “long-term deterioration” is a recurring theme in insurance litigation.

A4: Yes. Even though insurers frequently deny basement water and sewer backup claims, a Guilford homeowner can challenge the denial if there is coverage language, an endorsement, or ambiguous policy terms that favor the insured.

Guilford Insurance Law 101: Your insurance company has to prove the exclusion applies. Photographs, plumber reports, and records can help show this was a covered, event-based loss rather than simple neglect.

A5: Yes. Homeowners in Guilford 21210 typically deal directly with their own carriers on dwelling and structure claims, while renters may rely on renters’ policies that cover personal property and sometimes loss of use only. They are different coverages, so a different claims adjustment will follow.

Guilford Insurance Lawyer’s Tip #655: A denied claim for a Guilford renter might focus on alleged under-insurance, non-covered causes, or failure to document contents; for a homeowner, the denial often attacks the condition of the building itself. Both can be challenged, but the legal issues differ. Renters claims may not bear the cost of litigation.

Guilford Insurance Lawyer’s Caveat: I usually set 10,000 as the minimum amount in controversey.

A6: Everything. Why not? A Guilford resident should take step-by-step photos and videos of every impacted room, the roofline, exterior walls, trees, fences, and any tarps or temporary repairs. They should save contractor estimates, utility shut-off confirmations, and receipts for mitigation work.

Guilford Insurance Law 101: Early documentation is often the most important evidence when an insurer later tries to deny or underpay the claim.

A7: A Guilford homeowner should keep denial letters, emails, estimates, engineering reports, and photographs for years, not months. Maryland’s statutes of limitation and policy-based suit-limitation clauses can still allow litigation well after the first denial. Destroying or misplacing records in Guilford can undercut a future lawsuit, especially when the dispute centers on what the adjuster saw—or ignored—on the first visit.

Read The Law: Courts and Judicial Proceedings Section 5-101 – Three-Year Limitation in General

A8: It makes sense to call a denied insurance claim lawyer when the loss is significant, the property is a primary Guilford residence, and the carrier is refusing to pay for core structural or habitability issues—roof failure, major water damage, fire, or serious mold. In a higher-value neighborhood like Guilford, even a single denied claim can wipe out years of equity, so bringing in counsel early can be the most important step in protecting both the home and the family’s long-term finances.

How Attorney Eric T. Kirk Can Help with Your Denied Guilford Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

- ✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

- ✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- ✔ Gather your evidence to support your claim. Most Guilford denied insurance claims require expert analysis on the cause of loss and nature of damage.

- ✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

- ✔ File a lawsuit. I sue insurance companies.

- ✔ Take your case to trial. I try cases against insurance companies.

A Denied Insurance Claim Lawyer for Baltimore’s Guilford, I can and will tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.