Exposing Denied Insurance Claims | Baltimore’s Chinquapin Park/Belvedere 21212

TL;DR — Key Takeaways for Baltimore Homeowners

- Residents of Chinquapin Park/Belvedere 21212 often face insurance claim denials tied to aging homes, roof leaks, or water damage.

- A denied insurance claim lawyer can challenge insurer tactics under Maryland law.

- Attorney <span aria-label=”Baltimore Insurance Claim Denial Lawyer Eric T. Kirk”>Eric T. Kirk</span> provides step-by-step guidance for MIA, litigation, and negotiation.

- Understanding policy exclusions, filing deadlines, and maintenance requirements is crucial.

- In summary, homeowners here should not accept a denial at face value—legal review is vital.

Denied Insurance Claim Lawyer | Baltimore’s Chinquapin Park/Belvedere 21212

Baltimore’s Chinquapin Park/Belvedere 21212 neighborhood—bordered by Homeland, Cedarcroft, and the Northern Parkway corridor—represents one of the city’s most stable residential enclaves. Yet even in this well-established area, residents may encounter the same frustrating reality faced throughout Baltimore: valid homeowners’ insurance claims wrongfully denied or delayed by insurers.

As a denied insurance claim lawyer serving Chinquapin Park/Belvedere, I’ve seen insurers cite seemingly obscure exclusions, claim “wear and tear,” or blame maintenance lapses to avoid paying what’s owed. The consequences can be devastating: ceilings collapse after storms, pipes freeze in century-old rowhomes, or fallen trees crush newly renovated additions. When an insurer refuses to honor its own policy language, legal action often becomes the only path to justice.

For over 30 years, <span aria-label=”Baltimore Personal Injury and Insurance Claim Denial Lawyer Eric T. Kirk”>Eric T. Kirk</span> has litigated against national carriers across Maryland—demanding accountability through clear evidence, policy interpretation, and courtroom advocacy. This page explains what every Chinquapin Park/Belvedere 21212 homeowner should know: how denials happen, how to challenge them, and where to find credible local support.

Where Is Chinquapin Park/Belvedere in Baltimore?

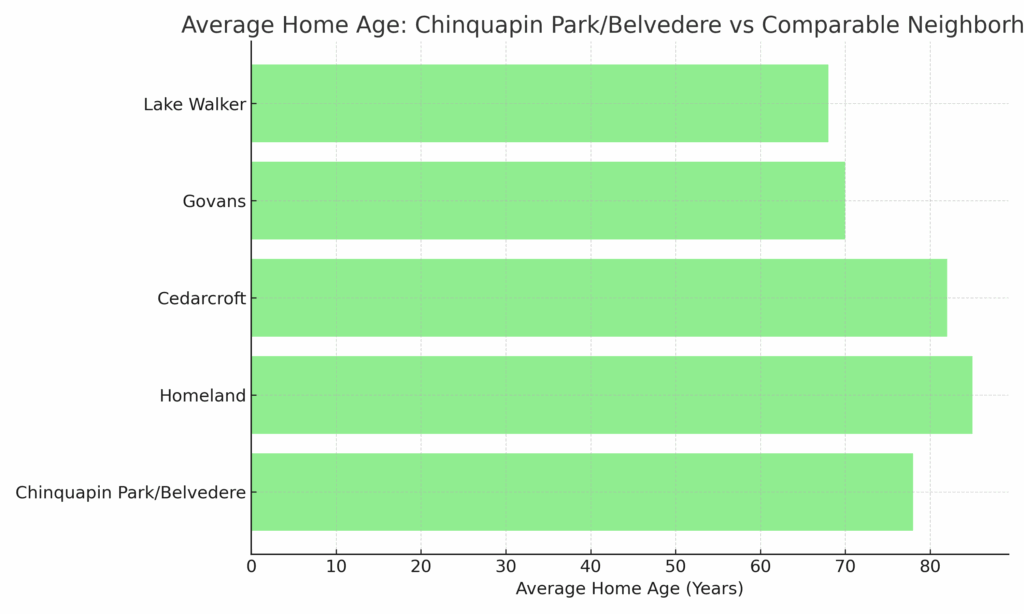

Located in North Baltimore, Chinquapin Park/Belvedere straddles the line between urban vitality and suburban calm. It’s framed by Chinquapin Run Park to the east, York Road to the west, and the tree-lined avenues connecting to Northern Parkway. Historic homes—many dating to the 1920s—blend with post-war townhouses and newer infill housing. According to Baltimore City Planning Department data, much of the housing stock here exceeds 75 years in age, making property-maintenance and storm-damage claims common.

Because Chinquapin Park/Belvedere 21212 homes sit on elevated terrain sloping toward Chinquapin Run, water intrusion, basement seepage, and sewer backups frequently appear in denied claims. Insurers often argue that groundwater infiltration or “repeated leakage” falls outside coverage—yet Maryland law can treat sudden, accidental discharges differently. Understanding that distinction can mean the difference between a valid payout and total denial.

The neighborhood’s dense tree canopy also leads to frequent wind-damage and falling-branch claims—look near Sherwood Gardens and along Belvedere Avenue. Older plumbing and galvanized pipes raise the risk of freeze-related losses each winter.

In short, Chinquapin Park/Belvedere residents face many of the classic Baltimore risk factors: aging infrastructure, intermittent flooding, and insurer scrutiny of every line item. Recognizing these patterns is the first step toward asserting your rights.

Why was my Chinquapin Park/Belvedere Insurance Claim Denied?

Common Reasons for Chinquapin Park/Belvedere Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Chinquapin Park/Belvedere Neighborhood

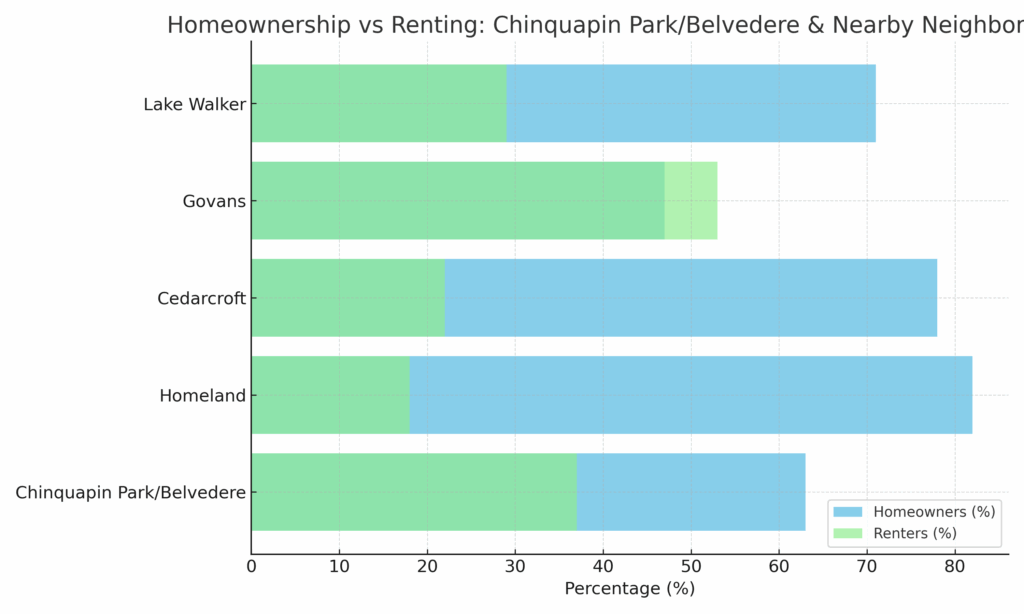

Chinquapin Park/Belvedere 21212 exhibits one of Baltimore’s highest home-ownership ratios north of Cold Spring Lane. Census ACS data show roughly 63 percent owner occupancy—above the citywide 52 percent average. Median home values hover near $230,000, and household incomes trend higher than many adjacent communities.

The community’s unique mix of pre-WWII colonials, mid-century ranchers, and modest duplexes creates insurance challenges: older wiring, original slate roofs, and aging plumbing systems often invite insurer skepticism after a claim. Denials frequently involve “age of system” or “gradual deterioration” defenses.

Yet the neighborhood’s tight community networks and active associations support residents facing these issues. Resources like the Chinquapin Park Improvement Association and Belvedere Community Association coordinate home maintenance workshops and advocacy with city housing programs. Nearby educational anchors such as Johns Hopkins University and Morgan State University also provide community outreach and neighborhood data resources.

Hyper-local online tools include the Baltimore City Department of Housing and Community Development, Open Baltimore, and the Greater Homewood Community Corporation, which offer repair grants, energy assistance, and legal referrals. Homeowners here should leverage these to mitigate risk before disaster strikes—and contact a qualified insurance claim denial lawyer if a carrier fails to honor its obligations.

Chinquapin Park/Belvedere Resources

- Chinquapin Park Improvement Association

- Baltimore City Department of Housing and Community Development

- Open Baltimore Data Portal

- Greater Homewood Community Corporation

- Baltimore City Recreation & Parks – Chinquapin Run Park

- Morgan State University Community Engagement Office

- Johns Hopkins University Neighborhood Initiatives

How to Challenge a Chinquapin Park/Belvedere Insurance Claim Denial – My Steps:

- Step 1 – Responsiveness

When a homeowner calls about a denied claim in Chinquapin Park/Belvedere, my first action is to notify the insurance company I am now handling your case, preserving evidence and documentation before others attempt to re-frame facts.

Chinquapin Park/Belvedere Insurance Lawyer’s Tip #76: This is sometimes called and “LOR” letter of representation. After getting it, your insurance company has to speak to me, not you. - Empathy & Compassion

Families here often feel betrayed when a policy they trusted fails them. By listening carefully and treating clients as neighbors, I ensure they understand each step from claim review to litigation.

- Advocacy & Negotiation

In every case, I aim to be armed with favorable expert reports and Maryland case law that favors the Chinquapin Park/Belvedere homeowner. I negotiate directly with insurers for a reversal or full payment. If the carrier persists, I initiate suit in Baltimore City Circuit Court.

- Results-Driven Action

Not every case results in a trial, but I prepare every case as if it will be tired.

Chinquapin Park/Belvedere Insurance Lawyer’s Tip #817: Litigation is a process not an event. Good cases, with a full recovery, do not happen automatically, or, overnight.

FAQ – Insurance Denial Issues in Chinquapin Park/Belvedere

Because many homes use aging slate or asphalt roofs, insurers can label storm damage as “wear and tear.”

Chinquapin Park/Belvedere Insurance Lawyer’s Tip #3: The reasons for claim denial may be limited only by the creativity of an adjuster. Ultimately, I can get a judge or a jury to question that creativity.

Yes. Maryland law permits litigation for breach of contract and bad faith if the insurer acted unreasonably.

Chinquapin Park/Belvedere Insurance Law 101: You have three years from the date the contract was broken to sue. The safe be it to file within 3 years of the loss.

Only separate FEMA National Flood Insurance Program policies cover groundwater flooding.

Yes, if the homeowner maintained reasonable heat, or drained water from the system, and the loss was sudden and accidental.

Next Steps After a Chinquapin Park/Belvedere Homeowners Insurance Claim Denial

Eric T. Kirk

Chinquapin Park/Belvedere Homeowners Insurance Claim Denial Lawyer- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example—known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—as covering a leaking roof with a giant blue tarp.

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage.

• Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication.

• Use a portal if one is available, but retain screenshots and independent records.

• State Farm

• Travelers

• Allstate

• Nationwide

• USAA - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim.

• The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written reason for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking—statute of limitations.

• Keep all correspondence, including emails and letters, in a dedicated file.

• The denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance. - Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are justified. Insurance companies sometimes deny valid claims for reasons that may be challenged in court.

• What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Chinquapin Park/Belvedere Homeowners Insurance Claim

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Policy Analysis and Coverage Review

✔ Evidence Collection and Expert Evaluation

✔ Aggressive Negotiation and If Necessary, Litigation

✔ Trial Readiness for Every Case