Contextualizing Denied Insurance Claims: Baltimore’s Edmondson Village | 21229

Denied Insurance Claim Lawyer: Baltimore’s Edmondson Village | 21229

TL;DR (read this first):

- Step-by-step game plan after a denial: document, mitigate, notify, comply, and escalate.

- Definition: a denied insurance claim lawyer challenges exclusions, timelines, and “maintenance” pretexts—then litigates.

- Most important: older rowhouses along Edmondson avenue face water, freeze, roof, and stormwater issues; policies often point to exclusions you can contest.

- In summary: if you live in Edmondson Village 21229, a focused Insurance claim denial lawyer who knows Baltimore’s codes, flood mapping, and claim patterns can flip “no” into “pay.”

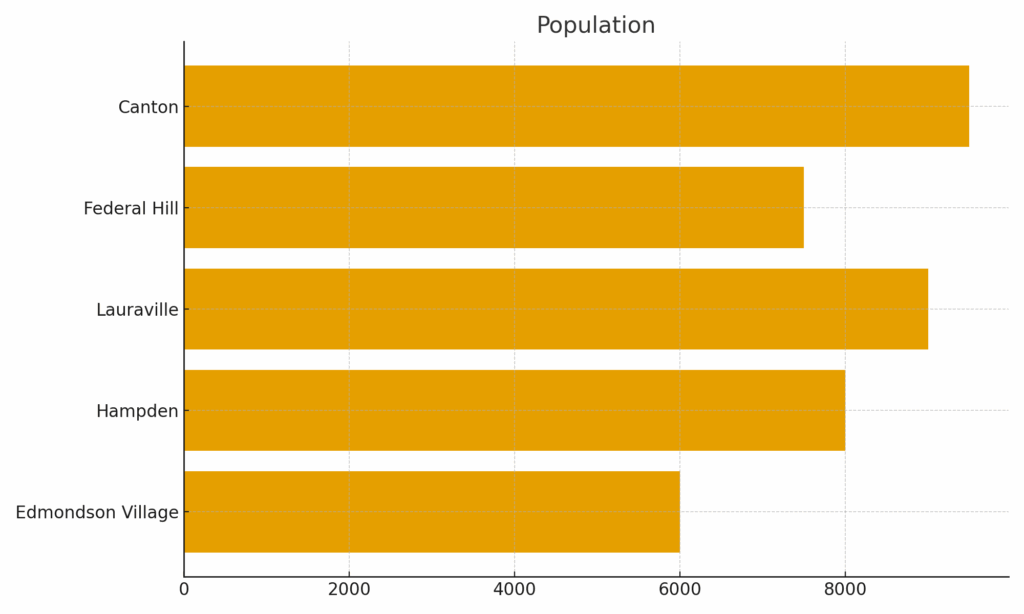

Where is Edmondson Village in Baltimore, Maryland?

Orientation :

Edmondson Village sits in west/southwest Baltimore along the Edmondson avenue (U.S. Route 40) corridor, north of Frederick avenue and just south of Gwynns Falls/Leakin park. The neighborhood includes or borders pockets such as Rognel heights, Uplands, Wildwood, Lower Edmondson Village, and Allendale, with the principal ZIP 21229. See the neighborhood overview on Edmondson Village and the broader historic district context at Edmondson Avenue Historic District.

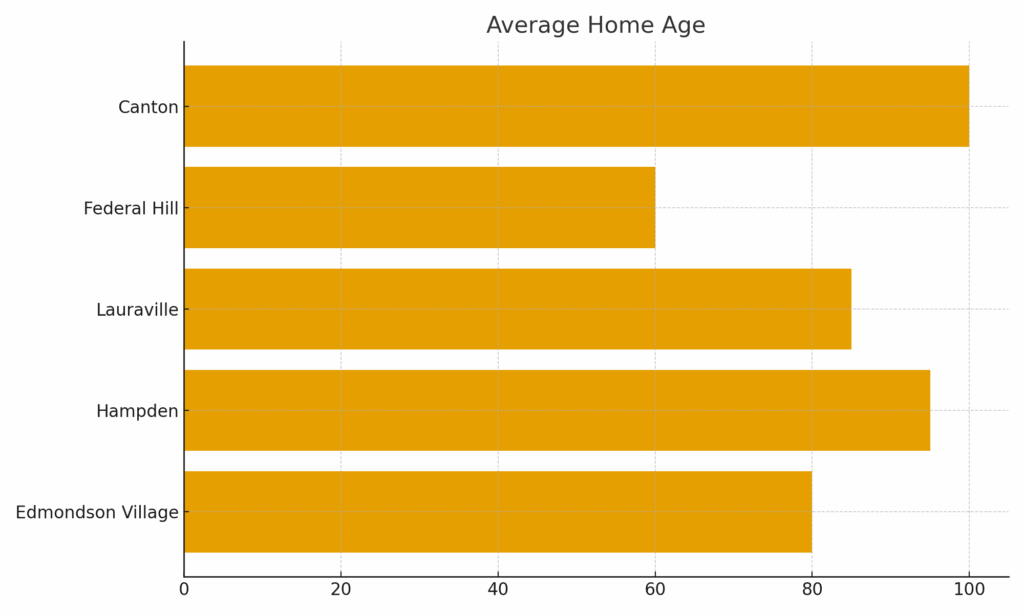

Housing stock & why it matters to claims :

Rowhouses and brick semis here are largely early- to mid-20th century construction. Aging roof systems, parapet caps, and flashing, older drainage and basement waterproofing, and legacy supply lines/radiators drive the claim patterns you actually see: wind-driven rain roofing disputes; “wear and tear” denials on seepage; frozen pipe bursts in cold snaps; and post-storm mold exclusions. The most important local dynamic is water—both surface runoff and basement intrusion.

Floodplain, runoff, and policy conflicts :

City and FEMA resources show where regulatory floodplains and runoff concerns live. You need to know your risks BEFORE the loss. Before you accept an adjuster’s “flood exclusion” narrative, check the mapping and code:

- City floodplain + FEMA FIRMs (overview and map links): Baltimore City Planning — Flood Insurance Rate Maps; Floodplain program; Sustainability Floodplain/FEMA maps. Department of Planning+2Department of Planning+2

- Stormwater rules & infrastructure context: DPW Stormwater, Minimum Requirements (PDF), and system overview. These can matter if an insurer blames you for “maintenance” rather than acknowledging a covered peril interacting with city systems. Baltimore DPW+2Baltimore DPW+2

Permit trails that prove timing (evidence tactic):

When carriers claim “prior damage,” permit and inspection records can timestamp repairs or upgrades. Use DHCD Permits & Inspections and the Accela Citizen Access portal to retrieve entries that rebut an adjuster narrative.

Why Was My Edmondson Village Homeowners Insurance Claim Denied?

Common Reasons for Edmondson Village Homeowners Insurance Claim Denials.

- “Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

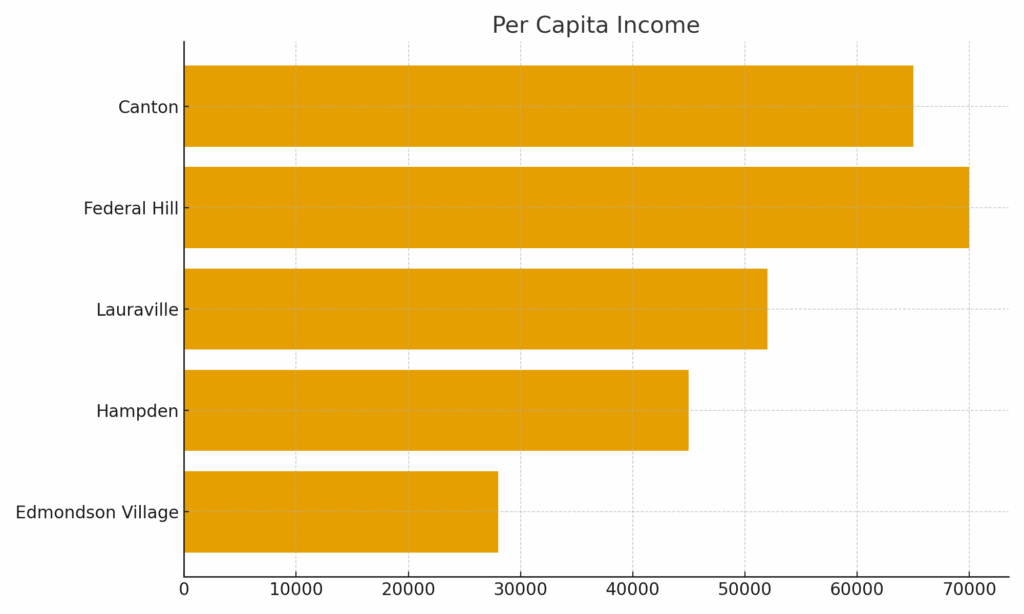

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

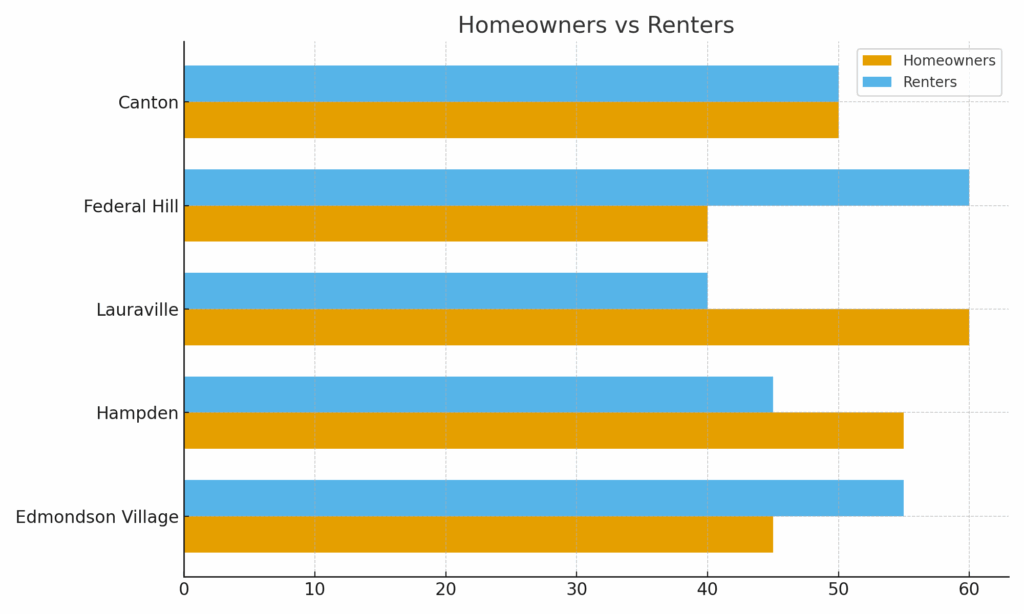

Homeownership in Baltimore’s Edmondson Village

Definition (what we’re covering): homeownership realities in Edmondson Village—and how they intersect with claim outcomes.

Step-by-step local picture:

Edmondson village presents a classic Baltimore pattern: early- to mid-century brick rowhouses and semis along Edmondson Avenue (U.S. 40) and adjacent streets (e.g., Rognel ave, Swann ave, Kensington Ave), with proximity to large green systems like Gwynns Falls/Leakin Park that influence drainage and tree-related losses. City resources that routinely matter in denied claims here include Planning’s Floodplain program and FEMA FIRM access via Sustainability when carriers invoke flood exclusions; DPW Stormwater and stormwater requirements PDF when the narrative shifts to runoff “maintenance”; and DHCD Permits & Inspections and the Accela portal when you need official proof of repair, reroof, or plumbing history to rebut “pre-existing” defenses. In summary, homeowners here are best served by tying photos, moisture readings, and contractor reports to these government records and maps—that’s the most important way to transform a denial into a payable claim. For general neighborhood orientation and historical housing context, see Edmondson Village and Edmondson Avenue Historic.

As a long time Baltimore Insurance Denial Litigator, I can tell you claims are not more likely to be challenged here, nor or they less likely to be. What I do tell you with 100% certainty is that they are.

Many policies exclude flood/seepage, but coverage may exist for sudden/accidental discharge.

Edmonson Village Insurance Law 101: photos, and expert causation often decide outcomes.

Yes, if wind created an opening or caused direct physical loss.

Edmondson Village Insurance Lawyer Tip #445: Age alone doesn’t nullify a covered peril—proof and precise policy language are key.

Mitigate and preserve then call counsel.

Edmonson Village Insurance Law 101: You might think my advise to call counsel to be self serving. I did not say call me. Call the insurance claim denial specialist of your choosing. The point is to get some Edmondson Village centric advice sooner rather than later.

Injured in an edmondson village car accident? Learn about your rights here.

Baltimore Car Accident Lawyer Eric T. Kirk

Edmondson Village Resources

- Baltimore City Department of Planning — Floodplain Program: https://planning.baltimorecity.gov/programs/floodplain

- Baltimore Office of Sustainability — FEMA Maps: https://www.baltimoresustainability.org/permits/floodplain/maps-and-code/fema-maps/

- Baltimore DPW — Stormwater: https://publicworks.baltimorecity.gov/stormwater

- DPW — Stormwater Minimum Requirements (PDF): https://publicworks.baltimorecity.gov/sites/default/files/SWM-Min%20req.pdf

- DHCD — Permits & Inspections: https://dhcd.baltimorecity.gov/pi/permits-and-inspections

- Accela Citizen Access (Permits/Records): https://aca-prod.accela.com/BALTIMORE/Default.aspx

- Baltimore City Planning — Maps & Data hub: https://planning.baltimorecity.gov/maps-data

Definition: an adjuster represents the carrier’s financial interest; a lawyer represents you. The difference is adversarial, not semantic. E.g. An adjuster may call seepage “maintenance.” A lawyer proves storm-created openings and sudden/accidental loss with expert reports, moisture mapping, and code-informed analysis.

A denied insurance claim lawyer familiar with Edmondson Village 21229 can

arrange step-by-step sworn proofs, EUO prep, and expert inspections that align with Maryland policy language.

Edmondson Village Insurance Lawyer Tip #445: Local facts win.

Policy and causation analysis (Legal knowledge). I parse insuring agreement, exclusions, and endorsements. I line up expert opinions (roofing/plumbing/IEP) to connect storm opening or sudden discharge to observed damage.

Edmondson Village Insurance Lawyer Tip #3: If the file stalls, I draft and file suit, notice depositions, and lock testimony and try the case when needed.

Next Steps After a Edmondson Village Homeowners Insurance Claim Denial

Eric T. Kirk

Edmondson Village Homeowners Insurance Claim Denial Litigator- Stabilize and Preserve the Scene of the Loss • If your home has been damaged, take immediate action to prevent further harm. • Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp). • Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss • Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate. • This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately • Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

• State Farm — https://www.statefarm.com/claims

• Traveler’s — https://www.travelers.com/claims

• Allstate — https://www.allstate.com/claims/file-track

• Nationwide — https://www.nationwide.com/insurance-claims/

• USAA — https://www.usaa.com/ - Comply with Policy Conditions & Your Duty to Cooperate • Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. • Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications • Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. • Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney • Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial? • An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will: ✔ Complimentary Case Analysis – Fight Back Against Unfair Denials ✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement. ✔ Gather your evidence to support your claim. Most edmondson village denied insurance claims require expert analysis on the cause of loss and nature of damage. ✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not ✔ File a lawsuit I sue insurance companies ✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”

SO SHOULD YOU.