Deciphering Denied Insurance Claims: Baltimore’s Seton Hill | 21201

TL;DR

If your homeowner’s insurance claim was denied and you live in the 21201 ZIP code in Seton Hill, Baltimore, you need a trusted insurance claim denial lawyer who understands this neighborhood’s historic housing stock, unique risks, and local insurance-company tactics. This article explains the role of an Insurance Claim Denial Lawyer | Baltimore’s Seton Hill 21201, why claims get denied here, what ownership looks like in this area, step-by-step how to challenge a denial, local resources, FAQs tailored to Seton Hill, and your next steps after a denial.

Denied Insurance Claim Lawyer: Baltimore’s Seton Hill | 21201

As a dedicated professional with over 30 years of experience, I have been committed to assisting residents in navigating the complexities of insurance disputes. If you live in Seton Hill — ZIP 21201 — and your claim has been wrongly rejected, you need a clear path forward. The title “Denied Insurance Claim Lawyer | Baltimore’s Seton Hill 21201” sets the tone: this is about fighting back when insurers deny or delay valid claims in this very neighborhood.

Where is Seton Hill in Baltimore, Maryland?

Seton Hill is a historic and compact neighborhood on the west-side of downtown Baltimore, roughly bounded by Orchard Street, Eutaw Street, Franklin Street and Pennsylvania Avenue. HistoryArchPreservation+2Wikipedia+2 Centered around the lovely green space of St. Mary’s Park, Seton Hill’s built-environment reflects an early rowhouse neighborhood with many two- and three-story gabled-roof homes. setonhill.org+1

Because of its proximity to major traffic thoroughfares like Martin Luther King Jr. Boulevard and Howard Street, and because many of its homes are older and located near transit and dense commercial corridors, Seton Hill brings together a mix of student renters, professionals, and long-term residents. Live Baltimore+1

Unique household & insurance-risk factors in Seton Hill

- Older housing stock: Many homes date back to the 19th century or early 20th century. HistoryArchPreservation+1 Older rowhouses often retain original building systems (roofs, plumbing, windows) that may be more vulnerable to weather, water intrusion or deferred maintenance. When damage occurs, insurers may try to argue the loss was due to “wear and tear” or homeowner neglect — putting you in a fight.

- Historic district designation: The neighborhood is a certified historic district which offers tax incentives. HistoryArchPreservation+1 But that can complicate repairs and insurance claims (e.g., replacing historic windows vs standard ones). An insurance claim denial lawyer familiar with historic-home issues is vital.

- Urban setting & infrastructure risks: Seton Hill sits near dense urban corridors, including bus/light-rail lines and older infrastructure: heavy rainfall, blocked storm drains, sewer backups, older roofs. In older homes, damage from water or freeze/thaw cycles may trigger claims. Insurers may deny on grounds of maintenance issues rather than covered peril.

- High renter component: Although homeowners exist, rental occupancy is high. Live Baltimore+1 For owners, this means rental-use exposures (tenant damage, sub-leasing, property condition), which can lead insurers to deny claims citing occupancy changes or lack of proper maintenance.

- Mixed use & transition zones: Commercial storefronts and rowhouses mix in the area. HistoryArchPreservation That means potential risks like water intrusion from adjacent buildings, fire risk, or structural overlap issues — insurers may attempt to deny or reduce claims on complex causation grounds.

Because of those factors, living in Seton Hill 21201 means you must be vigilant if your homeowners insurance claim is denied. An insurance claim denial lawyer with deep knowledge of such local conditions can help you hold the insurer accountable.

Why Was My Seton Hill Homeowners Insurance Claim Denied?

Common Reasons for Common Reasons for Seton Hill Homeowners Insurance Claim Denials.

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Seton Hill Neighborhood

In Seton Hill, ZIP 21201, homeownership presents a unique set of conditions shaped by the neighborhood’s historic character and evolving urban dynamics. The housing mix includes early rowhouses, historic structures around St. Mary’s Park and older single-family homes converted to multi-units, as noted by the Baltimore City Historic & Architectural Preservation Office. HistoryArchPreservation Because of this, ownership often means dealing with an older structure, which inherently increases the risk of property damage, deferred maintenance issues and insurance-claim exposure. According to the livebaltimore.com profile, Seton Hill’s ownership rate is remarkably low with ownership vs. renting around 9 % owners to 91 % renters. Live Baltimore That statistic suggests that individual homeowners are fewer, but those who do own may face distinct challenges: given the high‐renter environment, owners may deal with tenant-related wear, higher risk of property damage (vandalism, tenant neglect), and potentially stricter scrutiny by insurers. Because the neighborhood is designated as a historic district under ordinance and on the National Register, home-owners may encounter unique repair constraints (e.g., historic windows, preserving façade materials) which complicate mitigation and insurance claim remediation. Additionally, the median home purchase price is lower than many parts of Baltimore (per Niche data, median home value ~ $242,833, with median household income around $41,636). Some may argue this reflects properties in need of repair or heavier maintenance burdens.

For you as a resident of Seton Hill, an insurance claim denial lawyer brings most value when the property is older, large‐repair risks are present (roof, plumbing, structural cracks), or when the insurer tries to claim damage was due to wear and tear rather than a covered peril. Because the urban fabric of Seton Hill places many homes near commercial corridors and potential external damage exposure (for example, water intrusion from adjoining property, heavy foot and vehicular traffic), insurance companies may scrutinize losses more aggressively. They can. If they do so unfairly, you contact me. In summary, homeownership in Seton Hill means understanding that your property is part of an historic urban environment with higher-risk factors and unique exposures — making it all the more important to have a dedicated advocate who knows how to counter insurer arguments tailored to these types of claims.

Seton Hill Resources

Hyper-local websites for Seton Hill:

- Seton Hill Association (community organization)

- City of Baltimore Historical & Architectural Preservation – Seton Hill

- Live Baltimore – Seton Hill neighborhood page

- Maryland Historical Trust – Seton Hill Historic District (via Wikipedia overview)

- Baltimore Magazine “Hello, Neighbor: Seton Hill” feature

How to Challenge a Seton Hill Insurance Claim Denial — My Step-by-Step Guide:

- Review your policy and denial letter

I will examine your homeowners policy, identify exclusions or ambiguous language, analyze the insuring agreement, and determine whether the insurer’s basis for denial is valid or challengeable.

- Gather evidence of the damage cause

Whether it’s an aging roof rowhouse in Seton Hill, water infiltration from an adjacent commercial property, or freeze damage in historic construction, I will obtain the various expert inspections, document the damage (photos, videos, historic repair logs), and show the proper causal chain.

Seton Hill Insurance Lawyer’s Tip #77: The “proper” causal chain is one that leads to coverage under your policy, and and indemnification for your loss. - Negotiate, or litigate, both aggressively

Using my advocacy and negotiation training, background and experience, I’ll press the insurer for a fair settlement. If they refuse, I’ll prepare and file suit, execute discovery, and take the case through trial if necessary to fight for full compensation.

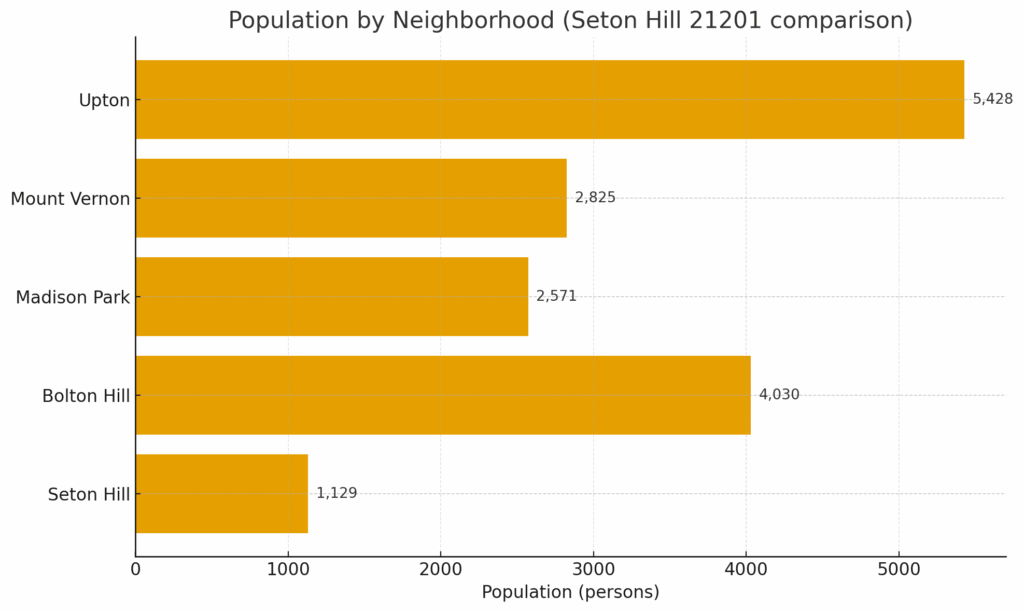

Nearby Neighborhoods

Homeowners near Madison Park, Bolton Hill, and Uptown / West Baltimore often face similar coverage disputes and can find guidance on those dedicated pages.

Next Steps After a Seton Hill Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

o State Farm https://www.statefarm.com/claims

o Traveler’s https://www.travelers.com/claims

o Allstate https://www.allstate.com/claims/file-track

o Nationwide https://www.nationwide.com/insurance-claims/

o USAA https://www.usaa.com/ - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations.

• Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance. - Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Because Seton Hill’s homes are older, insurers can cite “wear and tear” or “poor maintenance” when rejecting claims. These defenses can sometimes be challenged if the true, provable cause of damage is a covered peril.

Seton Hill Insurance Lawyer’s Tip #17: I will always contend that if an insurance company aims to avoid paying on a claim, they have to prove it is just.

The best time is immediately after receiving a denial letter. Delays can harm your rights and allow the insurer to argue you failed to cooperate. Early review helps preserve evidence and deadlines.

Seton Hill Insurance Law 101: The statute of limitations, they time by which you have to file suit is three years from the breach of the contract. [i.e. your policy].

Failing to get a legal review. Might seem biased. However, many accept the insurer’s reasoning without realizing it’s based on assumptions or exclusions that don’t apply to their specific policy or circumstances.

Seton Hill Insurance Lawyer’s Tip #645: It’s not just that an insurance company who aims to avoid paying on your claim has to give you a reason, hey have to prove it is valid.

Yes. Renters can dispute denials on personal property or liability coverage. In shared older rowhouses, water and fire losses are common.

Seton Hill Insurance Law 101: No all claims merit litigation expenses. As a practical matter, if your claim is not valued at 10,000 or more, a litigation cost/benefit analysis is called for.

Save your policy, denial letter, estimates, photos, emails, and any contractor reports. Organized records strengthen your legal position during reconsideration or trial.

It’s your property. You have to protect it.

Seton Hill Insurance Lawyer’s Tip #45: I will file suit to collect what you are owed. If your insurer has acted in Bad Faith, you can recover these litigation costs.

Your Chosen Insurance Company Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Seton Hill Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Seton Hill denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit – I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”

SO SHOULD YOU.