Baltimore’s Hampden: Insurance Claim Denial Lawyer

Denied Insurance Claim Lawyer | Baltimore’s HAMPDEN: Advocating for Homeowners in 21211

In the eclectic heart of northern Baltimore lies HAMPDEN—an artistic, historic enclave known for its charm and character. But behind its colorful facades and quirky storefronts, homeowners here face real-world struggles when disaster strikes and insurance companies refuse to pay. If you’ve received a denial letter from your insurer, you don’t have to handle it alone. This article will walk you through your rights and options when navigating a denied claim—and how Eric T. Kirk, an experienced insurance claim denial lawyer serving HAMPDEN and the entire 21211 ZIP code, can help. I’ve handled 1000s of denied insurance claims over a 30 year career. Yes. Homeowners in HAMPDEN deserve clarity and justice when their insurance companies say “no”- just like any other homeowner in any of Baltimore’s distinguished neighborhoods. Whether the issue involves alleged maintenance problems, disputed causes of damage, or technical filing issues, your claim may still be valid. As a Baltimore insurance claim denial lawyer with decades of experience, I fight back when insurers try to avoid paying what is owed. I’ve taken on national carriers in Baltimore courtrooms—and won.

If you’re in the 21211 ZIP code and searching for a trusted insurance claim denial lawyer familiar with the unique risks and coverage disputes HAMPDEN residents face, this resource is for you.

Where is HAMPDEN in Baltimore?

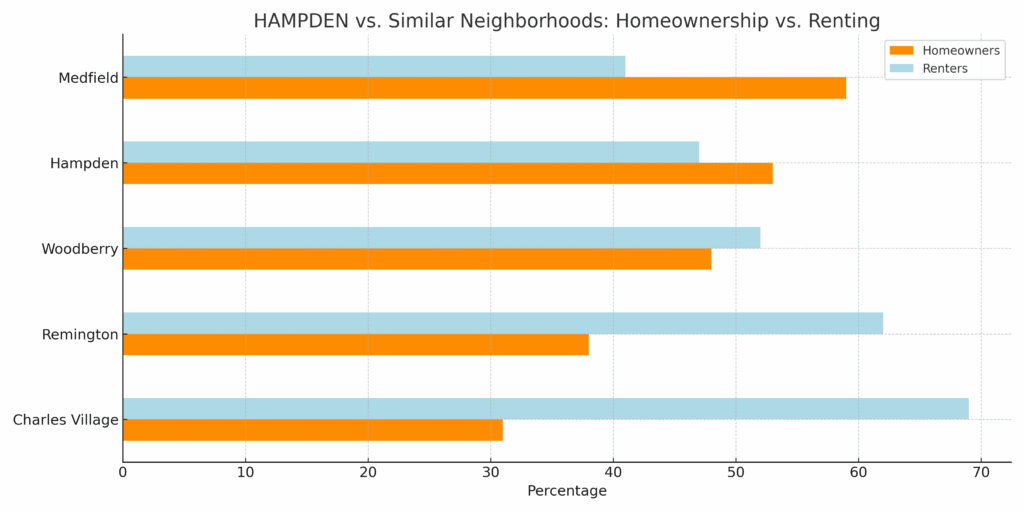

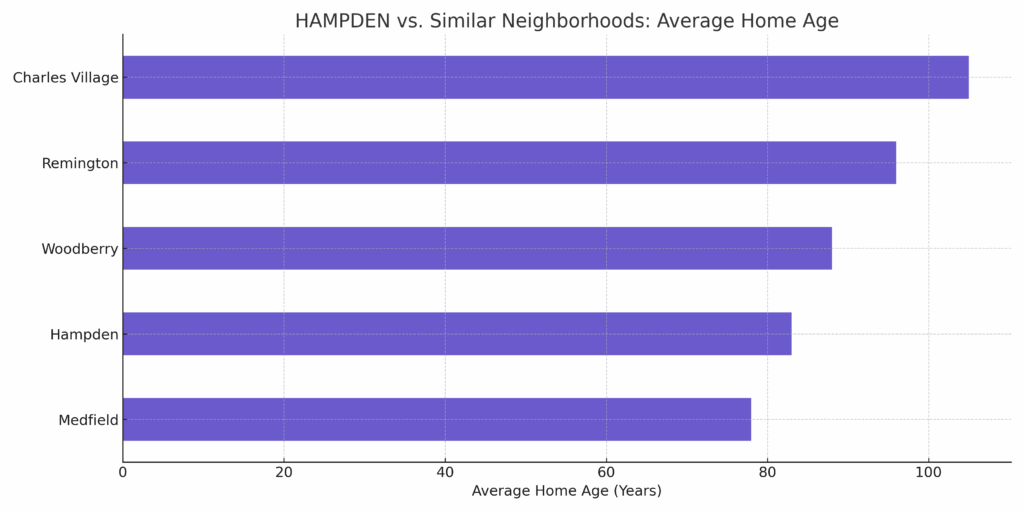

Nestled just west of Johns Hopkins University and bordering neighborhoods like Woodberry and Medfield, HAMPDEN is one of Baltimore’s most vibrant and recognizable neighborhoods. Originally built as a mill village in the 1800s, HAMPDEN grew into a working-class community with an industrial soul and a creative spirit. Today, it’s a bustling hub of art galleries, independent restaurants, and local boutiques centered around West 36th Street—affectionately known as “The Avenue.”

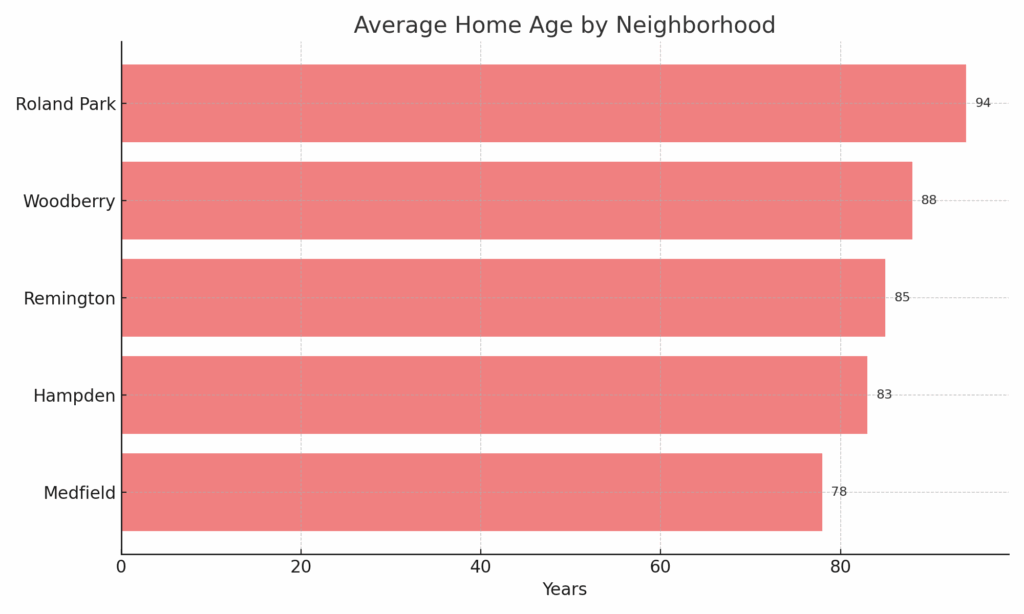

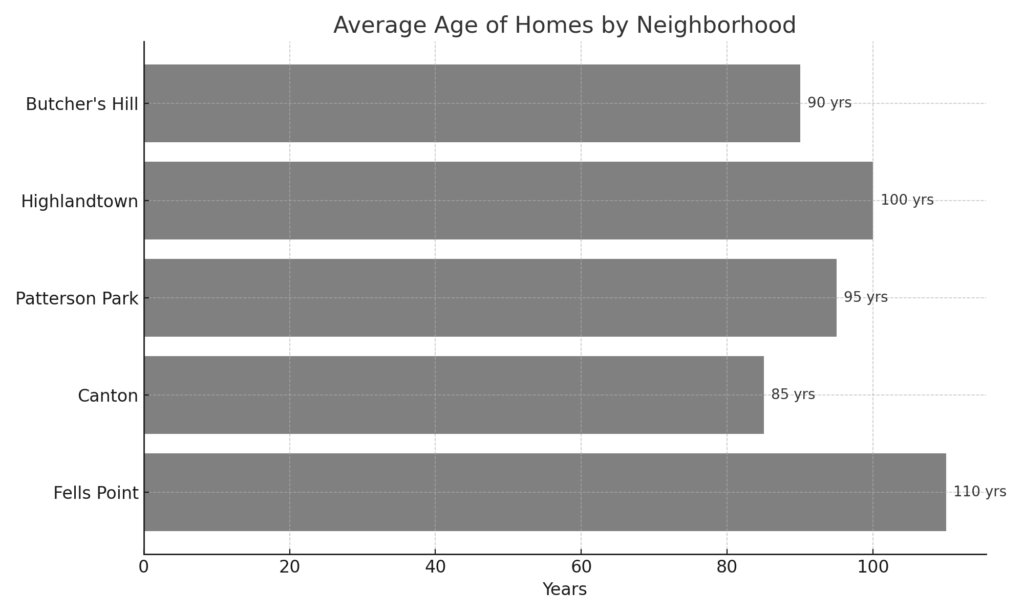

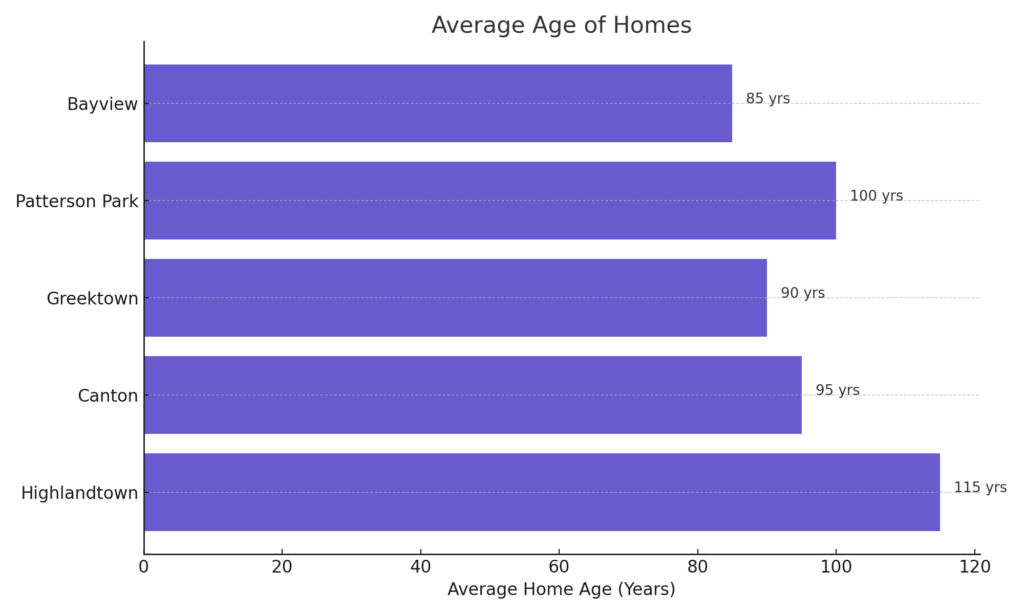

This neighborhood isn’t just hip—it’s historic. Many homes in HAMPDEN were built in the early 20th century and carry all the beauty and problems that come with age. For homeowners, this can often mean dealing with aging plumbing, weathered roofs, and older electrical systems—factors that can lead to insurance disputes when damage occurs.

HAMPDEN’s terrain also presents challenges. The area’s sloping streets and proximity to the Jones Falls valley can create stormwater runoff issues and flood risks, particularly in alleys and basement-prone rowhomes. Insurance companies can seek to deny water-related damage claims often arguing improper maintenance or citing policy exclusions.

HAMPDEN residents can be, perhaps uniquely, vulnerable to insurance claim denials which often involve:

- Water intrusion

- Roof damage from wind or falling debris

- Frozen or burst pipes

- Fire-related structural damage

- Allegations of policy misrepresentation

That’s why HAMPDEN homeowners need a Baltimore insurance claim denial lawyer who understands the neighborhood—its architecture, its layout, and the local dynamics insurers will no doubt utilize in the claims denial process.

Local community groups like the Hampden Village Merchants Association and revitalization partners like the Baltimore Office of Sustainability have worked to keep HAMPDEN vibrant. But even in a thriving neighborhood, insurance disputes remain a frustrating reality.

In summary, if you live in 21211 and are struggling to deal with a denied claim, your next step is to speak with a qualified insurance claim denial lawyer who knows HAMPDEN and fights for Baltimore’s homeowners every day.

Why Was My Hampden Homeowners Insurance Claim Denied?

Common Reasons for Hampden Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

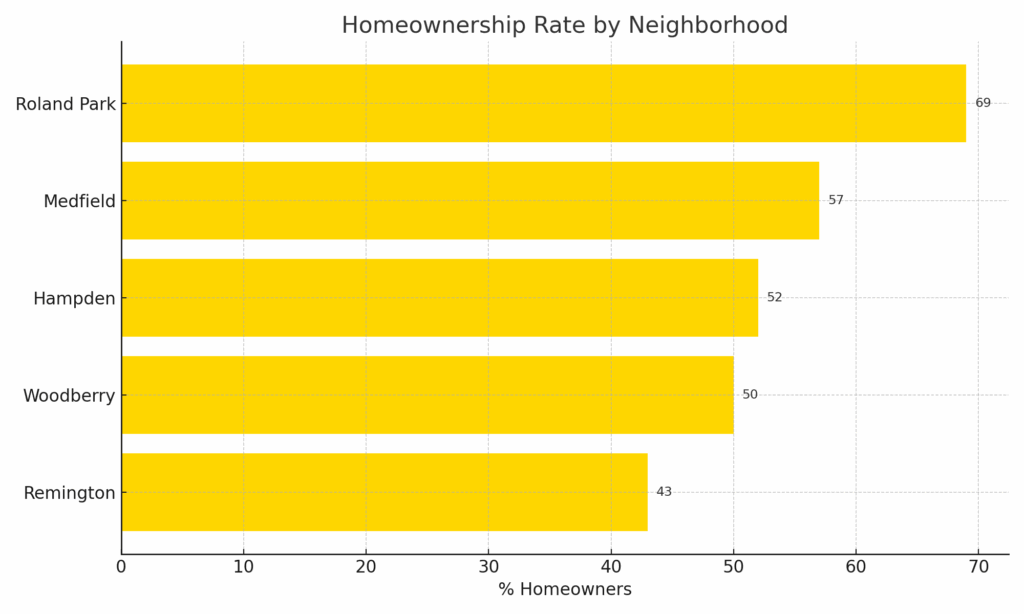

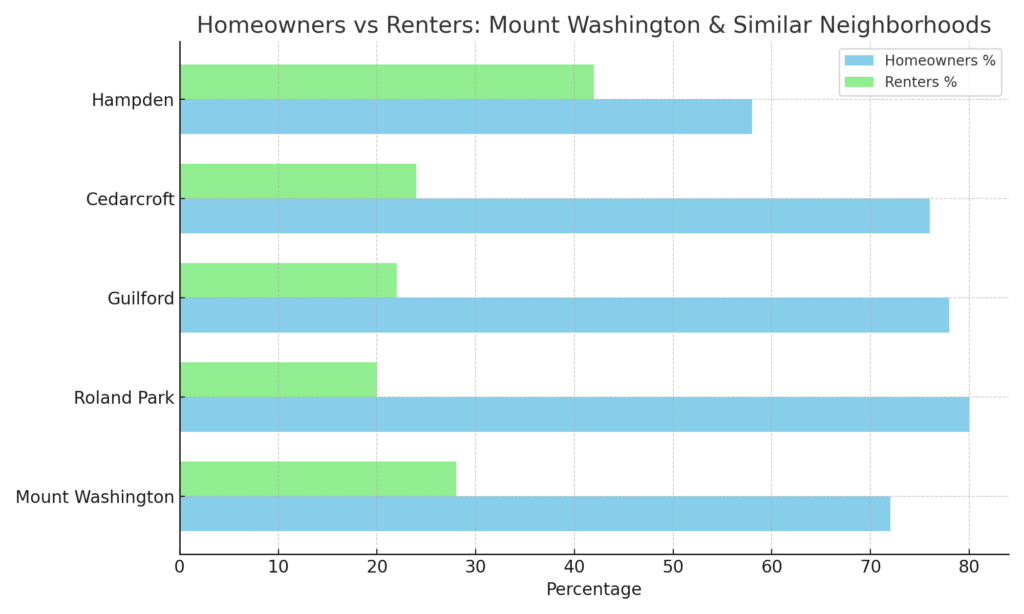

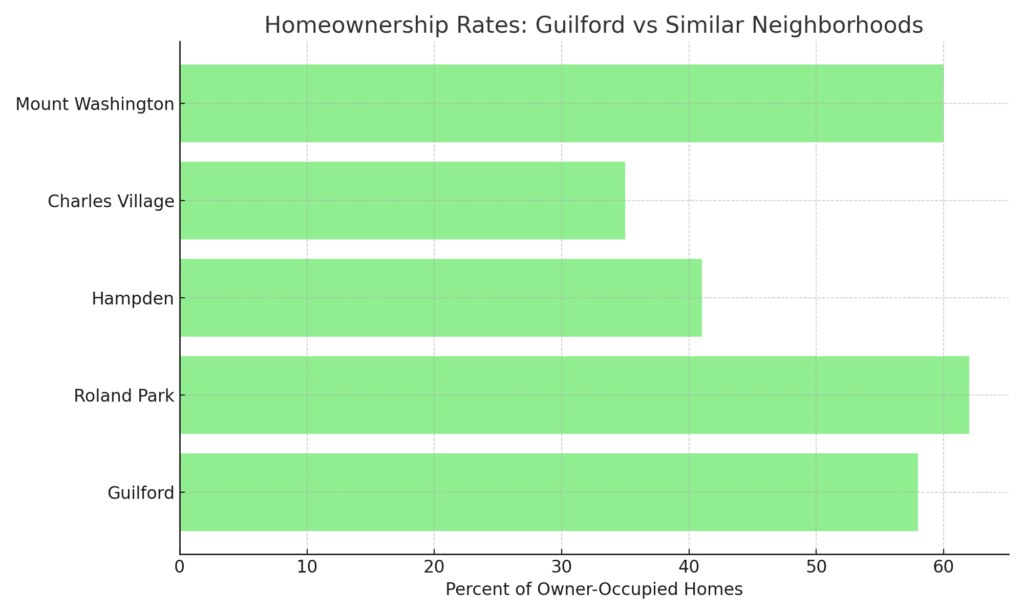

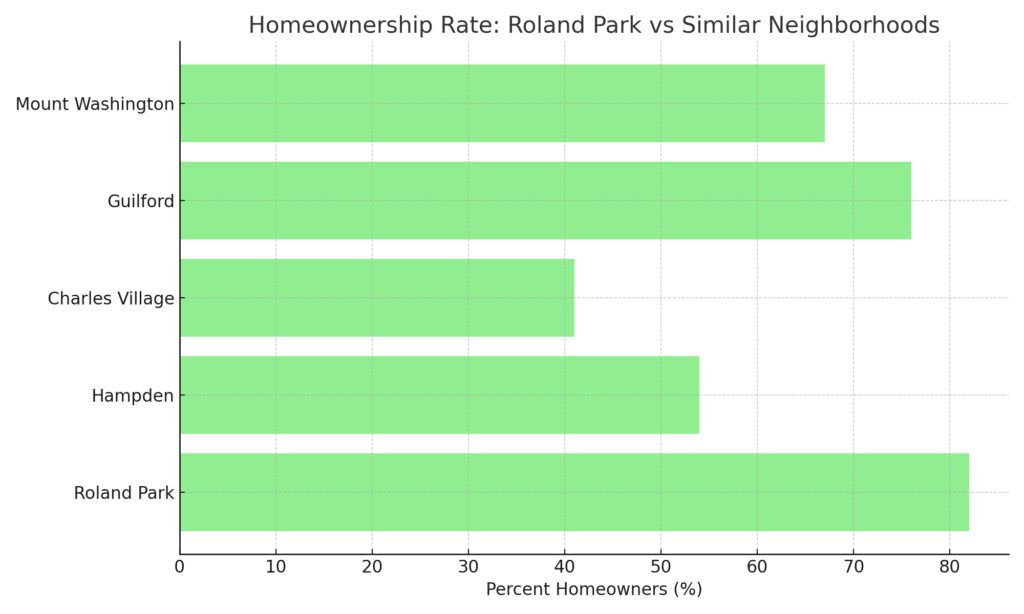

Homeownership in Baltimore’s Hampden Neighborhood

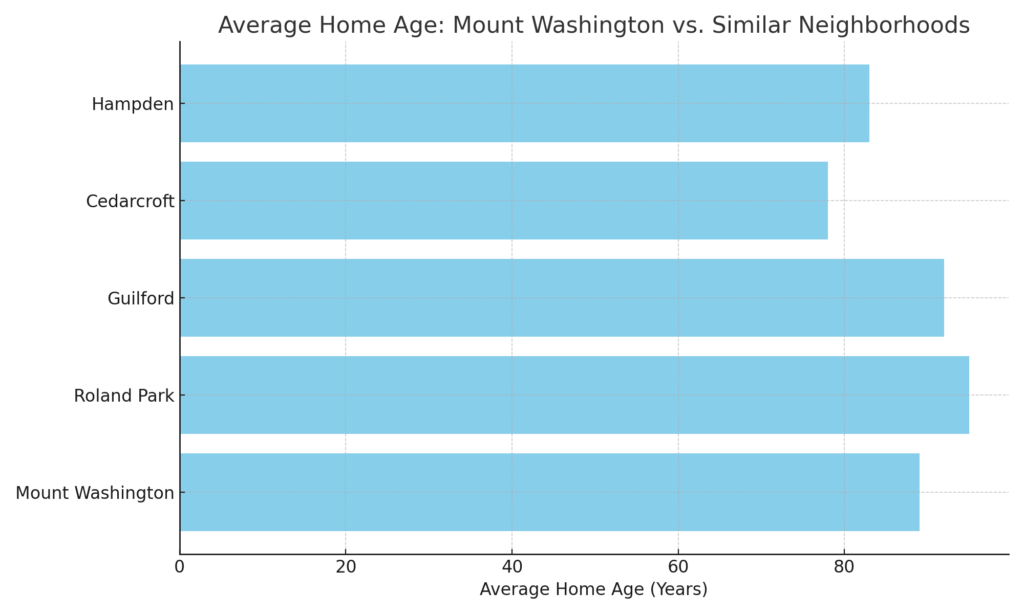

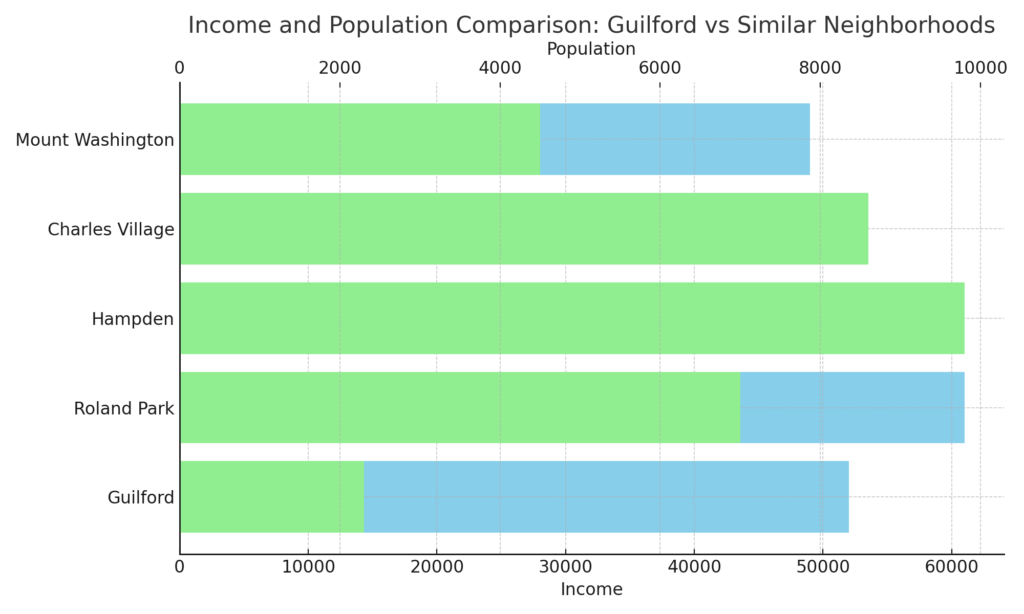

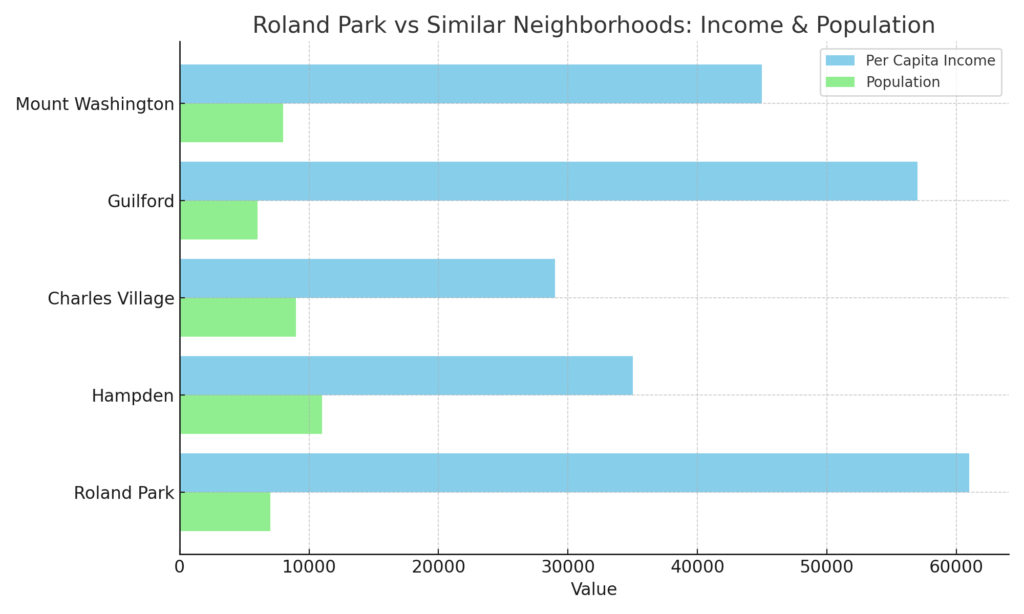

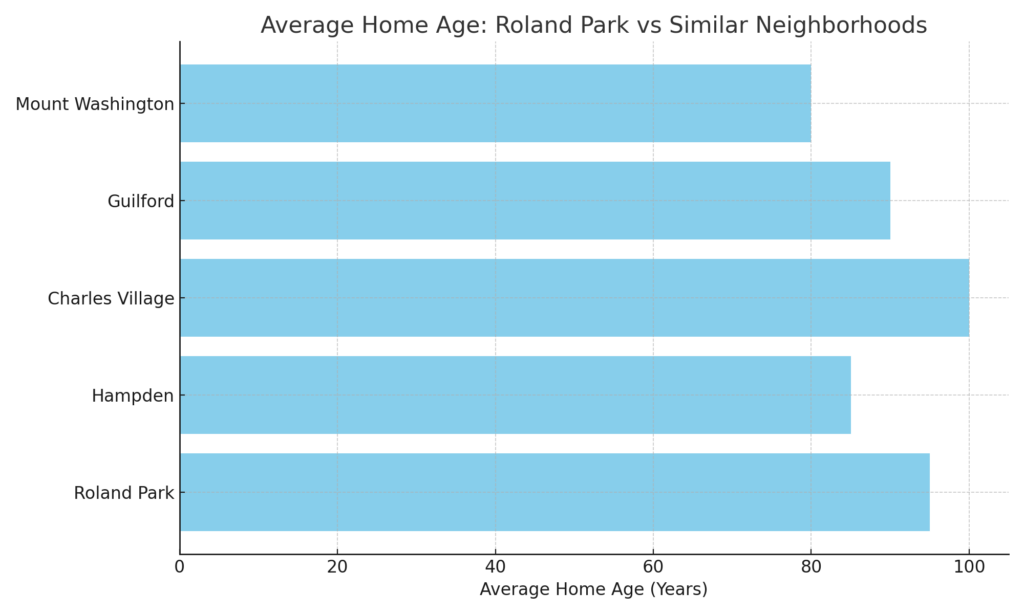

HAMPDEN boasts one of Baltimore’s most desirable housing markets. Its mixture of Victorian-era rowhomes, converted mills, and modern infill properties gives homeowners a diverse and valuable real estate footprint. According to the Baltimore City Department of Planning, HAMPDEN’s housing stock is generally pre-1940, with a significant number of homes 80–100+ years old.

Older homes often present unique insurance coverage issues. *Many [read: most/all] policies exclude or limit claims for “wear and tear,” leading to denials for claims involving aging roofs, outdated plumbing, or knob-and-tube wiring. Homes in HAMPDEN may also be at risk for burst pipe incidents due to Baltimore’s freeze/thaw cycles—resulting in winter claims that insurers reject due to maintenance exclusions.

Baltimore Claim Denial Lawyer Tip: Commercially available homeowners insurance does not cover something that breaks because it is old

Yet HAMPDEN’s charm is exactly what makes its homes so valuable. Residents here take pride in their properties and work hard to preserve them. But when an insurance company fails to honor a valid claim, that sense of security is shattered. That’s where having an insurance claim denial lawyer who understands HAMPDEN’s landscape can be critical.

Community groups like Strong City Baltimore and cultural anchors like Baltimore Heritage have a presence in and around HAMPDEN, supporting preservation and livability. These organizations—and your legal allies—can be valuable resources during an insurance battle.

Your Resources

- Hampden Village Merchants Association

- Baltimore Office of Sustainability

- Strong City Baltimore

- Baltimore Heritage

- Baltimore Department of Planning

Q1: Are HAMPDEN homes more prone to insurance disputes?

A1: Yes. Due to the age of HAMPDEN’s housing stock, insurers often cite “wear and tear” as a reason to deny valid claims for plumbing, roof, or water damage.

Q2: Can my claim be denied just because my pipes burst in winter?

A2: Not necessarily. While insurers may try to blame poor maintenance, a valid claim can still be pursued if you took reasonable precautions.

Q3: What if my home has been partially modernized—will that help my claim?

A3: Possibly. Upgrades like modern HVAC, new electrical panels, or replaced roofs can strengthen your claim and counter insurer arguments about aging systems.

Q4: I was denied coverage for water damage in my HAMPDEN basement—can I appeal?

A4: Yes. Many such denials can be appealed, especially if your policy language is vague or contradicts the insurer’s denial rationale.

Q5: Is mold damage ever covered under Baltimore homeowners insurance?

A5: It depends. Most policies exclude mold unless it results from a covered event like a pipe burst. A legal review is essential.

Next Steps After a HAMPDEN Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

1. Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,—known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible.

2. Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows.

3. Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

4. Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

5. Keep Your Denial Communications

• Your insurance company is required to give a written reason for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking. Statute of limitations.

• Keep all correspondence, including emails and letters, in a dedicated file. The denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

6. Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How to Challenge a HAMPDEN Insurance Claim Denial – My Steps:

- Step 1: Apply Professionalism & Integrity

– I begin with a review of your denial letter and policy.

– My process is honest, direct, and transparent—no gimmicks, no empty promises.

– I identify whether the insurer’s justification aligns with the policy and Maryland law. - Step 2: Use Responsiveness to Build Momentum

I communicate with you, your insurer, and any involved experts.

Time is critical—delays can damage a case. - Step 3: Deploy Advocacy & Negotiation Tactics

Document and substantiate why the denial is flawed.

Present supporting evidence and pressure the insurer into reviewing its position.

When needed, I escalate to formal litigation to protect your rights - Step 4: Bring Results-Driven Action to Trial

I file suit in the appropriate court and aggressively litigate the matter.

I use discovery to uncover the insurer’s methods, analysis and flaws in their investigation.

How Attorney Eric T. Kirk Can Help with Your Denied HAMPDEN Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most HAMPDEN denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement.

✔ File a lawsuit – I sue insurance companies.

✔ Take your case to trial – I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”