Denied Insurance Claim Lawyer Baltimore’s Canton | 21224

🟦 TL;DR: Key Takeaways — Denied Insurance Claim Lawyer | Baltimore’s Canton 21224

- 🏡 Canton, Baltimore (21224) has a unique mix of historic rowhomes and waterfront redevelopment — meaning insurance issues can involve flood, storm, or aging infrastructure.

- ⚖️ If your homeowners or property insurance claim has been denied, an experienced insurance claim denial lawyer can help challenge the decision.

- 💡 Common reasons for denials in Canton include policy exclusions, disputed cause of loss, and filing delays.

- 🧭 I help Canton residents navigate insurer pushback, review coverage language, and litigate denials when necessary.

- 📈 Canton has experienced increased claims tied to waterfront weather impacts and aging housing stock — making local knowledge critical in insurance disputes.

Canton, a vibrant waterfront community in southeast Baltimore, is known for its historic rowhouses, redeveloped harborfront, and lively streets. But like many neighborhoods with aging housing stock and proximity to the water, insurance claim disputes are common — and often complex. When a homeowners insurance claim is denied here, it can mean serious financial and emotional strain.

As an insurance claim denial lawyer serving Canton 21224, I focus on holding insurers accountable when they wrongly refuse to pay legitimate claims. Insurance companies frequently rely on fine print, technicalities, and aggressive legal teams. Residents of Canton deserve a strong advocate with deep knowledge of Maryland insurance law and Baltimore’s housing landscape.

This article explains — in practical, step-by-step terms — what to do when your insurance company denies your claim in Canton, how local conditions affect coverage issues, and how legal action can help you secure the compensation you’re owed.

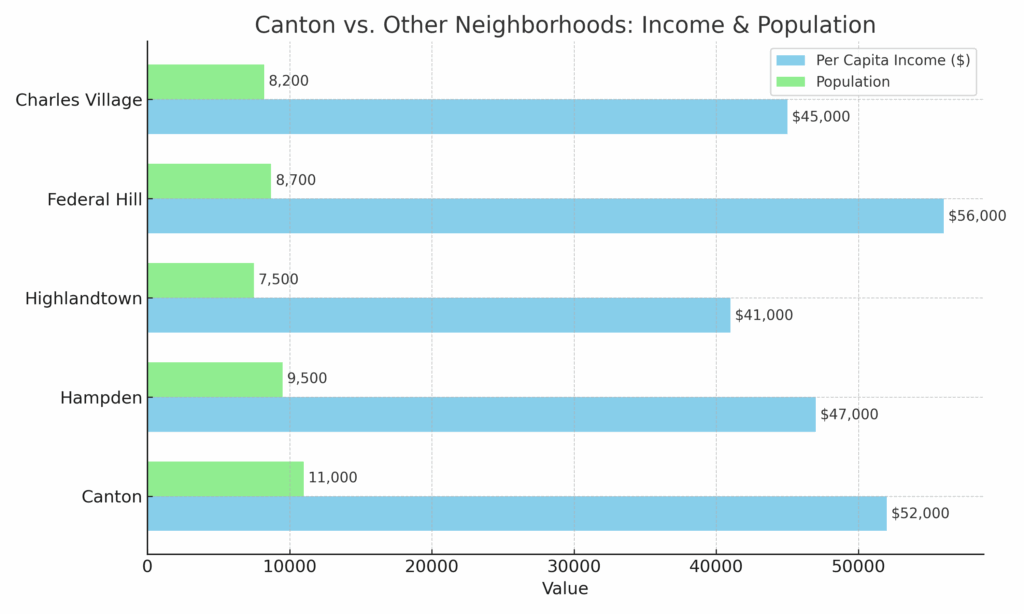

Canton sits on the southeastern edge of Baltimore City, ZIP code 21224, bordered by Patterson Park, Highlandtown, and the Inner Harbor. Once an industrial hub, it has transformed into a sought-after residential and commercial community. Boston Street, Canton Square, and the Canton Waterfront Park are well-known landmarks.

Canton has a mix of 19th-century rowhomes and newer waterfront townhouses. That blend means insurance issues here often involve water intrusion, storm surge, aging infrastructure, or complex renovation coverage questions. Homeowners may face claims arising from:

- Roof leaks due to aging or historic construction methods.

- Flooding or water damage tied to the neighborhood’s proximity to the harbor.

- Frozen pipes or HVAC failures in older homes with outdated plumbing.

- Storm surge and high winds along the waterfront corridor.

- Renovation-related disputes, particularly in homes with modern upgrades in historic shells.

Because Canton homes often sit on narrow lots with shared walls, claims can also involve neighboring property disputes — something many insurers try to exploit when denying coverage.

Local Factors Impacting Insurance Claims

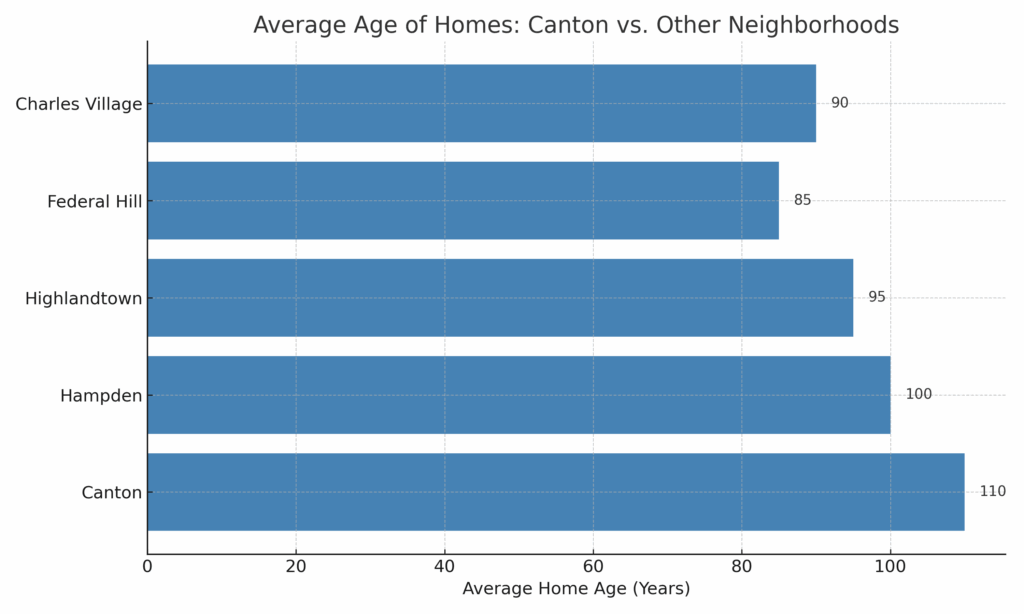

- Historic Housing: Much of Canton’s housing stock dates to the late 1800s and early 1900s. Older plumbing, roofs, and HVAC systems are fertile ground for insurer denials citing “wear and tear.”

- Waterfront Exposure: Canton’s harbor location increases the likelihood of flood and storm damage claims — often subject to exclusions or separate flood policies.

- Mixed Property Use: Some homes are converted into rentals or mixed residential/commercial units. This can lead to disputes over policy classifications and coverage scope.

- Weather Patterns: Heavy rain events and high tides can lead to basement flooding, roof leaks, and foundation seepage.

Your Canton home is likely your most valuable assets—don’t let an insurance denial leave you without it. You paid your premiums expecting protection, yet when disaster strikes, your insurer refuses to pay. I’m Eric T. Kirk, Baltimore Insurance Claim Denial Lawyer. I resist, dispute and counterattack insurance claims denial. I file lawsuits against those insurance companies, retaliating against unfair claim denials, always seeking to ensure Canton homeowners get the coverage they deserve – and paid for.These are precisely the conditions insurers seize upon to deny or underpay claims. A knowledgeable Canton insurance claim denial lawyer understands both the legal framework and the neighborhood realities.

Video Transcript: Insurance Claim Denials in Canton, Baltimore (21224)

The following is a verbatim transcript of a video in which Baltimore insurance claim denial lawyer Eric T. Kirk explains why homeowners insurance claims are denied in Canton, Baltimore (21224), how insurers distinguish between delayed and denied claims, and how Maryland insurance policy obligations apply.

Is a Delay the Same as a Denial in an Insurance Claim?

Insurance Won’t Pay in Canton? Here’s How They Can Keep Denying Claims.Is delay the same as a denial? How can you tell if your claim is being delayed? My name is Eric Kirk. I’m an attorney here in Baltimore, and I’ve been handling denied insurance claims for 30 years.

How to Tell When an Insurance Claim Has Been Formally Denied

A denied claim is not the same as a delayed claim, although it can be difficult to tell. If your claim is denied, you should know. The insurance company is obligated to send you a letter detailing the reasons for the denial.

What a “Functional Denial” Looks Like in Practice

A delayed claim is somewhat different. What I can offer is some guidance on the issue. What we tend to see here is what I’ll call a functional denial. A delay of such length that it is the practical and functional equivalent of a denial of the claim. A delay of such magnitude that it robs the insured person of the proceeds of the compensation that they need to fix the

This transcript is provided for educational purposes and reflects a general discussion of denied homeowners insurance claims under Maryland law.

Why Was My Canton Homeowners Insurance Claim Denied?

Common Reasons for Canton Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

| Canton Factors | Why This Matters for Insurance |

|---|---|

| Proximity to Baltimore Harbor & Tidal Canals | Many Canton properties sit steps from waterfront inlets and tidal canals. Insurers frequently dispute whether water intrusion is storm-driven rain (potentially covered) or excluded tidal flood, leading to claim denials over causation. |

| Rowhouse Redevelopment & Rooftop Decks | Widespread renovations and rooftop decks introduce drainage, flashing, and structural vulnerabilities. Insurers often argue that leaks are due to improper construction or maintenance rather than a sudden covered peril, triggering exclusion denials. |

| Mixed Residential–Bar/Restaurant Use | Canton homes are packed near commercial bars and restaurants. Fire, exhaust, and grease-vent hazards from adjoining structures can cause losses that insurers classify as commercial-originating, resulting in coverage disputes or exclusions. |

| Canton Insurance Lawyer’s Tip #17: It is page one in the claims denial playbook. If there is a possible cause other than a covered one- run with it. |

Homeownership in Baltimore’s Canton Neighborhood

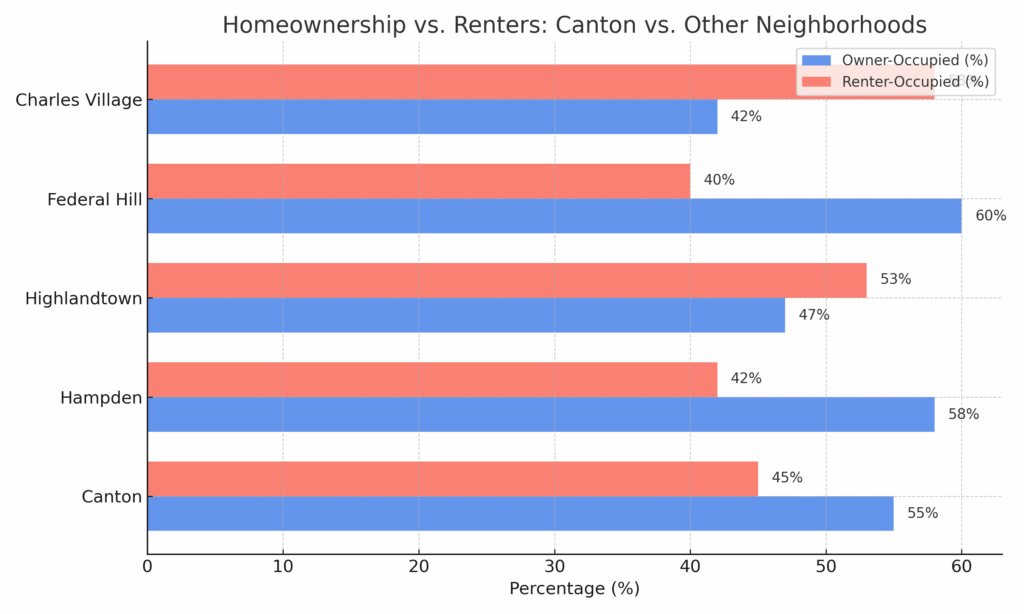

Canton’s housing market reflects its history as an industrial waterfront district reborn as a prime residential hub. The majority of Canton homes are historic rowhouses, often modernized with interior renovations. According to Baltimore City Planning Department, Canton is part of a mixed-market area where homeownership remains strong but rental conversion is rising.

Key housing characteristics in Canton 21224:

- 🏘️ Age of Homes: Many built between 1890 and 1930, with later infill development.

- 🧾 Ownership vs. Rental: A mix of owner-occupied rowhouses and newer condo developments, alongside rental properties.

- 🌊 Flood Risk: Proximity to the harbor puts basements and lower levels at risk of flooding, particularly during heavy rain and high tide cycles.

- 🧱 Renovation Trends: Significant interior remodeling means insurance disputes often involve what is “original structure” vs. “new improvements.”

Why This Matters for Insurance

- Older homes are more likely to be subject to maintenance-related claim denials.

- Waterfront properties face more exclusion disputes over flooding vs. stormwater intrusion.

- Rental conversions can create classification conflicts in insurance coverage.

These local nuances underscore why hiring a Canton insurance claim denial lawyer who understands both Maryland insurance law and Canton’s housing realities can make a decisive difference.

Canton Resources

- Baltimore City Department of Planning

- Canton Community Association

- Baltimore Office of Emergency Management

- Maryland Department of the Environment

- Baltimore City Department of Housing & Community Development

- Baltimore City Government

- Patterson Park Audubon Center

How to Challenge A Canton Insurance Claim Denial — My Steps:

How to Challenge A Canton Insurance Claim Denial — My Steps:

- Responsiveness

When a Canton homeowner calls after a denial, I review the denial letter, policy language, and obtain the claim file.

Camden Insurance Law 101: Client communication and thorough documentation prevent lost time and missed deadlines. - Understanding

Many denials involve sudden damage to family homes. I listen to the client’s story, explain the coverage dispute in plain language, and ensure they know they’re not facing the insurer alone.

- Advocacy & Negotiation

I analyze the insurer’s rationale, confront flawed or incomplete investigations, and negotiate aggressively to secure a fair settlement or prepare for litigation.

Canton Insurance Lawyers Tip #303: Claims that have not been formally denied, in whole or in part, are often not ripe for litigation. - Professionalism & Pursuit

I define a litigation strategy, honest cost expectations, and pursue the case persistently from pre-suit negotiation through trial.

Canton Insurance Claim Denials- FAQ

Canton’s location along the harbor means basements and foundations face greater exposure to flooding, seepage, and high-tide surges, leading to frequent insurance disputes.

Canton’s location along the harbor means basements and foundations face greater exposure to flooding, seepage, and high-tide surges, leading to frequent insurance disputes.

Yes, standard homeowners policies often exclude flood. Many Canton properties fall in flood-risk zones, making separate evaluations coverage critical.

Canton Insurance Lawyers Tip #106: When this question comes up, its tool late. You need the coverage beforehand.

Statutes of limitation apply, typically three years for breach of contract in Maryland. But the clock starts at denial, so prompt action is vital.

Read The Law: Maryland Statutes Courts and Judicial Proceedings Title 5 – Limitations

Flooding, roof leaks, pipe bursts, and storm damage are common — especially in older rowhomes near the waterfront.

Camden Insurance Law 101: Every property is unique, as is every claim.

Next Steps After a Canton Homeowners Insurance Claim Denial

- Stabilize and Preserve the Scene of the Loss • If your home has been damaged, take immediate action to prevent further harm. • Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp). • Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss • Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate. • This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately • Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

State Farm, Travelers, Allstate, Nationwide, USAA. - Comply with Policy Conditions & Your Duty to Cooperate • Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. • Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications • Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. • Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney • Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial? • An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

When your claim is denied in Canton, I step in to level the playing field.

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid.

✔ Gather your evidence to support your claim.

✔ Negotiate aggressively and consistently with your insurer.

✔ If needed, I sue insurance companies.

✔ And I try those cases in court.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”

So Should You.

Overall, Canton is a dynamic and desirable neighborhood in Baltimore, known for its historic character, waterfront location, vibrant culture, and strong sense of community. In specific neighborhoods like Canton in Baltimore, Maryland, insurance claims can be affected by various factors such as weather events, accidents, crime rates, and other local conditions.

Why Was My Canton Homeowners Insurance Claim Denied?

Insurance companies may, and do, deny claims for a variety of reasons, some legitimate and others designed with other motives. It has been suggested that reasons for Baltimore insurance claims denials may be limited only by the ingenuity of the claims adjuster. Understanding the common causes of denial can help you determine the best course of action.

Common Reasons for Caton’s Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company. Duty to Cooperate. EUO.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

Next Steps After Canton Homeowners Event / Loss / Damage

1. Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

- Take photos and videos to document the damage as soon as possible.

2. Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

3. Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

4. Prepare to be Frustrated, Out of Patience, and Angry

- Going through a homeowners insurance claim—especially when it’s denied or delayed—can be an supremely frustrating and disheartening experience. Over the course of the 30 years, I have heard homeowners voice the same consistent frustrations.

- Stuck in a cycle of endless phone calls and unanswered emails, just trying to get a response from their insurance company.

- The process can drag on for months.

- The waiting, the uncertainty, and the feeling of being ignored can make an already difficult situation feel overwhelming.

- Every step takes longer than expected, leaving homeowners unable to move forward with repairs or rebuilding.

- They’re left living in unsafe or uncomfortable conditions, often paying out of pocket for temporary solutions.

- Often left feeling like they’re fighting an uphill battle just to get what they’re owed.

5. Comply with Policy Conditions & Your Duty to Cooperate

- Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. These homeowner’s requirements and obligations are not transferrable to insurance claims denial attorney, or “handled by” the lawyer. The homeowner is the custodian of the records, the owner of the property, and the person most familiar with the loss. I’ve seen a tendency to “lawyer up” when these obligations mount. Timing is everything in life, and employing a claim denial attorney, while the claim is being adjusted, is likely not the best use of your money. The necessity to provide detailed inventories and extensive documentation, meet with contractors, and other claims details and nuances can seem overwhelming. But, read the next paragraph.

- A homeowner’s refusal or failure to adhere to requirements and obligations can have devastating consequences. Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Timing is everything in life, and employing a claim denial attorney, before the claim has been denied, in whole or in part, while the claim is evolving, is likely not the best use of your money. Hopefully, your journey to a complete financial recovery end there. When it does not, when your claim has been denied, fully or partially, I reccommend:

Denial of your insurance claim is a crucial juncture in the journey of you being made whole for your loss. It is when your claim has been rejected, in whole or in part, that a seasoned insurance claims denial litigator will be of the highest benefit.

How Attorney Eric T. Kirk Can Help with Your Denied Canton Homeowners Insurance Claim

Eric T. Kirk

Canton Insurance Claims Denial LawyerEric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Canton denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively, consistently and with intent and purpose with your insurer, seeking to engineer a fair settlement. If not….

✔ File a lawsuit I might have mentioned. I sue insurance companies.

✔ Take your case to trial. I try cases against insurance companies. I assure you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.