Denied Insurance Claim Lawyer | Baltimore’s Federal Hill | 21230

Denied Insurance Claim Lawyer: Baltimore’s Federal Hill | 21230

TL;DR (read this first)

- Federal Hill (21230) sits south of the Inner Harbor; dense rowhouses + waterfront micro-climate = unique property risk.

- Common denials: “wear and tear,” long-term seepage, surface-water/flood exclusions, and “pre-existing damage.”

- Step-by-step approach: document immediately, line up the definition of covered loss, and match facts to policy language.

- If your claim was denied, the most important next move is a rapid policy/denial-letter review and smart evidence mapping.

- In summary: an Insurance claim denial lawyer for Federal Hill 21230 ties local building realities to coverage, and litigates when needed.

Your Federal Hill home could be one of your most significant investments—do not allow a denied insurance claim to undermine that value. You’ve faithfully paid your premiums with the expectation of protection, yet when a calamity occurs, your insurer refuses to compensate you? Maddening? I’m Eric T. Kirk, a Baltimore-based Denied Insurance Claim Lawyer, and I make it my mission to oppose unjust claim denials. I file lawsuits against uncooperative insurance carriers, helping Federal Hill homeowners secure the coverage they worked for—and deserve. Denied Insurance Claim Lawyer | Baltimore’s Federal Hill—that headline speaks to what matters after a carrier says “no”, or “yes, but”…. or any variation of that. In 21230, where 19th-century brick rowhouses meet the Inner Harbor breeze, denials often hinge on exclusions, timelines, or causation fights. On this page I endeavor to explain the step-by-step response after a denial, the definition of covered loss versus excluded conditions, and why the most important decision you make is choosing representation that actually dues insurance companies and tries cases. If you searched for an Insurance claim denial lawyer for Federal Hill 21230, you’re in the right place: short, scannable guidance; local resources; and a practical plan—in summary, everything a homeowner needs to convert a paper denial into a real challenge.

Baltimore’s Federal Hill Neighborhood | 21230

Where is Federal Hill in Baltimore?

Federal Hill is the historic neighborhood perched just south of the Inner Harbor, anchored by the grassy summit of Federal Hill Park and ringed by brick rowhomes, corner storefronts, and the Cross Street Market corridor. From the park’s crest—documented in the neighborhood’s history and the hill’s wartime lookout role—residents look north to the skyline and east toward Locust Point and the Baltimore Peninsula/Port Covington waterfronts. See the core overview at Federal Hill (neighborhood) on Wikipedia for orientation and naming conventions, and the hill itself at Federal Hill Park; the latter confirms the park’s location at 300 Warren Ave., Baltimore, MD 21230. erictkirk.com

Two realities define risk in 21230. First, it’s a tight, masonry-heavy district with many older roofs, parapets, and party walls. Driving coastal rain can exploit flashing, coping, and mortar paths—then reveal itself late, which insurers often label as “long-term seepage.” Second, parts of 21230 lie near mapped floodplains and storm-surge pathways tied to harbor proximity; Baltimore DPW points residents to city and FEMA floodplain resources for awareness and maintenance obligations relevant to loss mitigation and building permits.

Nearby Neighborhoods

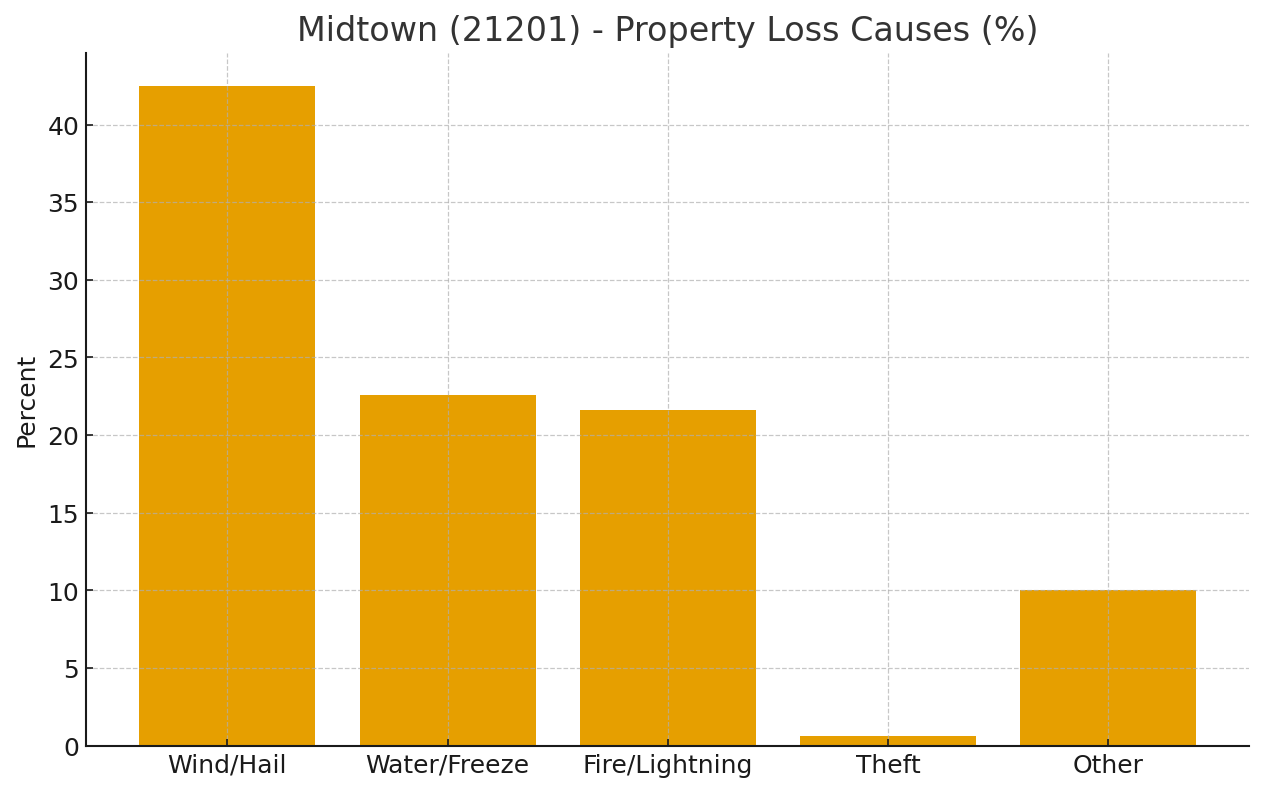

Homeowners near Fells Point, Midtown, and Remington

often face similar coverage disputes and can find guidance on these dedicated pages. erictkirk.com

Federal Hill also includes pockets within the CHAP (Commission for Historical & Architectural Preservation) Federal Hill Historic District overlay. CHAP’s guidance shapes exterior work methods and materials—facts that can influence scope, cost, scheduling, and the documentation you should keep for claims. erictkirk.com

Local investment has flowed through the South Baltimore Gateway Partnership (SBGP), which funds open-space, safety, and community projects across South Baltimore, including Federal Hill. For a denied property claim, SBGP isn’t a legal remedy; but its public records and community plans help show long-term neighborhood conditions, traffic patterns, green spaces, and infrastructure context—useful when you’re rebutting generic adjuster assumptions. erictkirk.com

Here’s the practical angle. A homeowner in Federal Hill 21230 who needs an Insurance claim denial lawyer generally faces one of three battles: (1) the carrier says water came from “surface water” or “long-term seepage”, or any other source of water (2) the carrier points to “wear and tear” on older roofing/masonry, or any other cause of damage, or (3) the carrier disputes causation where wind-driven rain meets tiny openings. The most important move can be to lock down timeline evidence—weather reports, photos, and invoices—so your definition of “direct physical loss” is supported by facts, not assumptions. In summary, the right attorney uses local building reality—not generic checklists—to challenge a carrier’s paper case.

Why Was My Federal Hill Homeowners Insurance Claim Denied?

Insurance companies can (and do) deny claims for numerous reasons—some with legitimate basis, others motivated by questionable objectives. As a denied Insurance Claim Lawyer for Baltimore’s Federal Hill, I suggest specific local factors such as waterfront weather events, property-related incidents, and community crime rates can impact the claim process. It is often said that the justifications for insurance denials may be limited only by the creativity of the adjuster. Recognizing common denial causes is a key first step in determining how to proceed.

Common Reasons for Federal Hill Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers frequently invoke exclusions like flood, freezing, earthquake, or mold damage. In some instances, these denials can be contested, depending on the policy language and Maryland statutes.

- Lack of Proper Maintenance: Companies may shift blame to homeowner neglect rather than a covered peril, leaving you responsible. Policies issued in Baltimore traditionally exclude normal wear and tear.

- Late or Incomplete Filing: Failing to notify your insurer in a timely manner or omitting key documentation can be used against you.

- Disputed Cause of Loss: An insurer may claim your damages stem from a non-covered event, even if available evidence suggests otherwise. This frequently bewilders homeowners and can ultimately lead to courtroom battles in Baltimore.

- Misrepresentation or Fraud Accusations: If you are accused—fairly or otherwise—of providing inaccurate details, your claim may be quickly denied. If those accusations are unjust, I can help you fight back.

When an insurance carrier denies your claim, securing a reputable Insurance Coverage Denial Lawyer is essential. A lawyer’s review can identify gaps in the insurer’s argument and challenge unfair denials.

| Federal Hill Factors | Why This Matters for Insurance |

|---|---|

| Historic Rowhouses Under CHAP Restrictions | CHAP guidelines limit exterior modifications and materials. When a loss requires older or matching materials, insurers may dispute replacement cost or refuse to pay code-upgrade costs, leading to reduced or denied settlements. |

| Steep Hillside Foundations & Drainage | Ineffective drainage on steep grades may create foundation seepage and water infiltration. Insurers can deny these claims as “groundwater,” “seepage,” or “maintenance,” even when a storm triggered the intrusion. |

| Federal Hill Insurance Lawyer’s Tip #17: | Contract terms “groundwater,” “seepage,” can have a determinative impact on the claim, depending on how they are interpreted by a Baltimore court. |

| Tourism & High Foot Traffic | Large event crowds, bars, and tourism increase liability exposures. Insurers may classify risks differently, surcharge policies, or deny claims tied to “business use,” type visitor injuries, or activity not contemplated by a standard homeowner policy. |

Homeownership in Baltimore’s Federal Hill Neighborhood

Federal Hill’s housing is a compact grid of historic brick rowhouses, converted flats, and modern infill near the Inner Harbor and Rash Field, with blocks radiating from Federal Hill Park down to Key Highway and across to Riverside and Otterbein. The housing mix, plus CHAP oversight in parts of the district, creates real-world friction in claims: roof edges and parapets can channel storm-driven rain; masonry repairs may require historically appropriate materials; and scaffolding/traffic control near busy corridors can expand repair scope. City resources referencing floodplain and stormwater obligations matter for homeowners who must mitigate further loss appropriately—see Baltimore DPW floodplain information and FEMA guidance used by the City. In this setting, a Federal Hill 21230 Insurance claim denial lawyer builds a file that marries high-resolution timelines (first signs of water, wind speeds, rain totals) with estimates tailored to preservation requirements—critical when a carrier calls normal deterioration or “faulty maintenance.” In summary, the coverage fight turns on matching your facts to policy language and local building constraints, not on generic adjuster scripts. erictkirk.com

Hyper-local resources (linked in-text and below):

– Federal Hill (neighborhood) and Federal Hill Park (orientation + history);

– CHAP Federal Hill Historic District (exterior work rules);

– Baltimore DPW (floodplain/stormwater);

– South Baltimore Gateway Partnership (community planning context). erictkirk.com+2erictkirk.com+2

Federal Hill Resources

- Federal Hill (neighborhood) — Wikipedia: https://en.wikipedia.org/wiki/Federal_Hill,_Baltimore

- Federal Hill Park — Baltimore City Recreation & Parks: https://bcrp.baltimorecity.gov/parks/federal-hill-park

- CHAP – Federal Hill Historic District: https://chap.baltimorecity.gov/federal-hill-historic-district

- Baltimore City DPW – Floodplain/Stormwater: https://publicworks.baltimorecity.gov (floodplain resources)

- South Baltimore Gateway Partnership (SBGP): https://sbgpartnership.org/

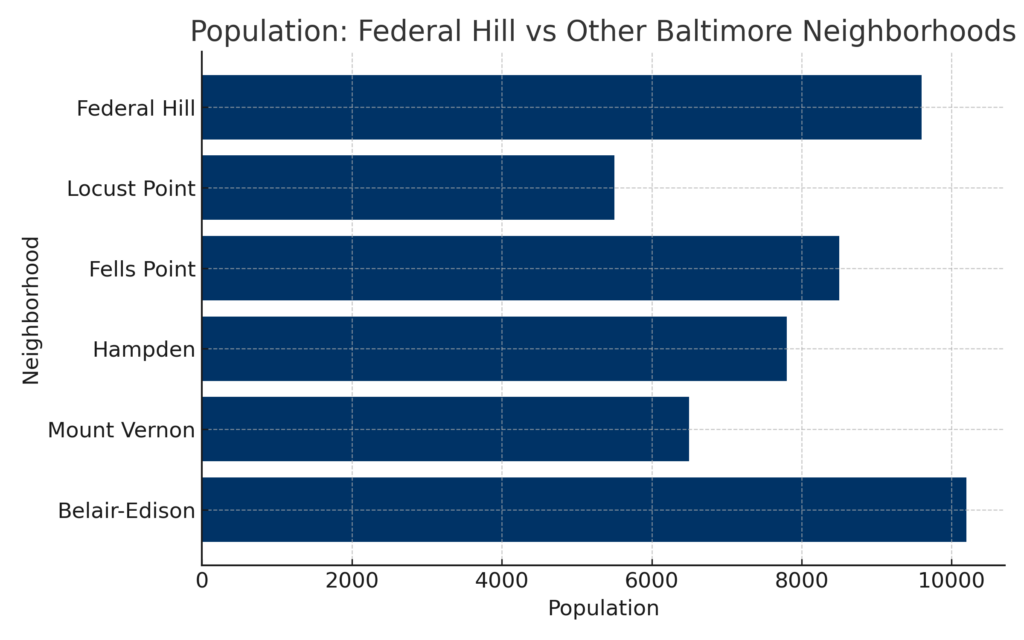

According to publicly available data from Baltimore City and federal sources, Federal Hill exhibits a robust housing market that skews toward renovated rowhomes, many originally built in the 19th century. As of the most recent figures, the median home value hovers around $380,000, while sales prices can vary based on proximity to the waterfront or historical status. Homes often spend roughly 40 days on the market—longer if they are higher-end or have extensive updates. About 60% of listings ultimately sell below initial asking price, indicating room for negotiation in this moderately competitive market. Urban charm, convenience, and strong community involvement have continued to make Federal Hill a desirable choice for many Baltimore residents.

Next Steps After a Federal Hill Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

• State Farm

• Traveler’s

• Allstate

• Nationwide

• USAA - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. Keep all correspondence, including emails and letters, in a dedicated file.

The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. Breach of Contract. I am A Denied Insurance Claim Lawyer, Baltimore’s Federal Hill | 21230. I will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Most understand “denied claims”. These steps explore ways to challenge the “functional denial”: and acceptance of the claim, without paying the full amount of damages

When and insurance company offers to pay only a part of the claim, or offers an amount that comes nowhere close to covering the damages.

Federal Hill Insurance Lawyer’s Tip #16: This is not a term of art found in your insurance policy or the Insurance Code. This is a practical label I’ve given to an everyway occurrence.

How Attorney Eric T. Kirk Can Help with Your Denied Federal Hill Homeowners Insurance Claim?

Eric T. Kirk

Federal Hill Insurance Claim Denial LawyerEric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Federal Hill denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies. I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.