Denied Insurance Claim Lawyer: Baltimore’s Fells Point | 21231

Fells Point, one of Baltimore’s oldest and most architecturally distinct neighborhoods, has been home to generations of hardworking residents. When disaster strikes—whether through storm damage, fire, water intrusion, or vandalism—residents expect their insurance coverage to do what it promises: pay valid claims. But when those claims are denied, the consequences can be devastating. I am a Denied Insurance Claim Lawyer for Baltimore’s Fells Point, 21231, with track record of holding insurers accountable, and I fight for fair outcomes—especially for those in tightly-knit communities like Fells Point.

This historic waterfront neighborhood in the 21231 ZIP code faces unique challenges. The combination of aged infrastructure, rowhouse density, and proximity to the harbor makes certain types of homeowner’s insurance claims more prevalent—and more likely to be denied. From roof collapse due to water saturation to disputes over wind damage, claimants in Fells Point must navigate a complicated and sometimes hostile claims process.

For those seeking answers and compensation, this article provides a step-by-step guide to understanding what to do after a denial, what common reasons insurers use to deny claims, and how an experienced insurance claim denial lawyer serving Baltimore’s Fells Point can help.

Where is Fells Point in Baltimore?

Fells Point sits southeast of Downtown Baltimore along the northern edge of the Patapsco River. With cobblestone streets, preserved 18th-century buildings, and a rich maritime history, the neighborhood is a well-known cultural hub. Stretching from Broadway to Caroline Street and northward to Eastern Avenue, it borders the neighborhoods of Canton, Harbor East, and Upper Fells Point.

As a popular tourist destination and residential enclave, Fells Point mixes high-density housing with small businesses, restaurants, and cultural venues. However, the older housing stock—often built in the early-to-mid 1800s—presents particular insurance risks. Wood frame structures, aging brickwork, and outdated plumbing or electrical systems all contribute to higher claim frequencies for water damage, electrical fires, and collapsed roofing.

A major insurance-related concern for Fells Point residents is the area’s vulnerability to flooding. Though not classified as a designated floodplain in its entirety, its harborfront location leaves many properties at elevated risk during heavy rainfall or tidal surges. I am a Denied Insurance Claim Lawyer for Baltimore’s Fells Point, 21231, and I can predict a common result. Insurance companies may invoke flood exclusions, claim pre-existing damage, or deny liability by citing maintenance issues—forcing homeowners to bear the cost alone.

Fells Point residents may also contend with bureaucratic complexities when filing insurance claims. Many properties fall within the bounds of the Baltimore City Historic Preservation Commission, which may delay or complicate necessary repairs. Additionally, limited on-site parking, tight alleyways, and limited roof access can impact damage inspections—raising issues that insurers may exploit.

For those dealing with denied claims, it’s important to act quickly, document thoroughly, and consult an experienced Baltimore insurance claim denial lawyer with knowledge of neighborhood-specific challenges.

Why Was My Fells Point Homeowners Insurance Claim Denied?

Common Reasons for Fells Point Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. I am a Denied Insurance Claim Lawyer for Baltimore’s Fells Point, 21231, and every successful challenge to a denied claim I have ever prosecuted necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Video Transcript: Insurance Claim Denials in Fells Point, Baltimore (21231)

The following is a verbatim transcript of a video in which Baltimore insurance claim denial lawyer Eric T. Kirk explains why homeowners insurance claims are denied in Fells Point, Baltimore (21231), what constitutes a “soft denial,” and how Maryland insurance disputes are litigated.

What Is a “Soft Denial” in an Insurance Claim?

Fells Point Insurance Claim Denial? Here’s How Homeowners Fight Back 31231What is a soft denial in an insurance claim? I’m Eric Kirk. I’m an attorney here in Baltimore. And for the last 30 years, I’ve been litigating cases against the nation’s largest insurance companies to get them to pay fair compensation to my clients.

How Insurers Partially Accept Claims While Denying the Most Expensive Repairs

A soft denial is a claim in which the insurance company recognizes that a portion of the claim is valid. This is typically a very small portion of the claim and certainly almost always a portion of the claim that involves the fewest dollars.

Why the Remaining Portions of the Claim Stay Denied

The balance of the claim, which invariably is the larger components of the claim, the items that are going to cost the most to repair, this remains denied. We sometimes call this a soft denial or a functional denial in Baltimore insurance litigation.

This transcript is provided for educational purposes and reflects a general discussion of denied homeowners insurance claims under Maryland law.

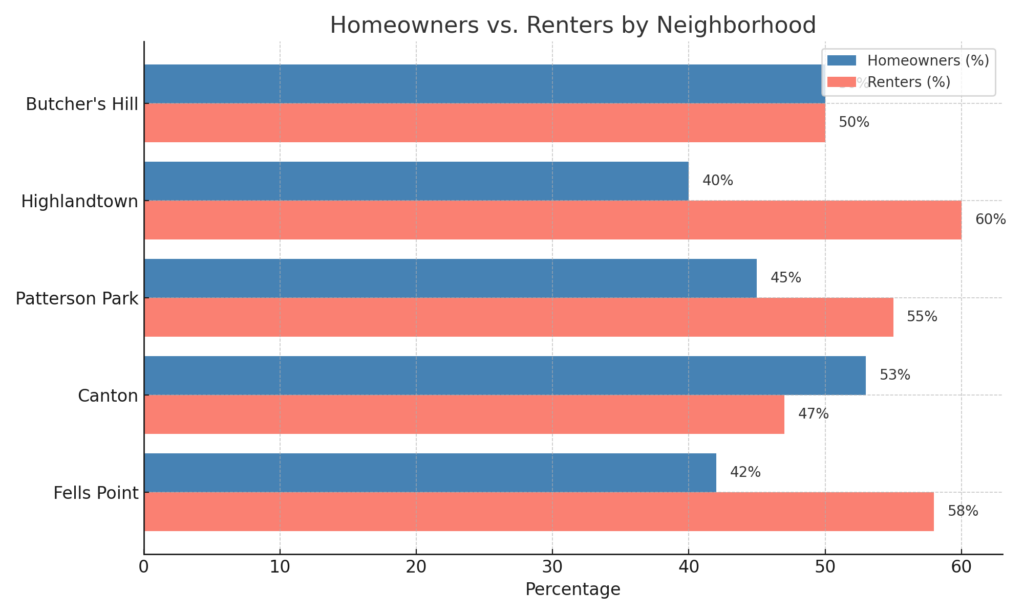

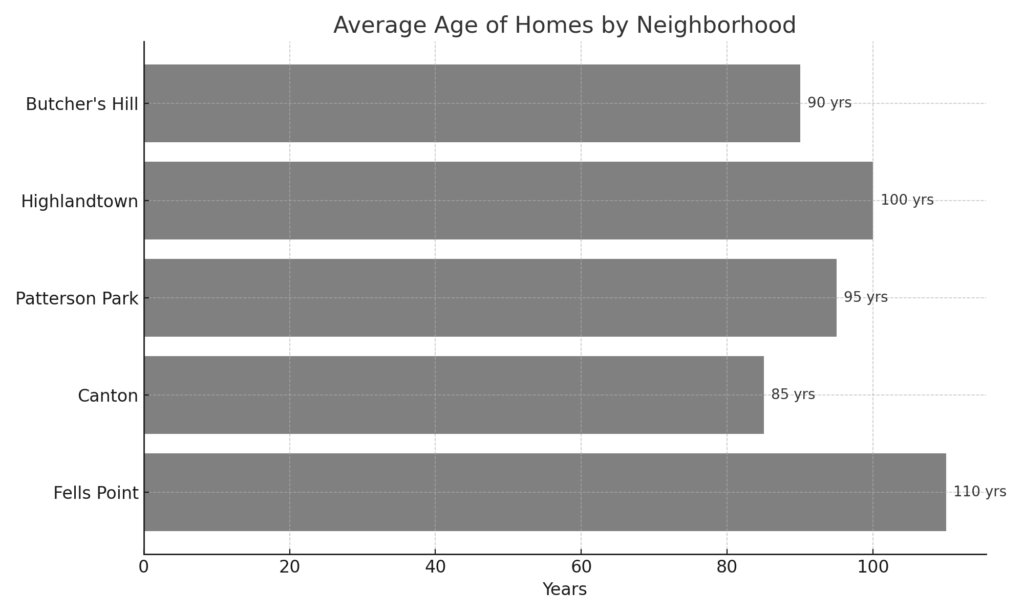

Homeownership in Baltimore’s Fells Point

Fells Point is one of Baltimore’s most distinctive neighborhoods, known for its historic charm and vibrant waterfront culture. But beneath the aesthetic appeal lies a mix of insurance-related risks that stem from older housing stock, dense urban design, and environmental exposure to harbor-related flooding and storm surge events. Many homes here were constructed before 1900, long before modern building codes or materials. According to the Baltimore City Planning Department, the average age of homes in the area exceeds 100 years. With outdated systems, aging foundations, and narrow lot configurations, homeowners face insurance hurdles that newer neighborhoods do not.

The Fells Point Residents Association has long advocated for more proactive city support in resolving sewer backups and groundwater intrusion issues that plague older properties. Many insurance claims from this neighborhood involve water damage—yet these claims are frequently denied due to assertions of pre-existing conditions or inadequate maintenance. Further complicating matters, homes located within historic districts face significant delays in repair work due to architectural preservation requirements.

Local groups such as the Southeast CDC provide assistance to residents seeking home improvement grants or legal support, while nearby institutions like the Maryland Legal Aid offer assistance for lower-income homeowners disputing wrongful denials.

Fells Point Resources

- Fells Point Residents Association

- Southeast Community Development Corporation

- Maryland Legal Aid

- Baltimore City Historic Preservation Commission

- Waterfront Partnership of Baltimore

Next Steps After a Fells Point Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

• State Farm

• Travelers

• Allstate

• Nationwide

• USAA - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations.

• Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance. - Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Fells Point denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit — I sue insurance companies

✔ Take your case to trial — I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial”

So Should You.