Denied Insurance Claim Lawyer | Baltimore’s Harbor East (21202)

TL;DR — Inner Harbor East Homeowners Insurance Claim Denials (21202)

- Inner Harbor East homeowners face unique denial risks tied to waterfront exposure, high-rise condos, and mixed-use buildings.

- A denied claim is not the end—policy exclusions, causation disputes, and maintenance allegations can often be challenged.

- An Insurance claim denial lawyer serving Inner Harbor East (21202) can analyze the policy, preserve evidence, and litigate when insurers refuse to pay.

- This page explains why claims are denied, how to fight back step-by-step, and what local factors matter in Inner Harbor East.

Denied Insurance Claim Lawyer: Baltimore’s Inner Harbor East | 21202

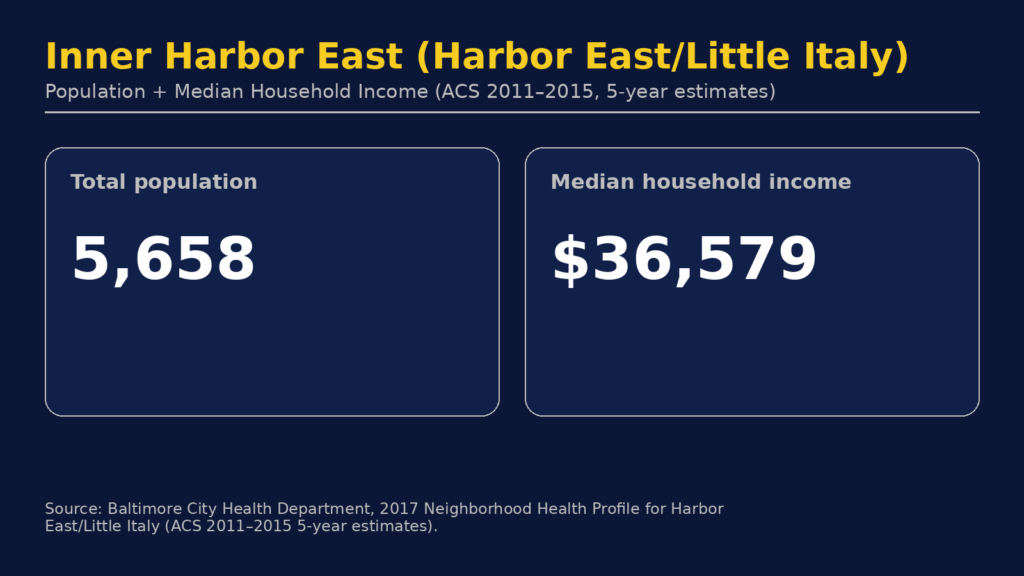

Residents of Inner Harbor East live in one of Baltimore’s most distinctive waterfront communities—defined by high-rise condominiums, mixed-use developments, and proximity to the harbor itself. When a homeowners insurance claim is denied, the consequences can be severe. Water intrusion, wind damage, roof failures, burst pipes, and storm-related losses are common claim scenarios in this neighborhood, yet insurers frequently dispute coverage. As an Insurance claim denial lawyer serving Inner Harbor East (21202), Eric T. Kirk has spent decades challenging unfair denials and forcing insurers to honor the policies they sold.

Homeowners in Inner Harbor East, 21202 often encounter denials framed around exclusions, causation disputes, or alleged maintenance failures. These defenses are not always correct. In many cases, insurers rely on technicalities, selective readings of policy language, or aggressive interpretations of exclusions to avoid payment. A Denied Insurance Claim Lawyer | Baltimore’s Inner Harbor East can evaluate whether the denial complies with Maryland law and the policy’s insuring agreement. This page explains what makes Inner Harbor East unique, why denials happen here, and how to appeal, dispute, and fight a homeowners insurance claim denial effectively—step-by-step, with clarity and precision.

Estimated reading time: 1 minute

Where is Inner Harbor East in Baltimore?

Inner Harbor East sits immediately east of Baltimore’s Inner Harbor, bounded by the waterfront, downtown corridors, and Harbor East’s dense residential-commercial footprint. The neighborhood is characterized by luxury and mid-rise condominiums, converted industrial structures, and newer construction clustered near the harbor. Streets such as Aliceanna Street and adjacent waterfront promenades reflect a blend of residential living and commercial activity, which directly impacts insurance coverage analysis.

From an insurance perspective, Inner Harbor East presents distinct risk factors. Waterfront proximity raises disputes over flood versus stormwater intrusion, particularly when insurers attempt to invoke flood exclusions after major storms. High-rise living introduces complex questions about unit owner versus association responsibility, shared infrastructure failures, and allocation of damage between building systems and individual units. Many properties rely on centralized HVAC, plumbing stacks, and roof systems—when these fail, insurers often argue the loss falls outside individual coverage.

Q: Are water damage claims denied often in Inner Harbor East?

A: Insurers frequently dispute whether water intrusion qualifies as excluded flooding or covered storm damage.

Inner Harbor East Insurance Lawyer’s Tip 9: Water damage claims present an easy denial rationale for insurers. Water intrusion has multiple sources: some are included in your coverage, while many are not.

A: Yes. Determining responsibility between master and unit policies can be critical. The good news- you may be an insured person under more that one policy.

Inner Harbor East Insurance Lawyer’s Tip 323: The bad news- the involved insurance companies have two sets of exclusions at their disposal.

A: Yes. I am the lawyer who handles denied claims “Appeals”. Disputes, and litigation are all potential options.

Inner Harbor East Insurance Law 101: Here, by appeal, I mean file a lawsuit to challenge the insurance companies denial rationale in court. Another potential “appeal” option is filing a complaint with the Maryland Insurance Administration.

Read the Law: §27-1001 Civil Complaint

A: Often yes, depending on policy language and causation. Maintenance facts and weather data often direct the correct path when challenging an Insurance Denial.

A: My answer- No. Many denials are based on contested interpretations.

Inner Harbor East Insurance Lawyer’s Tip 780: The lager question is what you ultimately do about it. If a $200, or $2,000 dollar claim is wrongfully denied, it would not make financial sense to litigate. If your home has $200,000 in damage, the opposite is true.

Housing stock in Inner Harbor East is relatively newer than many Baltimore neighborhoods, but that does not prevent denials. Newer construction claims often trigger allegations of construction defects, latent design issues, or exclusions tied to workmanship. Insurers may attempt to shift responsibility away from coverage by blaming developers or contractors, even when the policy covers ensuing damage. Additionally, wind and hail damage claims—particularly to roofs, windows, and exterior systems—are frequently contested under causation theories.

Transcript: “Inner Harbor East Homeowners: Underpaid or Denied Insurance Claim? Challenge the Policy Decision.”

Are mold damage, mold remediation, or mold related concerns covered under your insurance policy? My name is Eric Kirk. I am a lawyer in Baltimore. I’ve been practicing law for 30 years. I’ve devoted a substantial portion of my career litigating against insurance companies to obtain fair and just compensation for my clients that was originally denied to them. A frequently asked question in insurance litigation is what is covered and what is excluded. A core principle of any insurance claim is read the policy. Each coverage and each exclusion that may beat issue in your case is contained in your policy. A careful reading and a careful understanding of that policy is key to winning any insurance dispute.

Residents of Inner Harbor East (21202) also face challenges tied to condominium bylaws and master policies. Insurers sometimes deny claims by asserting that the association’s policy should respond, or by limiting coverage to “bare walls.” These disputes require careful policy analysis and a clear understanding of Maryland insurance law. An Insurance claim denial lawyer familiar with Inner Harbor East can untangle these layers and pursue the correct coverage path.

Why Was My Inner Harbor East Homeowners Insurance Claim Denied?

Common Reasons for Inner Harbor East Homeowners Insurance Claim Denials.

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

How to Challenge A Inner Harbor East Insurance Claim Denial — My Steps:

- Legal knowledge

Analyze exclusions, causation language, and insuring agreements common to condominium and waterfront claims in Harbor East

- Responsiveness

Review the denial letter and policy, collecting and assembling evidence in writing to preserve rights.

Inner Harbor East Insurance Lawyer’s Tip 556: The denial letter is a vital document in homeowners insurance litigation. - Advocacy & negotiation

Present evidence, expert opinions, and legal arguments to dispute improper denial grounds.

- Litigation, with emphasis on professionalism & integrity

If negotiations fail, prepare and file litigation, conducting discovery and taking the case through trial when necessary.

Inner Harbor East Insurance Law 101: Frustrated homeowners want to “appeal” the denial. I do just that. I file a lawsuit to challenge the insurance companies denial rationale in court.

Homeownership in Baltimore’s Inner Harbor East Neighborhood

Homeownership in Inner Harbor East differs markedly from traditional rowhouse neighborhoods. The area is dominated by condominiums and mixed-use buildings, with a higher concentration of owner-occupied units in vertical developments. This structure creates insurance disputes that are specific to Inner Harbor East. Unit owners often discover, after a loss, that coverage responsibilities are split between a master policy and individual HO-6 policies—an issue that frequently leads to denied homeowners insurance claims.

Waterfront exposure is a defining characteristic. While many properties are outside FEMA-designated flood zones, insurers still attempt to classify water intrusion as excluded flooding rather than covered storm damage. These distinctions matter. The definition of flood versus stormwater intrusion is one of the most important issues in Inner Harbor East insurance litigation. Roof systems, façade elements, and window assemblies are also frequent points of failure during storms, leading to roof damage claim denials and wind damage claim denials.

Another factor is the neighborhood’s reliance on shared building systems. Burst pipes, frozen pipes, and plumbing failures often originate in common areas, yet cause extensive damage to individual units. Insurers may deny frozen pipe or burst pipe claims by asserting the loss falls under association responsibility or by alleging insufficient heat maintenance. These arguments are not always supported by policy language or Maryland law.

Resources relevant to Inner Harbor East homeowners include Baltimore City Department of Housing & Community Development, Baltimore City Planning, and Maryland Insurance Administration, all of which provide guidance on housing standards, development patterns, and insurance regulation. Understanding how these local factors intersect with insurance policies is critical to challenging a denial effectively. In summary, Inner Harbor East homeowners face layered, technical insurance disputes that demand careful legal analysis.

Inner Harbor East Resources

- Baltimore City Department of Housing & Community Development — https://dhcd.baltimorecity.gov/

- Baltimore City Planning Department — https://planning.baltimorecity.gov/

- Maryland Insurance Administration — https://insurance.maryland.gov/

- Baltimore City Government — https://www.baltimorecity.gov/

- Inner Harbor East (Wikipedia) — https://en.wikipedia.org/wiki/Harbor_East,_Baltimore

Inner Harbor East Factors

Local Factor | Why This Matters for Insurance

Waterfront exposure | Increases disputes over flood exclusions versus storm damage coverage.

Condominium structure | Creates allocation conflicts between unit and master policies.

Shared building systems | Leads to causation disputes in plumbing and HVAC failures.

Nearby Neighborhoods

Homeowners near Harbor East,

Downtown,

and Fells Point

often face similar coverage disputes and can find guidance on those dedicated pages.

Next Steps After a Inner Harbor East Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

- Mitigate Further Loss

- Notify Your Insurance Company Immediately —

State Farm |

Travelers |

Allstate |

Nationwide |

USAA - Comply with Policy Conditions & Your Duty to Cooperate

- Keep Your Denial Communications

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

Your Chosen Insurance Chose Not to Pay You. Choose Me.

So Should You.

Injured in a Inner Harbor East car accident? Learn about your rights here.