Denied Insurance Claim Lawyer: Baltimore’s Mount Washington | 21210

Mount Washington, nestled in the northwestern corner of Baltimore City, is a neighborhood known for its historic charm, lush landscapes, and tight-knit community. With its mix of Victorian homes, modern residences, and proximity to natural features like the Jones Falls and Western Run, residents here enjoy a unique blend of urban and suburban living. However, this distinctive setting also brings specific challenges when it comes to homeowners insurance claims. As a dedicated insurance claim denial lawyer serving Mount Washington and the 21210 area, I understand the complexities homeowners face when dealing with insurance companies that may unjustly deny valid claims.

In this article, we’ll explore the unique aspects of Mount Washington that can impact insurance claims, common reasons for claim denials, and the steps you can take to protect your rights and property.

Where is Mount Washington in Baltimore?

Mount Washington is a historic neighborhood located in the northwestern section of Baltimore City, Maryland. It’s bounded by the Jones Falls Expressway (I-83) to the east and the Western Run to the west, providing residents with scenic views and easy access to downtown Baltimore. The neighborhood is characterized by its hilly terrain, mature trees, and a mix of architectural styles, including Victorian, Colonial, and modern homes.

Key landmarks in Mount Washington include:

- Mount Washington Village: A charming commercial area featuring boutiques, restaurants, and the Mount Washington Light Rail Station.en.wikipedia.org

- Mount Washington Mill: A renovated historic mill now housing shops, offices, and eateries.en.wikipedia.org

- Mount Washington Arboretum: A community-maintained green space with native plant species and walking trails.

- Meadowbrook Swim Club: A historic swim club that has trained Olympic athletes.

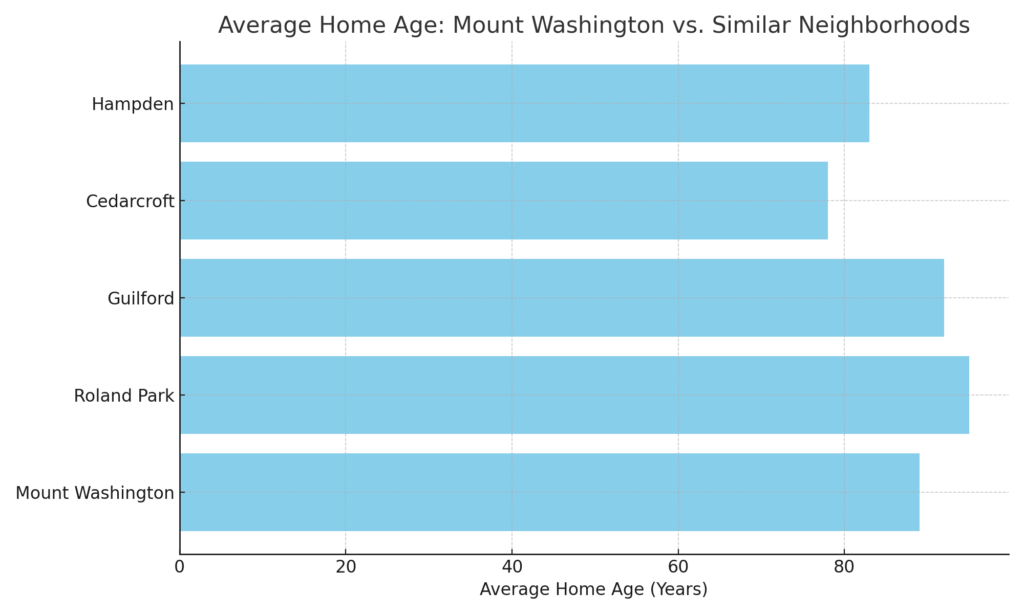

The neighborhood’s unique topography and older housing stock can present specific challenges for homeowners, particularly when dealing with insurance claims related to water damage, aging infrastructure, and maintenance issues. Homes built in the early 20th century may have outdated plumbing or electrical systems, which insurers might cite as reasons to deny claims. Additionally, the area’s proximity to waterways increases the risk of flooding, yet standard homeowners insurance policies often exclude flood damage, requiring separate coverage.

Community organizations like the Mount Washington Improvement Association (MWIA) and the Mount Washington Preservation Trust (MWPT) play active roles in preserving the neighborhood’s character and addressing local concerns. These organizations can be valuable resources for homeowners navigating insurance issues, providing guidance and support.livebaltimore.com

Why Was My Mount Washington Homeowners Insurance Claim Denied?

Common Reasons for Mount Washington Homeowners Insurance Claim Denials:

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company. Duty to Cooperate. EUO.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Mount Washington Neighborhood

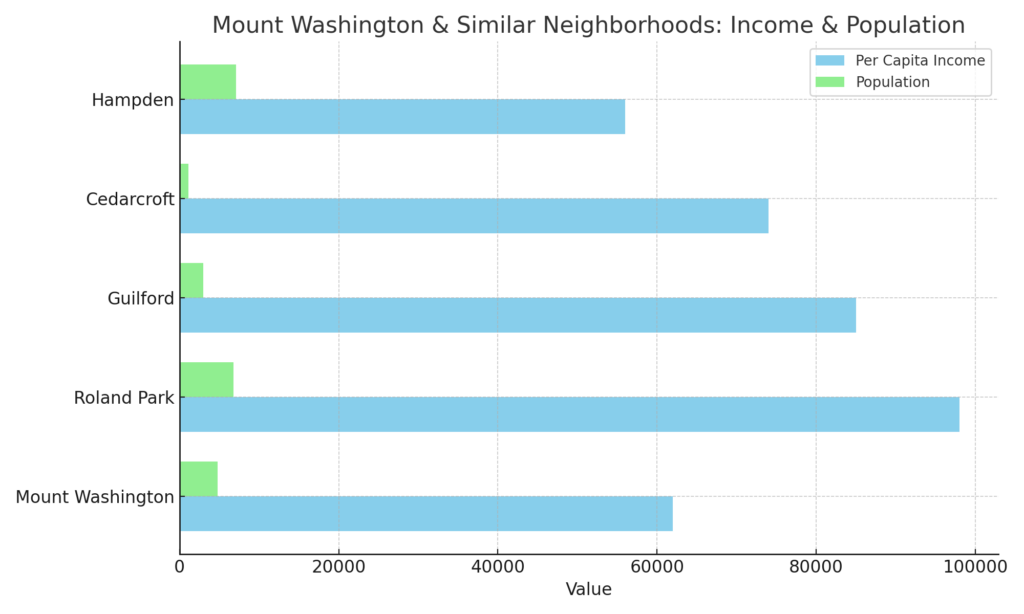

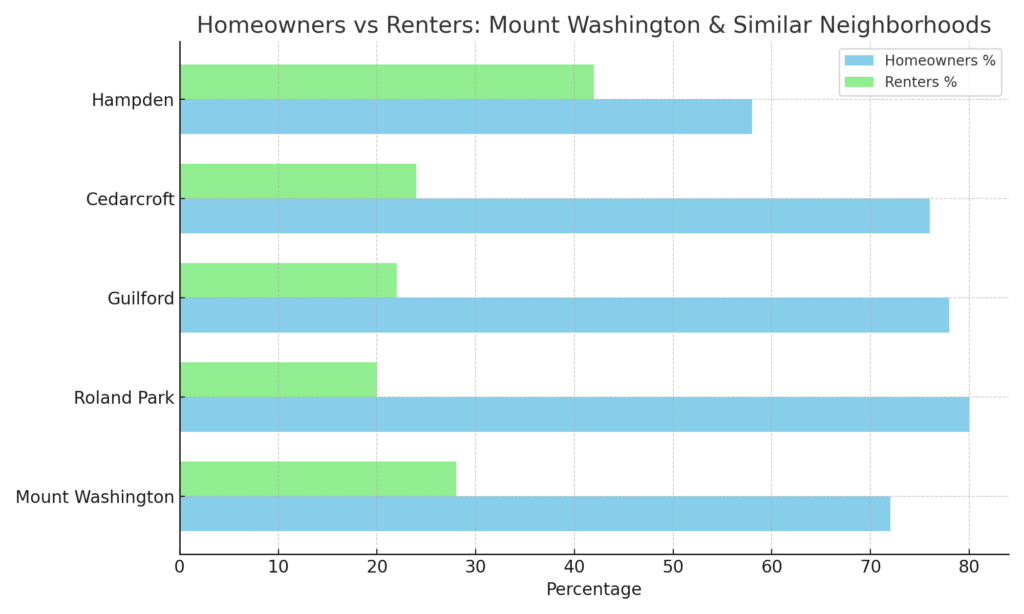

Mount Washington is a residential enclave known for its historic homes, verdant landscapes, and active community involvement. The neighborhood’s housing stock is diverse, with many homes dating back to the early 20th century. According to Homes.com, the median year built for homes in Mount Washington is 1934, indicating a prevalence of older structures that may require specialized maintenance and updates.

Video Transcript: Insurance Claim Denials in Mount Washington, Baltimore (21210)

The following is a verbatim transcript of a video in which Baltimore insurance claim denial lawyer Eric T. Kirk explains why homeowners insurance claims are denied in Mount Washington, Baltimore (21210), what insurance coverage actually is, and how policy language governs whether a loss is covered under Maryland law.

What Is Insurance and Why Do Policyholders Pay Premiums?

Denied Insurance Claim Lawyer: Baltimore’s Mount Washington | 21210A frequently asked question by anyone who has had their claim denied by their own insurance company is what exactly is insurance? That question is usually closely followed by what did I pay all of those premiums for?

Insurance as a Contract Between the Policyholder and the Insurer

At its most basic, an insurance agreement is a contract between you and your insurance company. You agree to pay premiums. Your insurance company agrees to indemnify you or hold you harmless should a specified loss occur.

How Disputes Arise Over What Losses Are Covered

The core dispute in many insurance claims is identifying exactly what that covered loss is. The question the insured raises is it’s a covered loss within the terms of the policy. The insurance company invariably takes the position it is not a covered loss. It is limited or otherwise excluded by the language of the policy.

This transcript is provided for educational purposes and reflects a general discussion of denied homeowners insurance claims under Maryland law.

The neighborhood boasts a high rate of homeownership, with many residents deeply invested in the upkeep and preservation of their properties. However, the age of the homes can lead to unique challenges, such as outdated plumbing, electrical systems, and roofing materials. These factors can complicate insurance claims, as insurers may attribute damage to wear and tear or lack of maintenance, rather than covered perils.

Mount Washington’s proximity to natural features like the Jones Falls and Western Run also increases the risk of water-related damage. Flooding, while not common, can occur during heavy rainfall, and standard homeowners insurance policies typically exclude flood damage. Homeowners are encouraged to assess their risk and consider additional coverage options.

Community organizations play a vital role in supporting residents. The Mount Washington Improvement Association (MWIA) offers resources and advocacy for neighborhood concerns, while the Mount Washington Preservation Trust (MWPT) focuses on conserving green spaces and the area’s historic character. These organizations can provide guidance and support for homeowners navigating insurance issues.washingtonpost.comwallaceinsurancelaw.com

Mount Washington Resources

- Mount Washington Improvement Association (MWIA): https://www.mwia.org/

- Mount Washington Preservation Trust (MWPT): https://www.mwpt.org/

- Mount Washington Arboretum: https://naturesacred.org/sacred_place/mount-washington-preservation-trust-inc/

- Baltimore City Health Department Community Resource Guide: https://health.baltimorecity.gov/sites/default/files/Community%20Resource%20Guide%202023.pdf

- Mount Washington Village Association: https://mountwashingtonvillage.com/

Next Steps After a Mount Washington Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

- Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retainretain screenshots, and independent records.

State Farm

Traveler’s

Allstate

Nationwide

USAA

Comply with Policy Conditions & Your Duty to Cooperate

Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

Keep Your Denial Communications

Your insurance company is required to give a written reason for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking. Statute of limitations.

Keep all correspondence, including emails and letters, in a dedicated file. The denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retainretain screenshots, and independent records.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Mount Washington denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit – I sue insurance companies

✔ Take your case to trial – I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.“

So Should You.