Denied Insurance Claim Lawyer: Baltimore’s Northwood | 21239

As a Baltimore insurance claim denial lawyer, Eric T. Kirk helps policyholders in Northwood, Baltimore (21239) challenge denials, delays, and underpayments in homeowners, property, and auto coverage disputes.

Free ConsultationHome › Denied Insurance Claim Lawyer › Northwood 21239

TL;DR

Residents of Northwood 21239 face insurance claim denials tied to aging housing stock, stormwater drainage, and water intrusion claims.

Many homeowners encounter policy exclusions or causation disputes that can delay or reduce coverage.

This page walks through the most important steps to challenge denials, outlines local risks, and provides step-by-step guidance on what to do next.

Attorney Eric T. Kirk has more than 30 years of experience helping Baltimore homeowners fight back.

About Northwood 21239

Northwood has distinctive property risks and claims patterns tied to its aging post-war housing, mature tree canopy, and stormwater runoff corridors. Key facts:

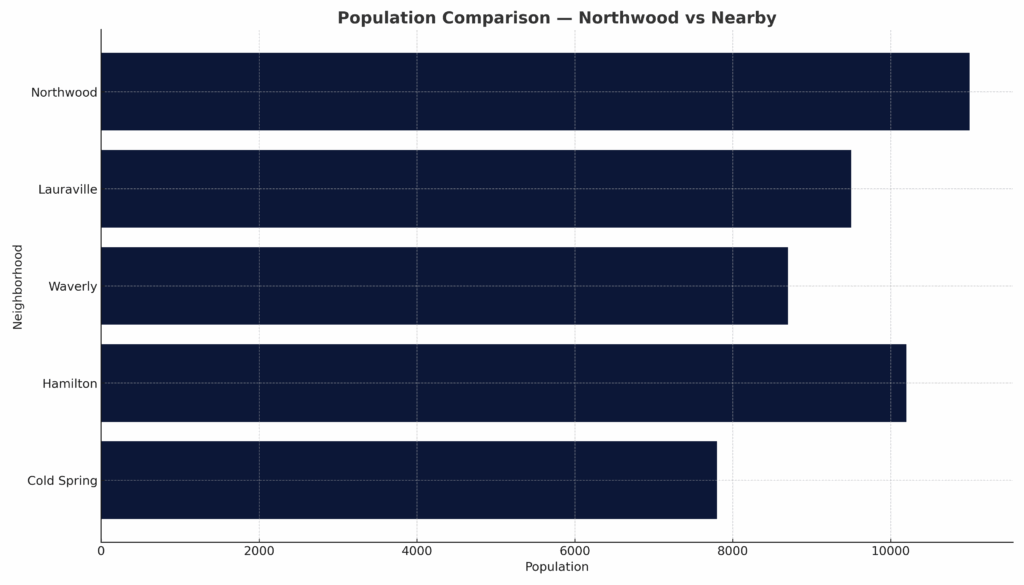

- Population: ~8,500

- Median Household Income: ~$60,000

- Median Home Age: ~75 years

- Common Claim Pressures: Stormwater, tree damage, roof leaks, plumbing failures

Related Baltimore Neighborhoods

Where is Northwood in Baltimore?

Northwood is a residential neighborhood located in northeast Baltimore, ZIP code 21239. Bordered by Loch Raven Boulevard, Hillen Road, and Argonne Drive, it’s known for its postwar Cape Cods, sturdy brick rowhomes, and tree-lined streets. The neighborhood sits near Morgan State University and has easy access to Loch Raven Boulevard, a major arterial route that connects commuters to the city center.

From an insurance claim denial lawyer perspective, Northwood’s housing stock presents several common claim triggers:

- Aging roofing and plumbing can lead to interior water damage.

- Mature tree canopies increase risk for storm and wind-related claims.

- Stormwater drainage patterns in some blocks can contribute to basement seepage and sump pump failures.

Homeowners in Northwood 21239 often face denial arguments that hinge on whether water damage was “flood,” “seepage,” or “sudden and accidental.” Insurers may also assert wear and tear exclusions, leaving residents to dispute causation.

The area is served by major roads such as Argonne Drive and Perring Parkway, which are prone to stormwater pooling and tree-limb fall claims after heavy rain events. The neighborhood is a short drive from I-695 and sits within Baltimore City’s older utility infrastructure zones — making maintenance-related denials common.

Local civic infrastructure affecting claims includes:

- Baltimore City Department of Public Works (drainage/sewer issues)

- Baltimore City Department of Housing & Community Development

- Baltimore Office of Sustainability

- Maryland Insurance Administration

- FEMA Flood Map Service Center

Homeowners may well choose to contact an insurance claim denial lawyer in Northwood 21239 after prolonged delays in coverage or disputes over policy exclusions. This area’s combination of old homes and tree canopy makes it uniquely vulnerable to coverage fights over roof leaks, foundation damage, and water intrusion.

Why was My Northwood Homeowner’s claim denied?

Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

State Farm → Portal

Travelers → Portal

Allstate → Portal

Nationwide → Portal

USAA → Portal

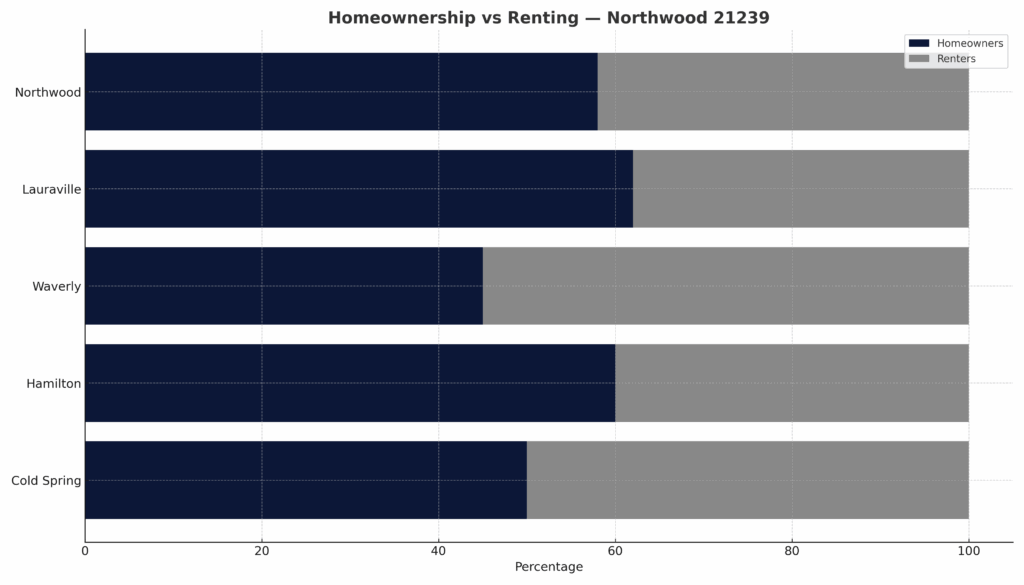

Homeownership in Baltimore’s Northwood

Northwood is characterized by post-WWII housing, largely brick construction, with basements common throughout the neighborhood. The median home age exceeds 70 years. Homeowners here face frequent plumbing line failures, roof degradation, and tree damage from mature canopy growth. These conditions often lead to insurance claims involving water, structural compromise, or storm-related incidents.

The neighborhood’s location near Chinquapin Run Park and Loch Raven Boulevard also places some properties near minor flood risk zones, even outside FEMA-designated flood plains. Many denials here turn on whether an incident qualifies as “sudden and accidental” or excluded surface water.

Hyperlocal resources influencing coverage or claim disputes:

- Baltimore City Department of Housing & Community Development

- FEMA Flood Map Service Center

- Maryland Insurance Administration

- Baltimore Office of Sustainability

- Morgan State University (anchor institution influencing local infrastructure)

Northwood Resources

- Baltimore City Department of Housing & Community Development

- FEMA Flood Map Service Center

- Maryland Insurance Administration

- Baltimore Office of Sustainability

- Morgan State University

Any good insurance claims attorney will tell their client that each case is dependent on the unique facts and circumstances. I do offer general guidance.

Easy answer to this one. Contact me. This is the type of case we handle. In the wheelhouse, if you will.

Northwood/Baltimore Insurance Lawyer’s Tip #76: You should also take measures to protect your property and mitigate your damages.

Any claim is subject to denial. Insurance companies writing policies in Baltimore are subject to practice standards. Running afoul of them can lead to sanction from the MIA.

Read the law: Md. Code Regs. 31.15.08.03 – Unfair Claim Settlement Practices

See 1. You should do so when the claim is denied. It is at this point I can be of the most use to you.

Northwood/Baltimore Insurance Lawyer’s Tip #412: After a claim is denied, you’ll need to litigate [i.e. file a lawsuit] to achieve any financial recovery.

Yes. An “Appeal” is typically filed by filing a lawsuit. You may also be able to appeal an adverse MIA decision through administrative Hearings, or the decision of a lower court to a higher court.

Read the law: Section 27-1001 – Actions Under 3-1701 of the Courts Article

Age can impact the subject of any claim. We typically see the age of plumbing become an issue in freeze cases.

Every case is unique, as every home is unique. The same can be said for each of Baltimore’s 278 neighborhoods, all of which I am proud to serve. We handle each case on the specific policy language, and basis for denial.

See 1. See 4. I will be happy to personally review a denied claim, and, if wrongfully denied, honored to represent you in your pursuit of a rightfully recovery.

I am not aware of statistics that track claim denial in reference to damage sought. Frequently contested damage claims relate to the cost [or scope] of repair, and value of property.

Northwood/Baltimore Insurance Lawyer’s Tip #8: The contents of your home are typically worth far more to you than the items would get on the open market.

How Do I Maximize my Northwood Homeowner’s Claim?

- How to report a denied insurance claim in Northwood.

Contact you insurance company by any means. Many of the portals for the largest insurers are on this page.

Northwood/Baltimore Insurance Lawyer’s Tip #362: Many don’t realize you have an absolute duty to cooperate with you insurance company- even if you assist them in denying your claim. - How to document water damage for a Northwood homeowners claim.

High quality Video is best. Photographs are secondary. Make sure your contractor is documenting the same.

- How to get a copy of your insurance denial letter in Baltimore.

I love answering these type of questions. All you have to do is ask for it. The insurance company is required to tell you why they are denying you.

- How to appeal a homeowners insurance denial in Northwood.

See Steps 1, 4 and 7 above. The most common method, albeit indirect, to challenge the insurance company is by filing a lawsuit against them.

Northwood/Baltimore Insurance Lawyer’s Tip #1: That’s what I do. I sue insurance companies. - How to find a local contractor to document damage in 21239.

Word of mouth is often the best referral source. The state of Maryland licenses contractors.

for more: Maryland Home Improvement Commission (MHIC) - How to protect your rights after your insurer denies coverage.

You must thoroughly document:

a] the condition of the property

b] all of your interactions with the insurance company

c] all of your bids, estimates, and receipts,

Then:

Call me: 410 591 2835 - How to build your case with a Northwood insurance claim denial lawyer.

I offer all of my prospective clients an initial, confidential, case analysis. Here, we begin the process of your financial recovery.

How to Get to Eric T. Kirk

tep-by-step directions from Northwood (21239) to 1001 N Calvert St, Baltimore, MD 21202:

Destination: 1001 N Calvert St on the right.

Head south on Hillen Road toward Cold Spring Lane.

Continue on Hillen Road and merge onto I-83 South via Coldspring Lane ramp.

Take Exit 3 for Guilford Avenue toward Mt Royal Avenue.

Turn right onto Guilford Avenue.

Turn left onto E Chase Street.

Turn left onto N Calvert Street.

Insurance companies deny valid claims in Northwood every day, often using old home infrastructure or stormwater exclusion arguments to shift costs back to homeowners. But Eric T. Kirk brings 30 years of trial experience to the table, forcing carriers to honor their obligations. If your property insurance claim was denied, delayed, or underpaid in Northwood (21239), your next step should be a free consultation to evaluate your options.