Denied Insurance Claim Lawyer: Baltimore’s Woodbury | 21211

When a Baltimore insurer says “denied,” it isn’t the end of the road. It’s the beginning of a methodical, step-by-step response—rooted in Maryland law and the policy’s plain language—to secure the benefits you paid for. This page focuses on Woodbury (21211), a historic Jones Falls valley community often associated with the light-industrial mill heritage of nearby Woodberry and the green edges of Druid Hill Park. As a Denied Insurance Claim Lawyer serving Baltimore neighborhoods block-by-block, the goal here is to give clear definitions, practical timelines, and the most important local details specific to Woodbury—so homeowners know what to do after a claim denial, who to contact, and how to position a case for reversal or litigation. In summary: insurers rely on policy wording, deadlines, and alleged technicalities. We’ll rely on the policy insuring agreement, your duty to cooperate, evidence, and, when necessary, Baltimore City courtroom advocacy. Throughout this page you’ll also find hyper-local resources (government, education, and nonprofit) that residents of Woodbury 21211 may use immediately after a loss. If you searched for “Insurance claim denial lawyer Woodbury 21211,” you’re in the right place. Below you’ll see a definition of some the neighborhood’s specific potential risks (older rowhomes near steep grades and stream valleys), common denial reasons, an actionable “how-to,” FAQs, and exactly what to do next. In summary, the path from denial to payment begins with understanding your policy and the unique local facts of Woodbury—and then pressing your rights under Maryland law.

Where is Woodbury in Baltimore?

Woodbury sits in the Jones Falls corridor in north-central Baltimore, wedged between the green expanse of Druid Hill Park and the historic mill landscapes that grew up around the rail lines and the river. Residents identify with nearby anchors like the Woodberry Light RailLink station (operated by the Maryland Transit Administration) and the distinctive cluster of broadcast towers on TV Hill—all part of the same valley geography. The location matters for insurance because stream valleys, older foundations, and steep slopes affect how losses happen and how insurers analyze causation.

What’s unique about Woodbury?

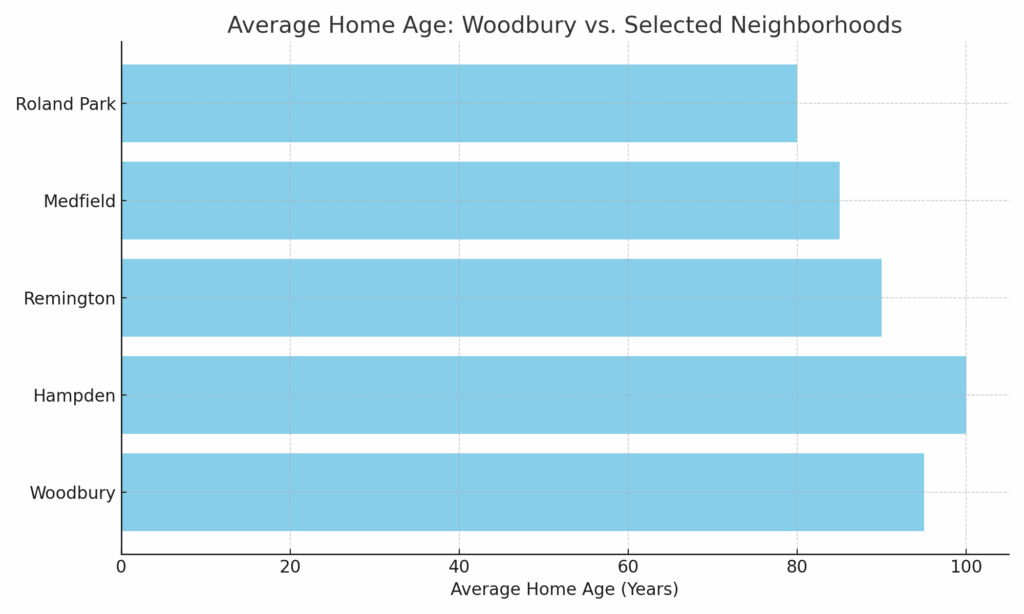

• Historic housing near industrial legacy. Many homes trace their origins to early-to-mid 20th-century stock influenced by the mill era that flourished along the Jones Falls. Older framing, masonry, and roof assemblies can lead to claims involving interior water intrusion, roof failure during high-wind events, and sewer or drain backups that follow heavy rainfall.

• Parks and trails at the doorstep. Proximity to Druid Hill Park and the Jones Falls Trail frequently seen as a quality-of-life asset—is a clue about drainage patterns. Stream-adjacent blocks may experience surface runoff concentration, basement seepage, or hydrostatic pressure. Insurers can call these conditions “maintenance” or “excluded surface water” unless the insuring agreement and endorsements say otherwise.

• Transit and right-of-way corridors. Homes near the Light RailLink right-of-way sometimes report vibration-related cosmetic cracking or stormwater channeling along embankments- or worse! Disputes can arise over “sudden and accidental” versus “wear and tear.”

Local issues that influence claims

• Water & sewer. Baltimore City emphasizes stormwater best practices and user responsibility for mitigation. After a cloudburst, disputes often revolve around whether damage came from “flood,” “surface water,” or a covered backup. Knowing the definition of each term in the policy (and Maryland case law) is often most important.

• Older roofs/windows. Insurers argue for reasons to deny and minimize claims. One frequently argument concerns “age-related deterioration.” A careful step-by-step inspection protocol, moisture readings, and a weather correlation (wind/hail) can rebut “wear and tear” tactics.

• Tree and limb fall near park margins. Coverage can hinge on whether a fallen limb triggered an opening that led to interior damage or whether pre-existing rot is blamed.

• Druid Hill Park is one of America’s great urban parks and a Woodbury neighbor; see the Baltimore City Recreation & Parks page for the park and facilities (bcrp.baltimorecity.gov).

• The Jones Falls Trail runs the corridor and explains why valley drainage defines the local micro-climate (Baltimore City Recreation & Parks trail page).

• The MTA Light RailLink Woodberry Station situates Woodbury’s transit identity (mta.maryland.gov).

• For floodplain awareness and mapping, consult FEMA’s Flood Map Service Center (fema.gov) and Baltimore’s Office of Sustainability resources for resilience planning (baltimoresustainability.org).

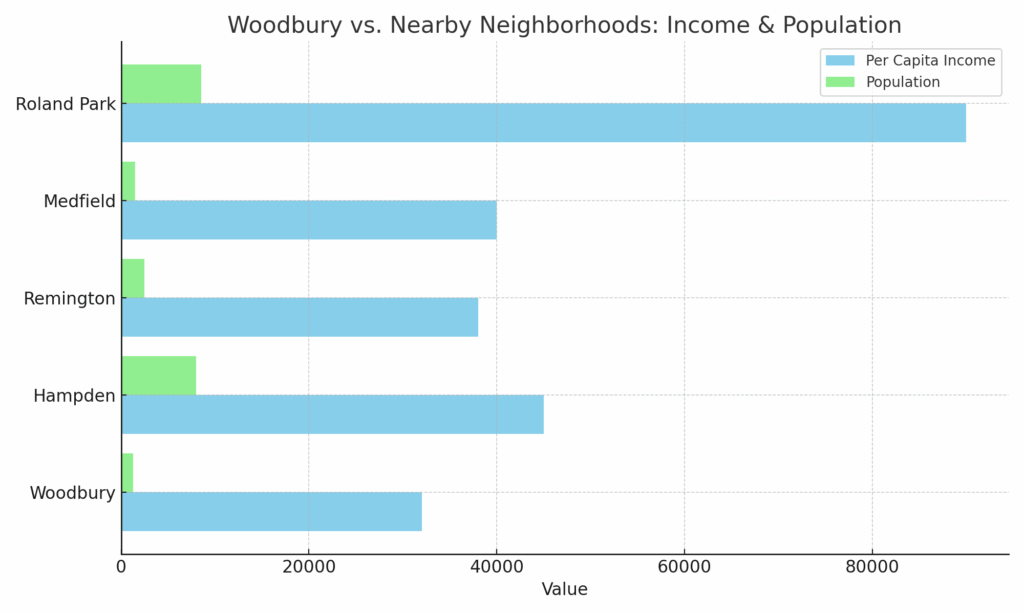

• Neighborhood-level indicators (owner-occupancy, population) are tracked by the Baltimore Neighborhood Indicators Alliance (BNIA-JFI) (bniajfi.org).

If you need an Insurance claim denial lawyer in Woodbury 21211, this page offers insights on the definitions insurers use and the step-by-step way to contest them.

Why Was My Woodbury Homeowners Insurance Claim Denied? Common Reasons for Woodbury Homeowners Insurance Claim Denials.

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

Baltimore Insurance Claim Denial Lawyer Tip: Keep all maintenance records.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Woodbury Neighborhood

Woodbury homes tend to be older, modestly scaled, and influenced by the mill-era typologies found throughout the Jones Falls corridor. That means brick and stone foundations, aging slate/asphalt roofing, and occasional knob-and-tube or older service panels still present in some structures—each of which can factor into coverage disputes if an insurer labels loss as “wear and tear” or “maintenance.” Proximity to Druid Hill Park and the Jones Falls Trail also matters; neighborhoods near stream valleys can encounter basement seepage or stormwater backup during peak rain events, which makes understanding your policy’s definition of “flood,” “surface water,” “back-up of sewers or drains,” and “sump overflow” most important. Residents may commute by Light RailLink from the Woodberry station, so temporary displacement after a loss (ALE—Additional Living Expense) frequently becomes a real need while repairs are underway.

Homeowner

For building permits, right-of-way issues, or tree limb removals along park perimeters, Baltimore’s government agencies and open data tools provide guidance that is both practical and admissible if litigation is required. In summary, Woodbury’s older housing stock and valley setting are indeed distinctive, and they shape methods to investigate, document, and challenge a denial. Two immediate step-by-step tips: (1) photograph all moisture staining and measure humidity/MC (moisture content) at the time of discovery; (2) request the carrier’s engineer’s qualifications and calculations if they attribute interior damage to long-term seepage. An Insurance claim denial lawyer in Woodbury 21211 will parse the insuring agreement, the exclusions, and any endorsements—line-by-line—and align your evidence with Maryland’s standards of proof.

Woodbury Resources

- Baltimore City Recreation & Parks – Druid Hill Park: https://bcrp.baltimorecity.gov/parks/druid-hill-park

- Baltimore City Recreation & Parks – Jones Falls Trail: https://bcrp.baltimorecity.gov/parks/trails/jones-falls

- Maryland Transit Administration – Woodberry (Light RailLink): https://www.mta.maryland.gov/schedule/lightrail (select “Woodberry”)

- BNIA-JFI – Medfield/Hampden/Woodberry/Remington indicators: https://bniajfi.org/community/medfield_hampden_woodberry_remington/

- FEMA Flood Map Service Center: https://msc.fema.gov/portal/home

- Baltimore Office of Sustainability (resilience/flood resources): https://www.baltimoresustainability.org/

- Druid Hill Park Conservancy: https://www.druidhillpark.org/

- Maryland Historical Trust – Woodberry Historic District: https://mht.maryland.gov/ (search “Woodberry” for the NRHP file)

When you need an Insurance claim denial lawyer for Woodbury 21211, proof of cause of loss—not labels like “old” or “deferred maintenance”—often wins the day.

How to Challenge A Woodbury Insurance Claim Denial – My Steps:

- Step 1 – Prepare:

Gather your denial letter, your policy (all endorsements), your photos/video, and your repair estimates, the call me.

- Step 2 – Legal knowledge:

Clause-by-clause analysis of the insuring agreement, exclusions, and anti-concurrent causation language. Build a coverage analysis connecting facts to Maryland law and carrier obligations.

- Step 3 – Advocacy & negotiation:

In an appropriate case, present a structured rebuttal with expert support (roofing, plumbing, or forensic moisture), quantify damages, and demand reconsideration under specific policy provisions.

- Step 4 – Litigation

If the carrier won’t correct a wrongful denial, file suit, serve discovery, and move step-by-step toward trial.

A seasoned Insurance claim denial lawyer for Woodbury 21211 will insist the carrier apply the definition of each policy term to your specific evidence, not generic assumptions.

A1. Carriers may cite flood/surface water exclusions. The key can be documenting entry points and whether a covered opening occurred. Independent moisture readings may help.

A2. Yes it can—limb and tree impacts are common near urban park edges.

Baltimore Insurance Claim Denial Layer Tip: Additional issues arise if if the impact created an opening that allowed subsequent rain intrusion.

A3. The denial letter, full policy/endorsements, your proof of loss, estimates, and time-stamped photos/videos

A5. If your policy includes Loss of Use, yes—subject to limits and the causation determination.

If you’re searching for an Insurance claim denial lawyer in Woodbury 21211, start by securing the policy and denial letter; those are the most important documents we’ll analyze.

Next Steps After a Woodbury Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss • If your home has been damaged, take immediate action to prevent further harm. • Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp). • Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss • Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate. • This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately • Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records. o State Farm https://www.statefarm.com/claims o Traveler’s https://www.travelers.com/claims o Allstate https://www.allstate.com/claims/file-track o Nationwide https://www.nationwide.com/insurance-claims/ o USAA https://www.usaa.com/insurance/claims.

- Comply with Policy Conditions & Your Duty to Cooperate • Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. • Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. 5.Keep Your Denial Communications • Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. • Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney • Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial? • An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Woodbury Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will: ✔ Complimentary Case Analysis – Fight Back Against Unfair Denials ✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement. ✔ Gather your evidence to support your claim. Most Woodbury denied insurance claims require expert analysis on the cause of loss and nature of damage. ✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not ✔ File a lawsuit I sue insurance companies ✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.