Denied Insurance Claim Lawyer in South Baltimore | 21230

Denied Insurance Claim Lawyer: Baltimore’s South Baltimore | 21230

Estimated reading time: 12 minutes

TL;DR (Quick Summary)

- If your homeowners insurance claim was denied in South Baltimore (21230), you may still recover compensation.

- Insurance companies frequently deny claims involving flooding, burst pipes, roof damage, storm losses, and water intrusion affecting older rowhomes common in this ZIP.

- A seasoned insurance claim denial lawyer fights lowball settlements, unfair exclusions, and misapplication of policy language.

- Baltimore homeowners can challenge a denial, negotiate a fair payout, or litigate against an insurer in court.

- Eric T. Kirk fights denied insurance claims across South Baltimore, aggressively litigating against unfair denials.

South Baltimore is a vibrant, diverse neighborhood located in the southern section of Baltimore, Maryland. Known for its rich history, strong community spirit, and a blend of historic row homes with modern conveniences, South Baltimore offers homeowners a unique urban experience. As a dedicated Denied Insurance Claim Lawyer in South Baltimore, I—Eric T. Kirk—understand the challenges you face when your claim is unjustly denied. If you’re a South Baltimore homeowner struggling with an insurance coverage denial, my firm is here to fight for the benefits you deserve. Contact me today to learn how I can help navigate complex insurance policies and secure the benefits you are entitled to.

Where is South Baltimore in Baltimore, Maryland?

South Baltimore sits directly below the Inner Harbor, extending through a tightly knit historic grid bordered by S. Charles Street, Light Street, Heath Street, Wells Street, and Race Street, forming the core service area of the South Baltimore Neighborhood Association (SBNA). Its geography is distinct from Riverside or Sharp-Leadenhall, although it borders them. What defines the true 21230 South Baltimore core is its dense rowhome streets, concentrated parks such as Solo Gibbs Park, and immediate proximity to the harbor’s storm drainage basin.

Nearby Neighborhoods

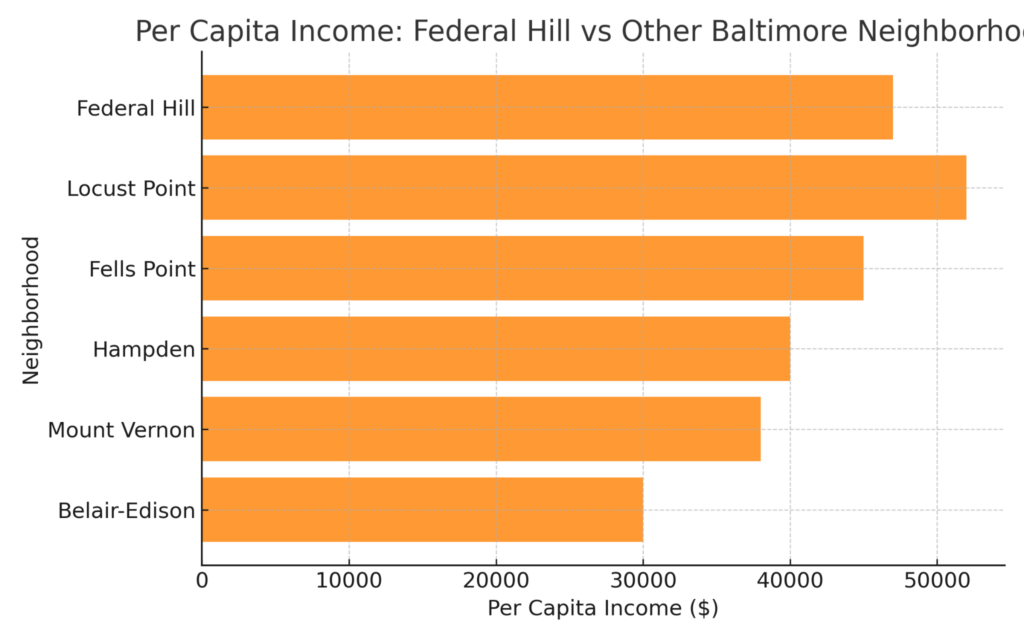

Homeowners near Federal Hill,

Washington Village,

and Locust Point

often face similar coverage disputes and can find guidance on those dedicated pages.

Insurance Risks Unique to South Baltimore

🔎 Aging Infrastructure

Rowhomes are iconic, Baltimore centric structure. South Baltimore rowhomes date back 80–110 years. Many still feature aging masonry walls, original soil stacks, and century-old subflooring. These weaken over time, causing failures insurance companies may try to classify as “wear and tear” rather than a covered event.

🌊 Flood-Zone Pressure & Groundwater Intrusion

Basement living is common in 21230, which exposes residents to groundwater infiltration, backed-up storm drains, and tidal surge risks during heavy rain. Insurers frequently assign these as “excluded flood events,” even when they were caused by stormwater backups or sewer issues, or even where the clause is uncertain.

🔥 Roof Age and Storm-Driven Losses

Historic roofing materials and steep pitch rows entice insurers to deny roof claims by asserting “lack of maintenance.” This denial tactic is common after windstorms passing through.

🧰 Post-Loss Contractor Disputes

Repairs in South Baltimore often trigger requirements tied to the historic district or SBNA area. We have seen insurers sometimes recommend contractors who are not properly licensed through MHIC, which Maryland law prohibits.

A knowledgeable insurance claim denial lawyer challenges denials in South Baltimore when they hinge on misclassifying water loss, ignoring legal licensing requirements, or misusing policy exclusions to avoid payment.

South Baltimore Resources

Center for this neighborhood:

Maryland Insurance Administration: https://www.mdinsurance.state.md.us/

South Baltimore Neighborhood Association (SBNA): https://www.southbaltimore.com/

Baltimore City Department of Planning: https://planning.baltimorecity.gov/

Baltimore City Department of Housing & Community Development: https://dhcd.baltimorecity.gov/

Baltimore Office of Sustainability – Flood Resilience: https://www.baltimoresustainability.org/

Why Was My South Baltimore Claim Denied?

Why Was My South Baltimore Homeowners Insurance Claim Denied? Common Reasons for South Baltimore Homeowners Insurance Claim Denials.

1. Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

2. Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

3. Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

4. Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

5. Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

| South Baltimore Factor | Why It Matter for Insurance |

|---|---|

| Waterfront / Patapsco Proximity | Homes near the Patapsco River or inner-harbor fringes face greater exposure to storm-surge, tidal flooding, and wind-driven water intrusion. These claims are frequently denied as “flood” (if excluded), or disputed as stormwater vs. flood causation. |

| Mixed Industrial–Residential Zoning | South Baltimore contains older industrial shoreline uses near residential property. Insurers may surcharge or carve out hazards tied to nearby industrial risks — and may deny claims if a loss is traced to commercial contamination or structural impacts. |

| Older Rowhouse Stock & Renovations | Many homes are historic rowhouses or renovated multi-use spaces. Insurers often scrutinize age-related conditions (plumbing, masonry, wiring), leading to denials labeling losses as “wear, tear, or maintenance” rather than sudden peril. |

How to Challenge a South Baltimore Insurance Claim Denial – My Steps

Time needed: 365 days

How to Challenge a South Baltimore Insurance Claim Denial – My Steps

- Step 1: Transparent Communication

I get to the hear of it. I’ll uncover the “real reason” why the insurer denied the claim, translating policy language into plain English.

- Step 2: Legal Knowledge Applied to Your South Baltimore Loss

I review the loss location, cause, and exclusions to determine whether the denial violates Maryland law or policy language.

South Baltimore Insurance Lawyer’s Tip #554: The starting point is determining if any part of the claim is being honored, with the larger components denied. I refer to this this as the “soft denial” or “functional denial” - Step 3: Advocacy & Negotiation

I challenge the insurer’s basis, push back against misused exclusions, and negotiate for a fair payout.

- Step 4: Professionalism & Integrity Through Litigation

When the insurer refuses a fair settlement, I litigate—with complete transparency and ethical advocacy.

South Baltimore Insurance Lawyer’s Tip #16: Litigation is an process, not an event. A complex claim may take more than a year to trial.

Homeownership in Baltimore’s South Baltimore

Homeownership in South Baltimore offers a unique opportunity to embrace a community steeped in history while benefiting from modern urban amenities. This neighborhood is noted for its distinctive blend of century-old rowhouses and new developments, reflecting both the area’s storied past and its promising future. Local government initiatives and community organizations actively work to preserve South Baltimore’s architectural character and enhance neighborhood services, making it an attractive option for families, first-time buyers, and longtime residents alike. With convenient access to public transportation, local parks, and a growing array of restaurants and cultural attractions, South Baltimore presents an ideal setting for building long-term wealth and community ties. The local economy is supported by small businesses and civic programs that encourage neighborhood revitalization. These efforts may ensure steady property value appreciation, of particular importance to s Denied Insurance Claim Lawyer handling homeowners claims in South Baltimore. Such a dynamic environment, coupled with dedicated municipal support and an engaged citizenry, makes homeownership in South Baltimore not only a wise financial decision but also a gateway to an enriching, community-focused lifestyle.

South Baltimore Comparison

South Baltimore Resources

- Baltimore City – South Baltimore

- Baltimore Heritage

- Baltimore Police Department

- Baltimore City Schools

- Baltimore City Planning

- Baltimore Community Health

- Baltimore Local Food

- South Baltimore Community Organization

- Baltimore Housing

- Baltimore Office of Sustainability

Q1: Are basement flooding claims denied in South Baltimore?

Yes. Insurers can often classify these as “flood events,” even when the cause was stormwater backup or sewage intrusion, which may still be covered.

South Baltimore Insurance Lawyer’s Tip #218: Causation analysis is key in all Baltimore insurance litigation.

Yes, it can. Carriers can blame “lack of maintenance” when older pipes or roofing fail, even when storms caused the loss.

South Baltimore Insurance Lawyer’s Tip #700: Insurance adjusters typically do not need to look to find reasons to question claims, and “age” is a very handy one, especially in Baltimore.

Yes. If freezing or sudden discharge caused the loss, Maryland policy wording may protect you despite “maintenance” accusations.

It starts with the policy language. Maryland law generally allows homeowners to pick a contractor, and insurers may not recommend unlicensed vendors. You have the right to choose.

South Baltimore Insurance Law 101: Every insurance dispute, and every lawsuit against an insurance company, and every successful claim against a denied Baltimore claims starts in the same place: a careful analysis of your policy.

Yes. Exclusions are often misapplied. A lawyer argues the exclusion is invalid.

South Baltimore Insurance Lawyer’s Tip #79: Insurance adjusters typically do not need to look to find reasons to question claims, and “age” is a very handy one, especially in Baltimore. A court determines if the exclusion is valid.

Next Steps After a South Baltimore Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example—known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—is covering a leaking roof with a giant blue tarp.

- Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

- Comply with Policy Conditions & Your Duty to Cooperate

- Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

- Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications

- Your insurance company is required to give a written explanation for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking. Statute of limitations.

- Keep all correspondence, including emails and letters, in a dedicated file.

Eric T. Kirk

South Baltimore Claims Denial Attorney6. Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court via a Breach of Contract lawsuit. An experienced Denied Insurance Claim Lawyer in South Baltimore | 21230 will review your policy, analyze the insurer’s reasoning contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

How Attorney Eric T. Kirk Can Help with Your Denied South Baltimore Homeowners Insurance Claim

Your Chosen Insurance Chose Not to Pay You. Choose Me.

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

- ✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

- ✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- ✔ Gather your evidence to support your claim. Most South Baltimore denied insurance claims require expert analysis on the cause of loss and nature of damage.

- ✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not, we will take further legal steps.

- ✔ File a lawsuit against insurance companies if necessary.

- ✔ Take your case to trial. I have extensive experience taking on the nation’s largest insurance companies, whose trial lawyers are highly skilled and aggressive.