Insurance Claim Denied? Lawyer for Baltimore’s Little Italy | 21202

Denied insurance claims create uncertainty and hardship for homeowners in Baltimore, just like they do everywhere else. When those denied claims occur in Little Italy, the impact on residents can be magnified. The neighborhood’s unique charm, historic housing, and tightly knit economic community make insurance protection especially critical. If you live in Little Italy and your insurance company has refused to honor your claim, you need to know what steps you can take and how a trusted insurance claim denial lawyer can help.

As a Baltimore attorney with over 30 years of experience battling insurers, I have handled countless cases where carriers unfairly an wrongfully denied legitimate claims. Whether the issue involves water damage in one of Little Italy’s historic rowhouses, fire damage to a family-owned restaurant, or storm damage affecting the tight residential blocks between Albemarle Street and Eastern Avenue, I understand the stakes.

Insurance companies have teams of highly skilled lawyers to meet you, depose you, and try to convince court to deny your claims. The insurer’s use adjusters with the business objective of minimizing payouts. My role is to hold them accountable, ensuring residents in the 21202 ZIP code are treated fairly under Maryland law. If your claim has been denied, you may feel overwhelmed—but you are not powerless. Don’t let an insurance adjuster dictate the value of your case. This article provides a step-by-step definition of what to expect, what your rights are, and how a denied insurance claim lawyer can intervene on your behalf.

In summary, if you live in Little Italy and face an insurance denial, I reccommend always, the most important thing you can do is act quickly and decisively. The following sections explain why claims are denied, what unique local issues matter for Little Italy residents, and how I can fight for your compensation.

Where is Little Italy in Baltimore?

Nestled just east of Baltimore’s Inner Harbor and bordered by Fells Point, Harbor East, and Jonestown, Little Italy is one of the city’s most recognizable neighborhoods. Known for its strong Italian-American heritage, the area is defined by family-owned restaurants, narrow residential streets, and historic rowhouses. Anchored by the iconic St. Leo the Great Catholic Church, Little Italy is more than a tourist destination—it is a living, breathing community where generations of families continue to reside.

Little Italy is unique in several ways that directly impact insurance claim denial cases:

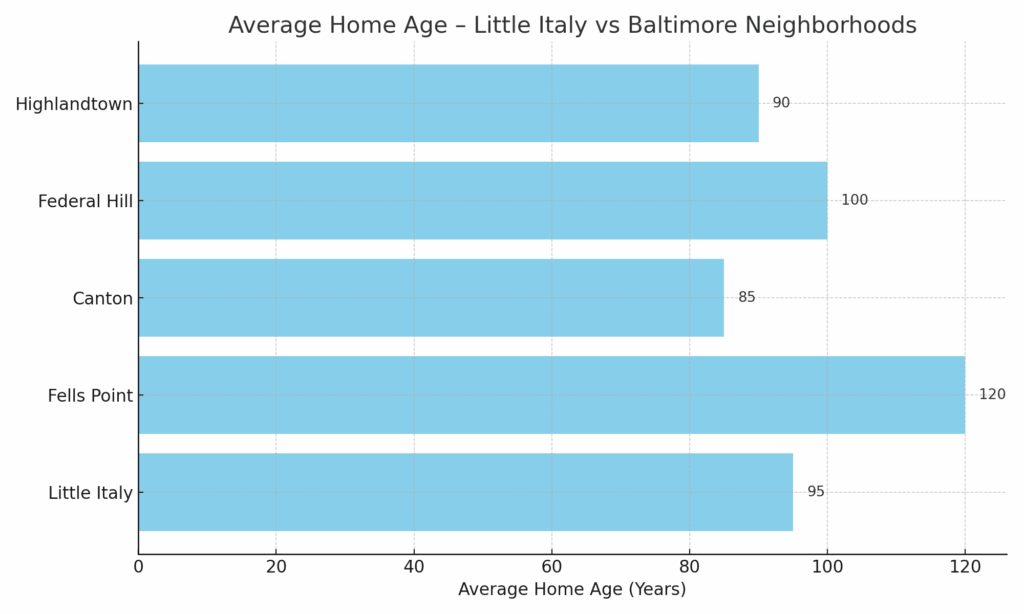

- Historic Housing Stock: Most homes in Little Italy are decades old, some dating back more than a century. This makes them prone to structural issues such as aging roofs, outdated plumbing, or faulty wiring. Insurers often attempt to deny claims on these properties by citing “lack of maintenance” or “wear and tear.”

- Proximity to the Harbor: Being adjacent to Baltimore’s waterfront raises the risk of flooding and storm-related claims. While standard homeowners insurance policies typically exclude flood damage, disputes often arise over whether water intrusion was caused by flooding or another covered peril.

- Dense Urban Environment: Houses in Little Italy are close together, which can increase the likelihood of fire spreading or property damage caused by neighboring structures. These circumstances can complicate insurance coverage and claims.

- Mixed Residential and Commercial Use: Many families operate businesses out of or near their homes. Restaurant fires, slip-and-fall injuries, or property damage tied to commercial activity often lead to disputes over whether a claim should be handled under homeowners or commercial insurance.

For residents of 21202, these factors mean insurance denials are not only common but also uniquely complex. Understanding the neighborhood’s makeup is critical for building a strong legal strategy.

Why Was My Little Italy Homeowners Insurance Claim Denied? Common Reasons for Little Italy Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

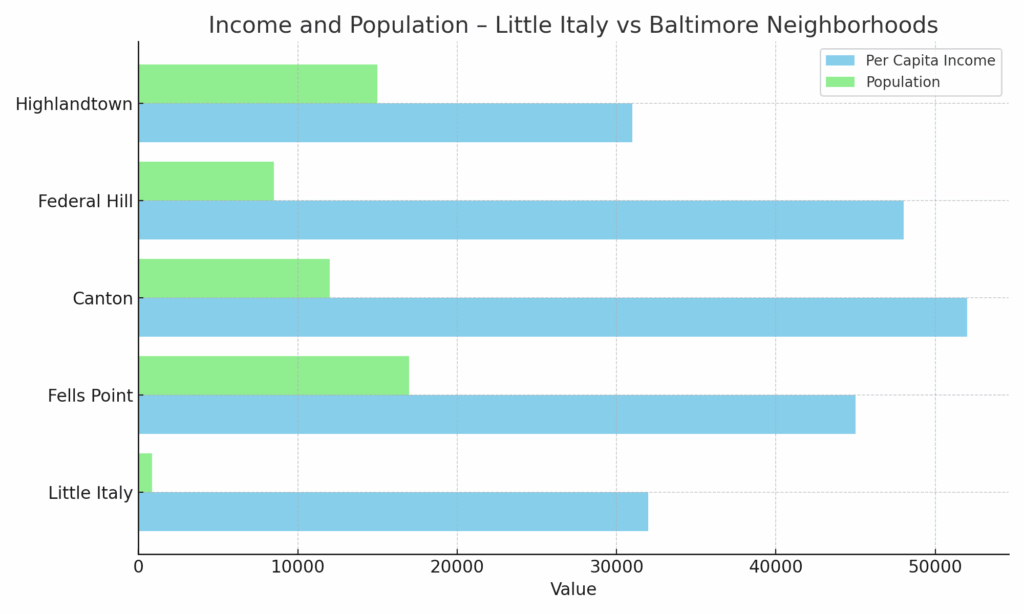

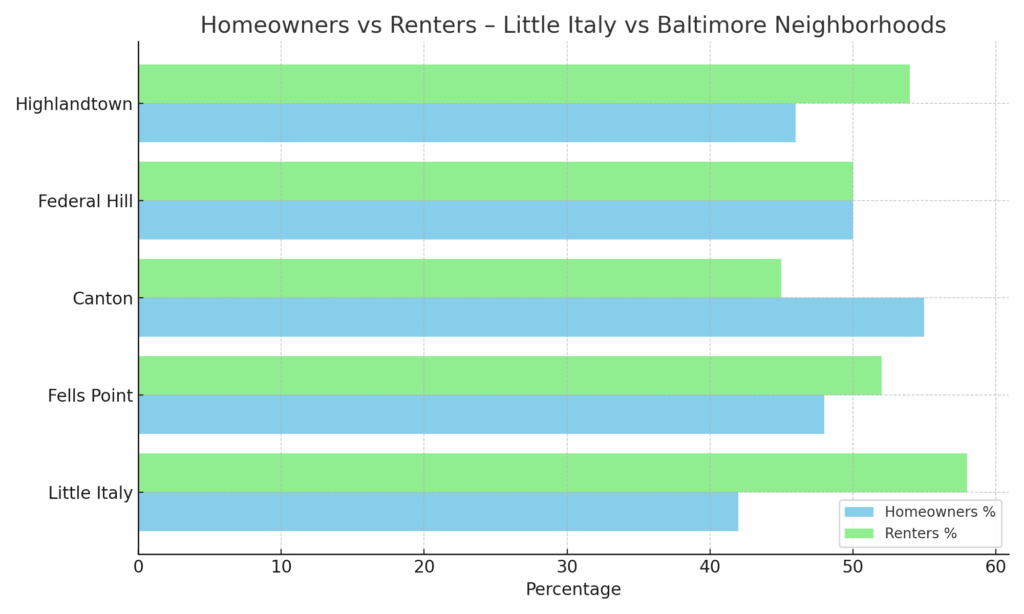

Homeownership in Baltimore’s Little Italy

Homeownership in Little Italy carries both pride and challenges. The neighborhood is notable for its compact blocks, walkable layout, and long-standing cultural institutions. Owning a home here means becoming part of a close-knit community, but it also means maintaining historic rowhouses that often date back to the early 20th century.

Baltimore City’s planning data confirms that the median age of homes in Little Italy exceeds the citywide average of 75 years. That means many properties may have original masonry, aging HVAC systems, and roofs requiring careful upkeep. These characteristics frequently become flashpoints in insurance claim denial disputes, as insurers can attempt to classify damage as “ordinary wear and tear.”

For residents in 21202, water damage from harbor storms, fire risks in rowhouse blocks, and disputes over structural collapse are particularly common. In addition, gentrification pressures have led to property improvements that sometimes spark disputes over coverage when renovations are underway.

Residents benefit from proximity to Baltimore City Government services, cultural institutions such as St. Leo the Great Catholic Church, and civic organizations like the Little Italy Community Organization. These resources play a role when navigating denied claims—whether it’s organizing neighborhood resilience programs or accessing citywide repair permits.

Little Italy Resources

- Baltimore City Government

- Little Italy Community Organization

- St. Leo the Great Catholic Church

- Baltimore City Department of Housing & Community Development

- Visit Baltimore – Little Italy

How to Challenge A Little Italy Insurance Claim Denial – My Steps:

Step 1: Responsiveness & Communication

I respond to calls promptly and keep clients updated every step of the way. When a Little Italy resident contacts me after a denial, I immediately review their policy and claim history to identify strengths and weaknesses.

Step 2: Empathy & Compassion

I understand the frustration and stress when a claim is denied. Many families in Little Italy have owned their homes for generations, and I treat those traditions with respect, guiding clients with patience and understanding.

Step 3: Advocacy & Negotiation

I construct strong arguments based on policy language, local housing risks in 21202, and aggressively negotiate with insurers. My advocacy ensures that unfair denials are challenged at every turn.

Step 4: Professionalism & Integrity

Clients in Little Italy can trust that I will handle their claims with honesty and transparency. From filing motions in Baltimore City Circuit Court to explaining policy exclusions, I operate with fairness and a focus on results.

Little Italy Insurance Claim FAQ

Q1: Are insurance claim denials more common in Little Italy than other parts of Baltimore?

Difficult to say with certainty. They are common. The age of homes in Little Italy often leads insurers to argue that damage was caused by lack of maintenance rather than a covered peril.

Q2: What types of claims are most often denied in 21202?

Water damage, roof claims generally, fire spread between rowhouses, and disputes involving older structures are frequently cited as the common.

Q3: Can businesses in Little Italy also challenge insurance denials?

Yes. Many residents own restaurants or small businesses. Commercial insurance disputes are common and require careful review of policy language. Learn More.

Q4: What role do local resources play in insurance disputes?

Neighborhood groups and city agencies can provide documentation, permits, and historical property information that may strengthen your case.

Q5: How soon should I contact an attorney after my claim is denied?

Immediately. Statutes of limitation or other notice requirements in Maryland can bar claims if you delay. Acting quickly ensures your rights are preserved.

Baltimore Insurance Claim Denial Lawyer Tip: My standard advice is to get me involved once your claim has been denied, in writing. It is at this point I can fully to to battle for you.

Next Steps After a Little Italy Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss • If your home has been damaged, take immediate action to prevent further harm. • Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp). • Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss • Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate. • This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately • Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records. o State Farm o Traveler’s o Allstate o Nationwide o USAA.

- Comply with Policy Conditions & Your Duty to Cooperate • Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. • Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications • Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. • Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney • Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial? • An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Little Italy Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Little Italy denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.