Medfield Denied Insurance Claim Lawyer

When your insurance company denies your rightful claim, it can feel like the very safety net you depended on has been ripped away. In Baltimore’s Medfield neighborhood, where close-knit community values meet an ever-evolving residential landscape, a denied claim can more than a financial inconvenience—it’s almost like breach of trust, or a breakup. As a Medfield insurance claim denial lawyer with decades of experience fighting for homeowners, I know how insurers operate. I litigate denied claims in court when necessary, pushing back against lowball offers, delay tactics, and wrongful denials. Here is my credo: What is the number on role of a Medfield denied Insurance Claim Lawyer? To get this Baltimore resident the compensation they deserve. This article is intended to provide a step-by-step breakdown of what Medfield residents should know, and do, when faced with an unjust claim denial. We’ll explore common reasons for denial, what makes Medfield unique, and how I help my clients build strong, evidence-backed insurance challenges.

I’m not telling you anything. Residents of 21211 deserve clarity and legal strength when dealing with powerful insurance carriers with monumental bank accounts. This page details your options and how a Medfield insurance claim denial lawyer may be your strongest ally in securing fair compensation. We cover everything from the language of your policy to actionable next steps. If you’re searching for a reliable attorney who has consistently gone to battle against national insurance companies, you’ve come to the right place. Whether the issue stems from damage to aging rowhomes or disputes over cause of loss, I discuss paths forward. This can be your resource—use it to better understand your rights and consider your next legal step.

Where is Medfield in Baltimore?

Medfield is a residential enclave in northwest Baltimore, bordered by Hampden, Woodberry, and Roland Park. Known for its mix of modest post-war homes and classic brick rowhouses, Medfield offers a distinct village-like atmosphere within city limits. Winding streets like Buchanan Avenue and Evans Chapel Road lead residents past community landmarks like Medfield Heights Elementary School and the recently renovated Medfield Recreation Center.

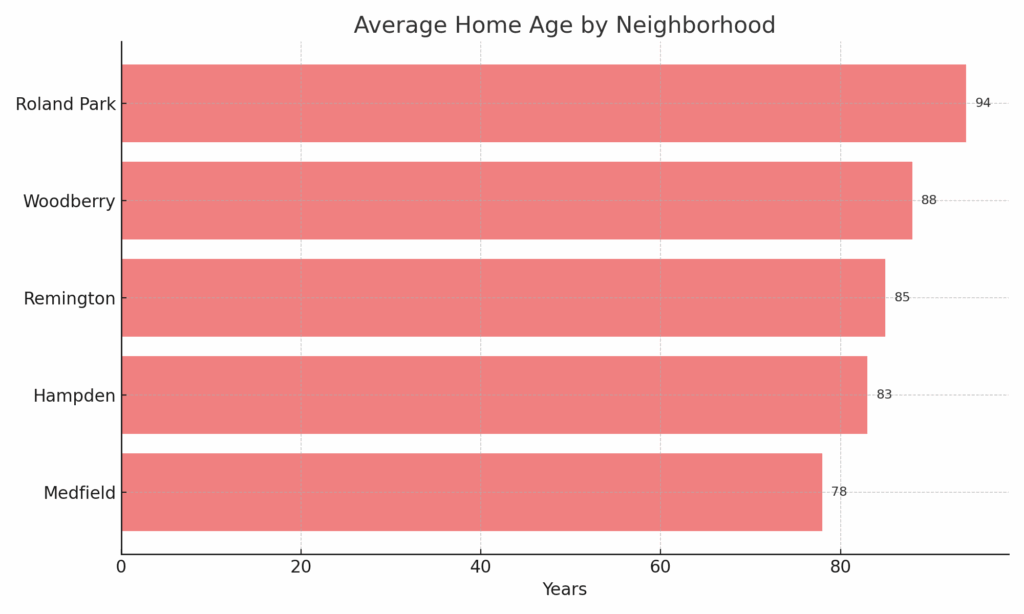

This neighborhood lies in a zone with older residential structures, many built before 1950, placing residents at higher risk for plumbing, roof, or HVAC system failures. Such features make homeowners insurance a necessity—and unfortunately, also a frequent source of disputes. Medfield’s proximity to steep hillsides and wooded terrain can lead to water intrusion, basement flooding, and mold-related claims. While are especially common, all are common. Additionally, the aging electrical systems found in many Medfield homes could lead to insurance claims, especially among rowhomes tightly packed along Cold Spring Lane and Falls Road. Residents of older homes should have periodic safety inspections.

In summary, Medfield residents are uniquely exposed to insurance challenges tied to property age, slope-related drainage issues, and historic zoning restrictions that can complicate repair timelines. These factors often become ammunition for insurance companies looking to deny claims due to alleged maintenance neglect or policy exclusions.

Community organizations such as the Medfield Neighborhood Improvement Association (MNIA) work hard to promote neighborhood safety and communication. However, when a claim is denied, these resources can’t and don’t offer legal remedies. I do. That’s where representation from an experienced Baltimore insurance claim denial lawyer can become essential.

Why Was My Medfield Homeowners Insurance Claim Denied?

Common Reasons for Medfield Homeowners Insurance Claim Denials:

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Medfield Neighborhood

Medfield’s real estate landscape offers a window into Baltimore’s working- and middle-class roots. Many homes in the neighborhood were built during or shortly after World War II, placing their average age near 80 years. Most properties are single-family rowhomes or modest detached houses, and the majority fall under R-6 residential zoning. This means homes can be tightly spaced and built with older materials that, while durable, can create insurance friction—especially regarding water damage, roofing, or outdated HVAC and electric systems.

As a Medfield insurance claim denial lawyer, I’ve encountered numerous cases where older plumbing causes water damage and the insurer blames “wear and tear” rather than accepting liability under a covered peril. The same holds true when trees growing on sloped terrain affect foundations or drainage. The close layout of homes also increases the potential for damage spread from one residence to another, which complicates liability and causation.

Medfield homeowners often face delayed repairs and extensive documentation demands from insurers due to the unique architecture and historical limitations placed on renovations. With fewer new construction permits and limited major renovations approved in the last decade, it’s common for insurance adjusters to use “deferred maintenance” as a reason to deny claims. Your legal response must be strategic.

For homeowners navigating these barriers, local resources can provide support and information:

Medfield Resources

- Medfield Heights Elementary School

- Medfield Neighborhood Improvement Association (MNIA)

- Baltimore City Department of Housing & Community Development

- Baltimore CityView Zoning Map

- Department of Public Works – Baltimore

- Baltimore Office of Sustainability

- Medfield Recreation Center (via Recreation & Parks)

Next Steps After a Medfield Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

o State Farm

o Traveler’s

o Allstate

o Nationwide

o USAA - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations.

• Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance. - Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

Water intrusion from slope-related drainage issues, aging roofs, and outdated plumbing are among the most common sources of damage that generate denied claims in Medfield.

Immediately. The sooner I review your policy and denial letter, the sooner I can take action to preserve your rights and avoid missing critical filing deadlines

Yes. Incomplete renovations or mixed-use updates don’t disqualify you from valid claims. I evaluate the full scope of property damage and challenge exclusions or delays.

Yes. Many Medfield homes are 70+ years old, and insurers often deny claims by citing “wear and tear” or deferred maintenance instead of honoring valid coverage.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Medfield Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Medfield denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit – I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies.