Denied Insurance Claim Lawyer: Baltimore’s Hamilton Neighborhood | 21214

Hamilton is a residential neighborhood tucked into northeast Baltimore, rich in architectural charm and known for its community spirit. I’ve found that tranquility, can, unfortunately, undergo tumult. Why a denied insurance claim lawyer in Baltimore’s Hamilton neighborhood, might be called upon might not be immediately obvious. Yet, like many Baltimore neighborhoods, Hamilton faces challenges with denied insurance claims that often leave residents frustrated, financially exposed, and unsure of what to do next. Working with an insurance claim denial lawyer who understands both the legal framework and the local context of Hamilton is critical. That’s where Baltimore attorney Eric T. Kirk comes in.

Insurance claims—whether from storm damage, plumbing failures, or fire—are supposed to be a safety net. But when insurers deny these claims, Hamilton homeowners are left to shoulder the cost of repairs themselves. As an insurance claim denial lawyer serving Baltimore’s Hamilton neighborhood, Eric T. Kirk works with homeowners to fight unjust denials, compel fair evaluations, and pursue litigation when necessary.

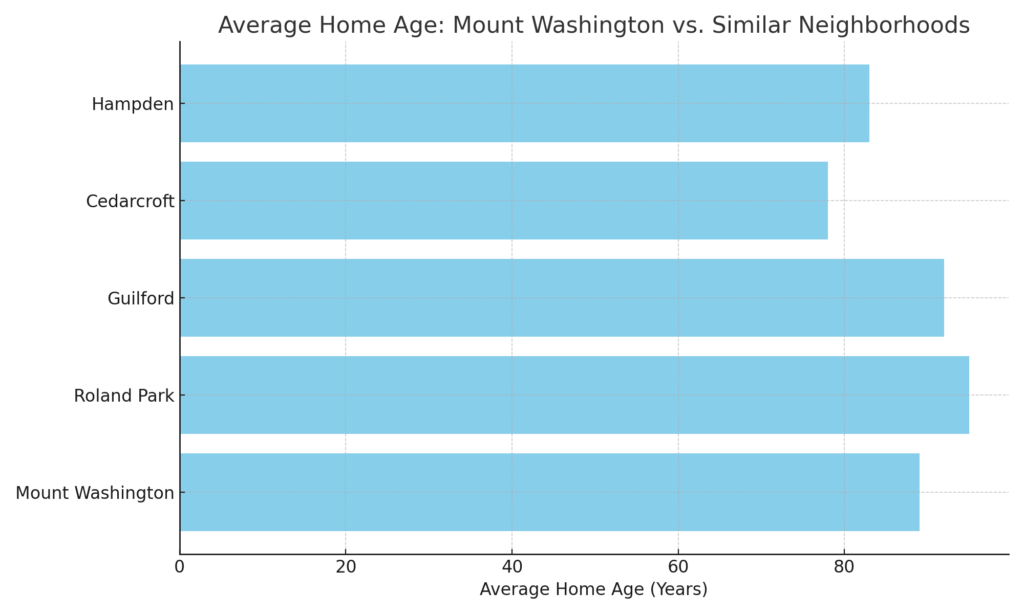

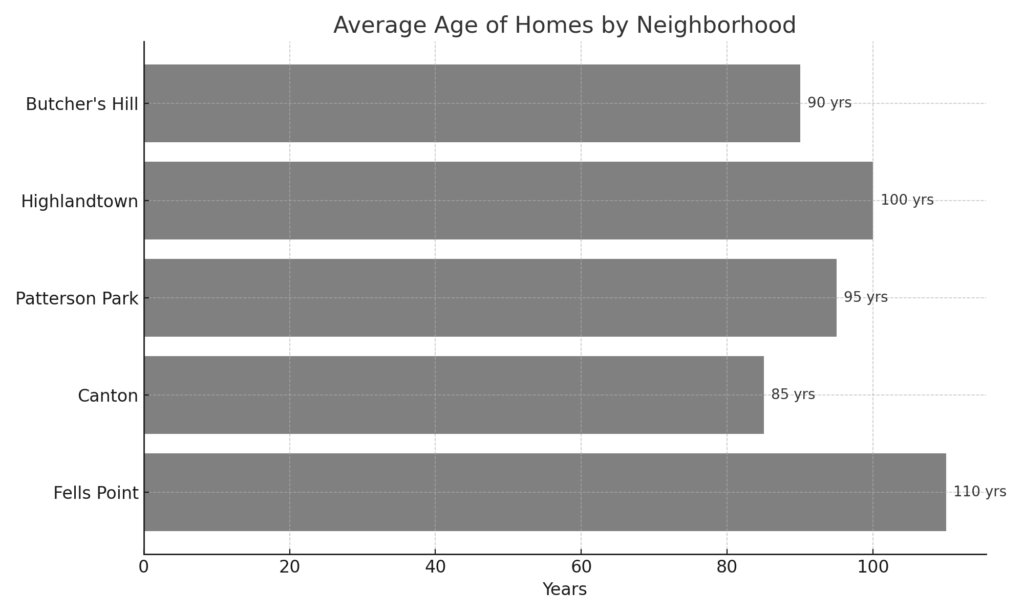

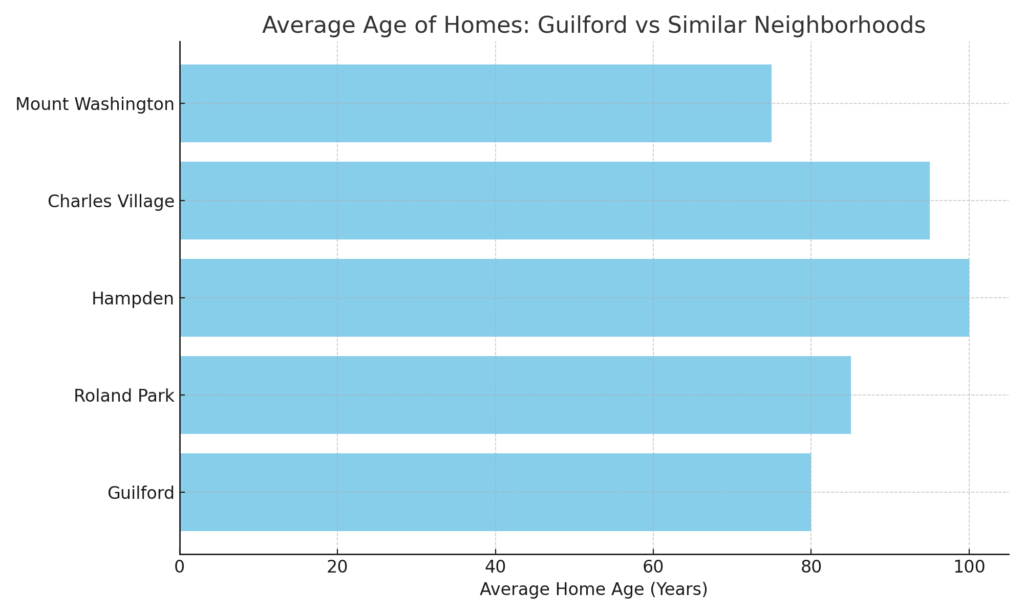

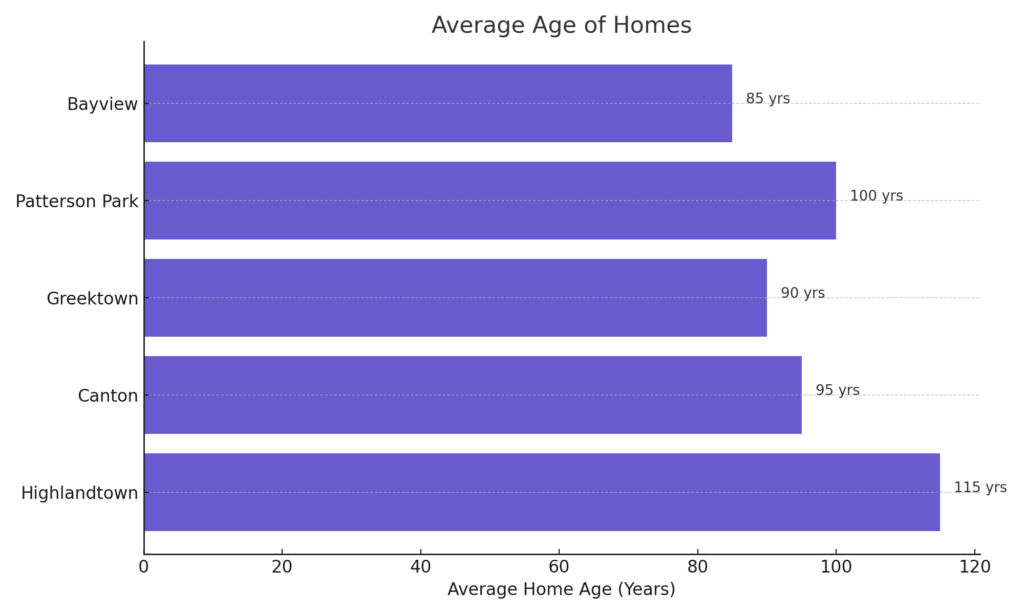

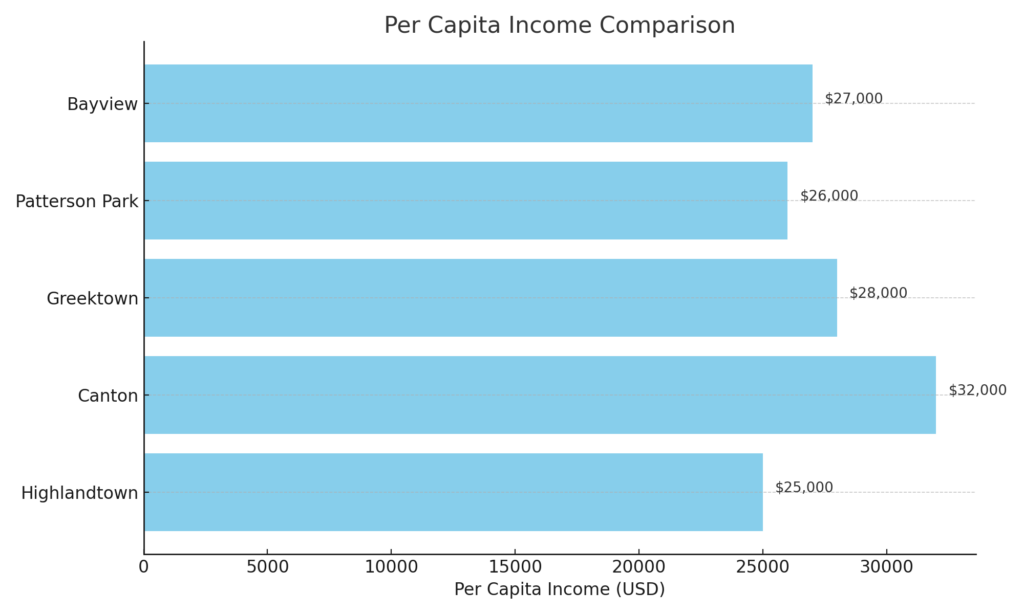

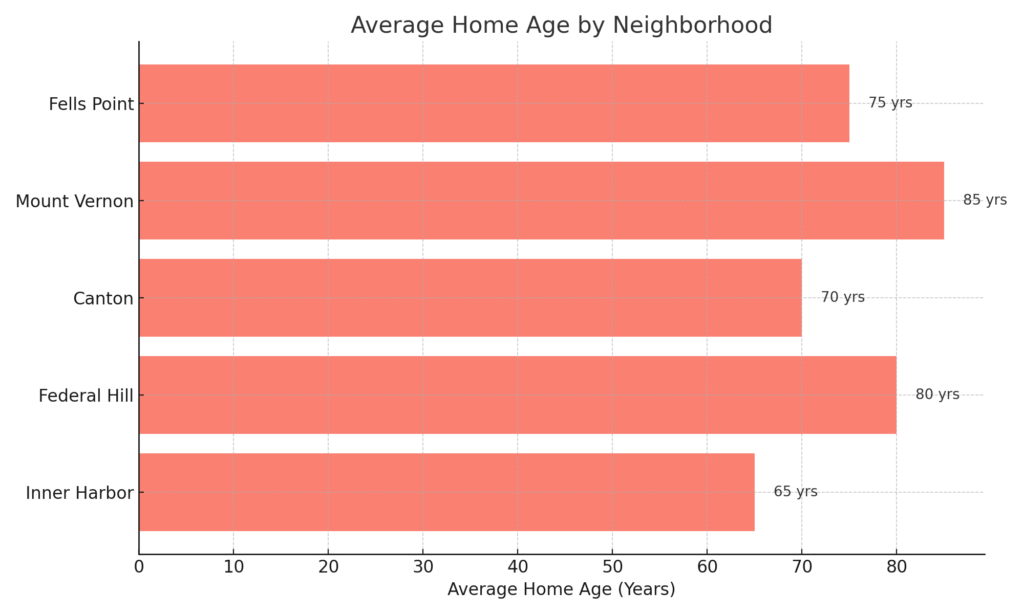

In Hamilton, where a blend of century-old homes and post-war construction dominates the housing stock, insurance disputes can be particularly contentious. A denied insurance claim lawyer in Baltimore’s Hamilton neighborhood might be the only sensible recourse where adjusters argue that aging structures were inadequately maintained or that the damage stemmed from preexisting issues. Having a seasoned Baltimore insurance claim denial lawyer who can counter these arguments with evidence and legal precision is essential.

For residents of Hamilton (ZIP code 21214), working with a local insurance claim denial lawyer like Eric T. Kirk can mean the difference between a denied claim and a fair payout. This article provides a step-by-step overview of what Hamilton homeowners should know about denied insurance claims and how to challenge them effectively. In summary: don’t accept a denial at face value. Know your rights, and take action.

Where Is Hamilton in Baltimore?

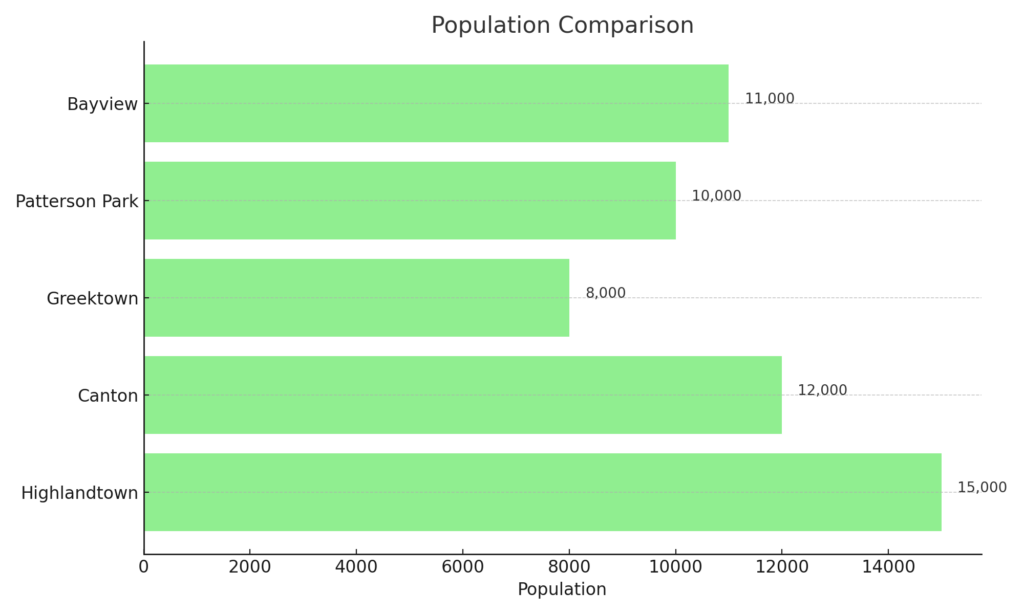

Hamilton is located in northeast Baltimore, bordered by Lauraville, Waltherson, and Frankford. The area is known for its mix of detached homes, tree-lined streets, and proximity to Harford Road—a commercial and transit corridor. Hamilton blends a suburban feel with city access, making it popular with families and longtime residents alike.

The neighborhood includes key residential streets like Glenmore Avenue and Echodale Avenue, and its architectural identity is shaped by craftsman-style homes, Cape Cods, and early 20th-century bungalows. Don’t quote me, but any denied insurance claim lawyer working on Baltimore’s Hamilton neighborhood claims will see that this older housing stock can raise complex issues in homeowner’s insurance claims—especially in disputes involving water damage, roofing problems, and structural issues.

Hamilton is also home to several parks, including Herring Run Park, and cultural institutions like the Hamilton-Lauraville Main Street Association, which fosters community events and revitalization efforts. However, despite these strengths, Denied Insurance Claim Lawyers here, in Baltimore’s Hamilton Neighborhood 21214 know the area faces infrastructure aging, occasional flash flooding, but also know the residents must overcome the insurance claim complexities that often accompany older homes.

Local issues such as deteriorating plumbing, aged electrical systems, and flat-roof designs common in some Hamilton homes may increase the likelihood of damage that insurers attempt to label as “maintenance-related” rather than from a covered peril. That’s why residents of 21214 turn to an insurance claim denial lawyer familiar with the neighborhood’s unique risks and conditions.

Why Was My Hamilton Homeowners Insurance Claim Denied?

Common Reasons for Hamilton Homeowners Insurance Claim Denials

Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company. Duty to Cooperate. Denied Insurance Claim Lawyers working Baltimore’s Hamilton Neighborhood 21214 know this acronym. EUO.

Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

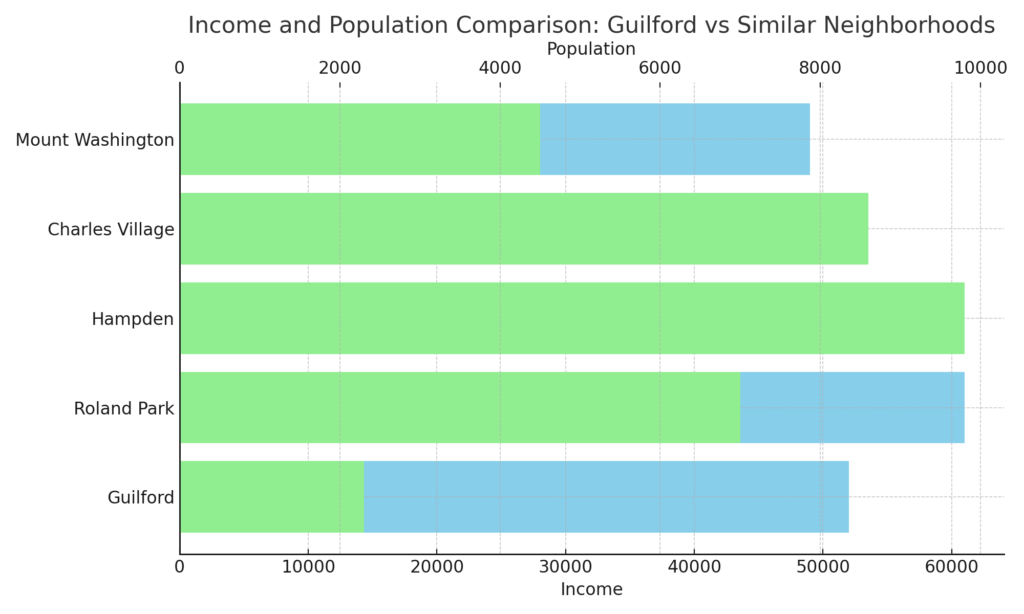

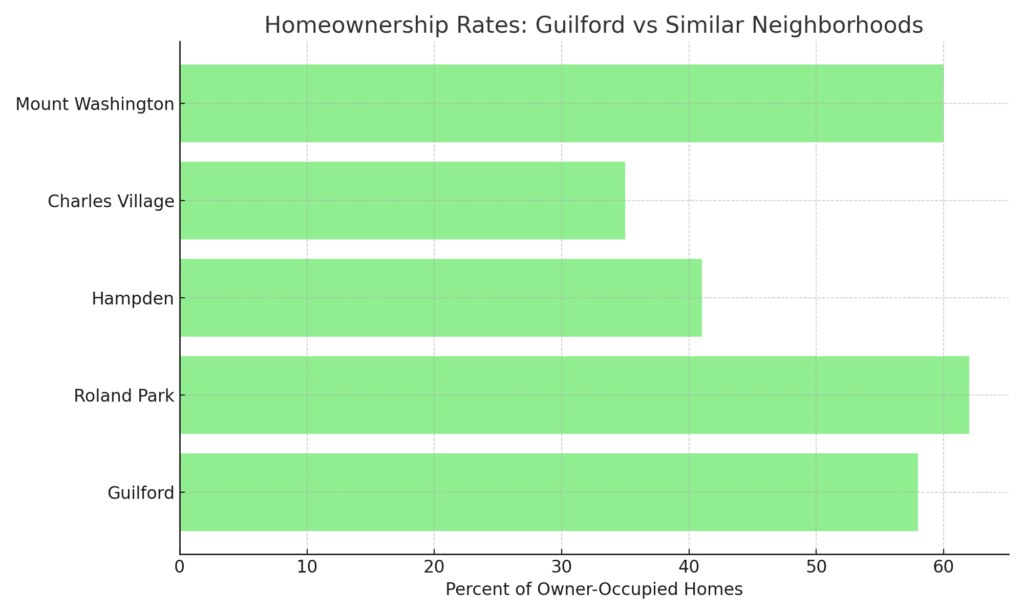

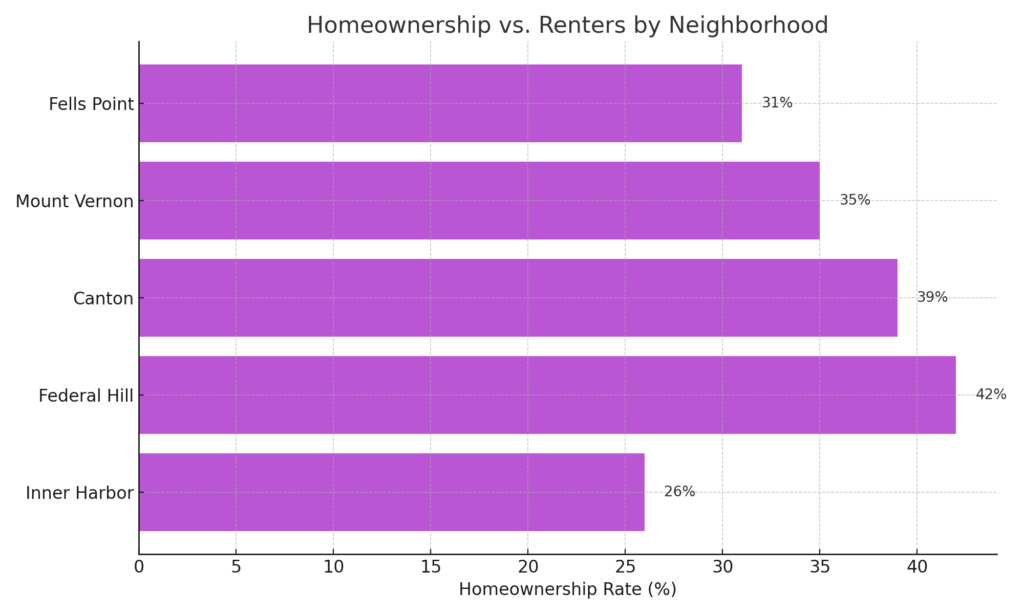

Homeownership in Baltimore’s Hamilton Neighborhood

Hamilton’s housing stock is among the most diverse in the city, with residences dating from the early 1900s through the 1950s. This means many homes exceed 75 years in age—contributing to complex issues in homeowner insurance claims. Properties are often constructed with original materials, such as slate roofs and plaster walls, which require specific maintenance and can be contentious points in claim evaluations. Some Hamilton homes are designated within Baltimore’s Housing Market Typology as “stable with middle market stress,” highlighting the need for careful handling of any damage claims that arise.

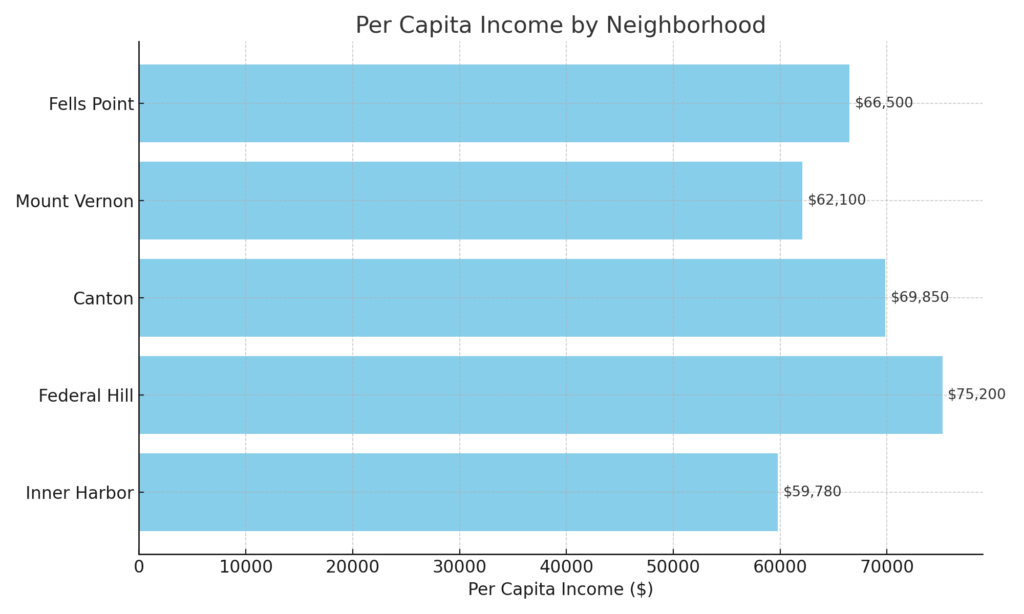

According to Baltimore City Planning Department data, Hamilton contains a majority of single-family detached homes and a relatively high rate of homeownership compared to other northeast neighborhoods. The neighborhood’s topography and older infrastructure make it vulnerable to water line breaks, tree root damage, and sewer backups—conditions that can quickly lead to a denied claim if not carefully documented and presented.

For residents here, navigating the fine print of policy exclusions and proving covered losses can be daunting—especially when insurers argue that gradual damage or outdated systems are to blame. That’s where an experienced Baltimore insurance claim denial lawyer becomes crucial.

Community anchors such as Hamilton Elementary/Middle School, the Harford Senior Center, and the Hamilton Branch of Enoch Pratt Library serve residents throughout 21214. These hyper-local resources offer helpful support to homeowners, whether through educational outreach, legal information, or municipal updates on neighborhood development.

How to Challenge A Hamilton Insurance Claim Denial- My Steps

Step 1: Review & Communication – Responsiveness

From the moment you contact me, I get to work. Hamilton residents don’t wait.

- I personally review your denial letter.

- I obtain the full claim file, policy, and insurer documentation.

- I preserve deadlines and advise on your next legal steps.

“He answers his phone himself.”

“Kept me updated every step of the way.”

“Answered on the first ring.”

Those are not marketing slogans. That’s what real Baltimore clients say.

Step 2: Strategic Claim Analysis – Legal Knowledge

Insurance policies contain traps. I know where many are, and am always looking for others.

- I analyze your policy language, including any exclusions or ambiguous definitions.

- I compare your case to Maryland case law and COMAR

Step 3: Lawsuit & Discovery – Relentless Advocacy

If we can’t resolve your case pre-suit, we file.

- I file in Baltimore City Circuit Court or District Court depending on the amount in controversy.

- I propound aggressive discovery: adjuster logs, emails, internal memos.

- I depose the adjusters, under oath, right here in Baltimore.

- I break down their defenses and expose contradictions.

Step 4: Trial – Unshakable Professionalism

I don’t shy away from trial. I do this. Hundreds of times.

- I prepare witnesses and exhibits tailored to Baltimore jury expectations.

- I seek to exclude prejudicial insurer tactics via motion practice where applicable.

- I present closing arguments that focus on truth and fairness — not tricks.

Whether the trial is heard in the Eastside courthouse, or resolved through settlement talks beforehand, I bring 30 years of trial experience and a reputation for courtroom integrity to every case.

What should I do first after a denied insurance claim in Hamilton?

Immediately contact an attorney. Preserve the denial letter and claim documentation. I will review the documents, outline your rights, and file necessary notices within critical deadlines.

Can I sue my insurance company in Baltimore for denying my claim?

Yes. If your insurer wrongly denied your claim, I can file a lawsuit in Baltimore City Circuit Court seeking breach of contract damages and possibly bad faith penalties.

Do you offer free consultations in Hamilton?

Yes. I offer free, no-obligation case reviews to Hamilton residents. You can call, email, or schedule online.

What types of denied claims do you handle?

I handle homeowners, auto (PIP and liability), renters, fire, flood, and commercial insurance denials — including bad faith conduct and delay tactics.

Hamilton Resources

- Hamilton-Lauraville Main Street Association

- Herring Run Park – Baltimore City Recreation & Parks

- Hamilton Branch – Enoch Pratt Free Library

- Hamilton Elementary/Middle School – Baltimore City Schools

- Harford Senior Center – Baltimore City Department of Aging

Hamilton Insurance & Legal FAQ

Q1: Are denied insurance claims common in Baltimore’s Hamilton neighborhood?

A1: It depends on what you mean by common. Hamilton’s older housing stock and aging infrastructure increase the likelihood of disputes over coverage for water damage, roof issues, and system failures.

Q2: What should I do if my Hamilton homeowners insurance claim is denied?

A2: Immediately preserve evidence, request a written denial, and consult with a Baltimore insurance claim denial lawyer like Eric T. Kirk.

Q3: Can I appeal a denied claim without a lawyer?

A3: While you can technically appeal on your own, working with legal counsel increases the odds of success, especially for complex Hamilton properties. I recommend lawyering up after a written denial of a substantial claim.

Q4: Does my insurance cover sewer backups common in Hamilton?

A4: Coverage for sewer backups can be covered. If you don’t have an endorsement, a claim may be denied unless negotiated or litigated.

Q5: Is storm or tree damage to my roof in Hamilton always covered?

A5: Not necessarily. It depends on the policy and the facts. Insurers may argue wear and tear or poor maintenance. Legal review is critical if you’re denied.

Next Steps After a Hamilton Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

1. Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions.

• Take photos and videos to document the damage as soon as possible.

2. Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss.

• This could include shutting off water in the event of a plumbing failure or securing broken windows.

3. Notify Your Insurance Company Immediately

• Contact your insurance company in writing. Use a portal if available.

4. Comply with Policy Conditions & Duty to Cooperate

• Provide required statements, proof of loss, EUO if requested.

• Courts in Baltimore enforce these duties strictly.

5. Keep Your Denial Communications

• Retain the insurer’s denial letter and all correspondence.

• Statute of limitations begins once the denial is issued.

6. Seek Legal Guidance

• Do not accept denial at face value.

• Eric T. Kirk litigates denied insurance claims for Hamilton homeowners.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Hamilton Homeowners Insurance Claim

✔ Complimentary Case Analysis

✔ Policy review and legal interpretation

✔ Collect and analyze cause of loss evidence

✔ Negotiate or litigate if necessary

✔ Trial-ready representation when insurers won’t act fairly

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”