Denied Insurance Claim Lawyer: Baltimore’s Cold Spring | 21209

Denied Insurance Claim Lawyer | Baltimore’s Cold Spring | 21209

Can a Denied Insurance Claim Lawyer serving Baltimore’s Cold Spring | 21209 be your trusted pathway to prevailing when insurers say “no.” Am I “that guy”? I don’t make such promises. I do promise my clients that if they are entitled to money unfairly or wrongly denied by an insurance company in Baltimore, Maryland, we will spare no effort to obtain appropriate and just compensation. In Cold Spring, deeply connected to green corridors, vibrant community life, and historical housing design, residents deserve a denied insurance Claim Lawyer who understands the neighborhood’s nuances—and delivers results. Eric T. Kirk, a seasoned force with over three decades of dedication to fighting insurance companies in Baltimore, stands ready to guide Cold Spring’s homeowners through the labyrinth of denials and into fair compensation. Whether your claim involves storm-related water damage to mid-century “deck houses,” unexpected legacy issues in older housing stock, or liability claims tied to adjacency with Cold Spring Park, our Denied Insurance Claim Lawyer | Baltimore’s Cold Spring | 21209 approach ensures your rights are front and center. This introduction is your first step—crafted as a step-by-step roadmap, rooted in definition of your rights, and centered on what’s most important: achieving fair recovery for your home. In summary, if you’re navigating a denial in Cold Spring, trust that our Insurance Claim Denial Lawyer expertise—tailored, local, and relentless—begins right here.

Where is Cold Spring in Baltimore, Maryland?

Cold Spring is nestled in the North District of Baltimore, bounded by West Northern Parkway to the north, Greenspring Avenue to the west, the Jones Falls Expressway (I-83) to the east, and West Cold Spring Lane to the south. This uniquely wooded, gently rolling terrain includes a significant swath of Cold Spring Park, linking the neighborhood’s northern and southern edges. The Jones Falls Trail runs through Cold Spring on its north–south course, with an offshoot to the Cylburn Arboretum via Cold Spring Park—providing critical recreational access. Architecturally, this venerable neighborhood showcases mid-century innovative Cold Spring architecture, and some say is best known for the “deck houses,” commissioned in the 1970s as part of the Coldspring Newtown planned concept—a “town within a town” blending architecture, green space, and walkability. Though the full vision was never realized, the deck house clusters remain a testament to that innovative tilt.

Cold Spring: Key Local Landmarks

- Cylburn Arboretum sits just west of the neighborhood, offering open space and nature access.

- The Jones Falls Trail brings connectivity and active‐transport routes through the parkland.

- Baltimore Polytechnic Institute (“Poly”) and Western High School anchor the southern border at West Cold Spring Lane.

- Cold Spring Lane Light Rail Station right on Cold Spring Lane between I-83 ramps provides transit options.

Insurance-Related Challenges in Cold Spring

- The architecturally unique deck houses built over parking structures—moisture intrusion, structural drainage, and aging concrete surfaces may prompt complex homeowners’ insurance claims.

- The proximity to greens and wooded areas increases exposure to falling trees or storm damage, which can be denied under “maintenance” exclusions.

- The mix of older homes and mid-20th century structures raises the incidence of weather-related degradation, roof leaks, and foundation issues with potential denials citing neglect or wear and tear.

- Transit corridors and overpass infrastructure might result in auto collisions and liability claims involving adjacent properties, increasing property and personal injury exposure.

Cold Spring Resources

- Baltimore City Department of Planning – Neighborhood Maps & Profiles

- Cylburn Arboretum

- Baltimore City Public Schools

- Maryland Transit Administration – Light Rail (Cold Spring Lane)

- Maryland Courts – insurance statutes and homeowner rights

Why Was My Cold Spring Homeowners Insurance Claim Denied?

Common Reasons for Cold Spring Homeowners Insurance Claim Denials.

Policy Exclusions: Insurers can deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. They must offer a reason. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

Lack of Proper Maintenance: Insurance companies sometimes argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Cold Spring

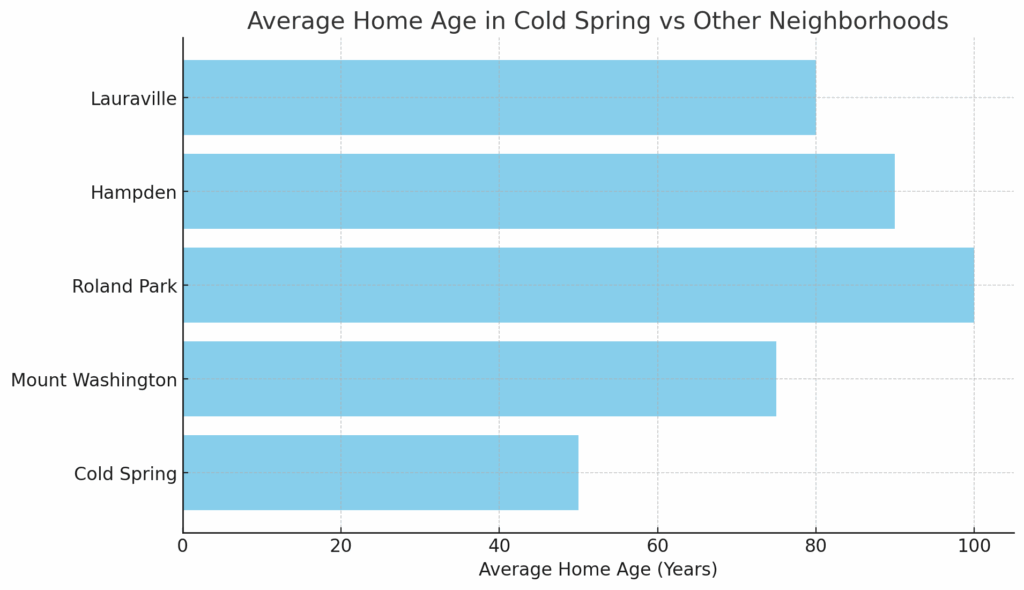

Homeownership in Baltimore’s Cold Spring centers on a unique blend of architectural legacy, green infrastructure, and mid-century innovation that sets it apart from other neighborhoods. Unlike traditional rowhouse communities, Cold Spring features –designed “deck houses” built over parking decks that merge density with park-like living, embedded in rolling woodlands and walking paths. This gives homeowners both modern utility and exposure to maintenance challenges—particularly regarding structural drainage, deck integrity, and concrete weathering.

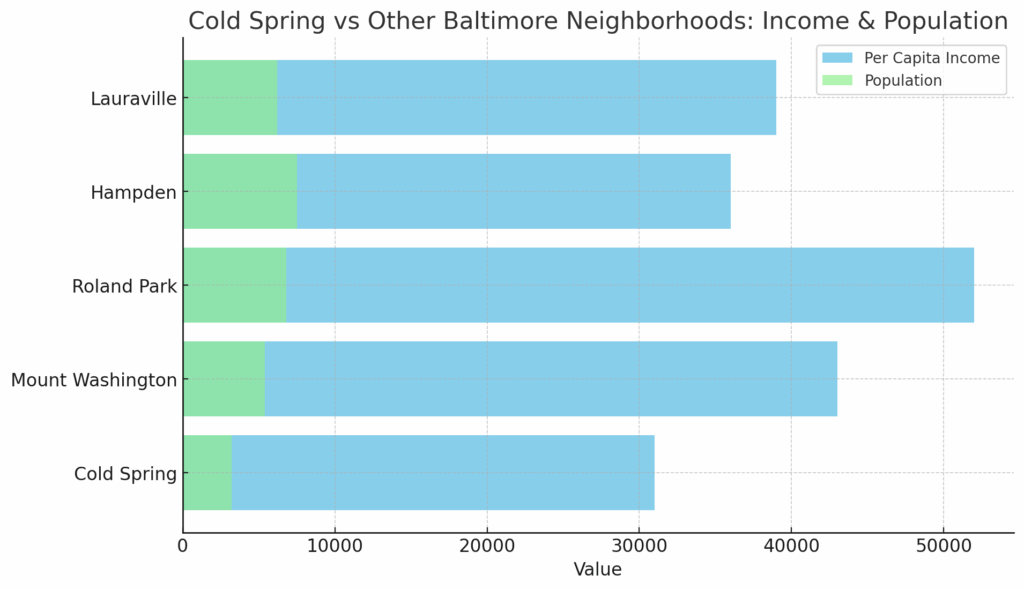

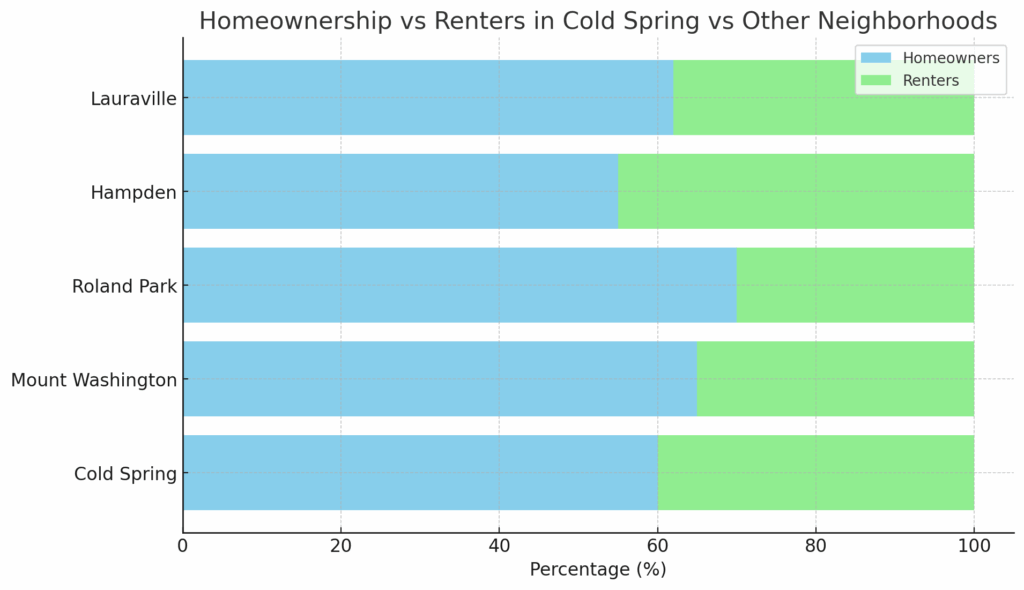

Many homeowners in Cold Spring own rather than rent. Conventional estimate say about 60% own / 40% rent in the area. These are often condos or town-style units with well-kept communal green spaces, a stark contrast to other Baltimore neighborhoods with higher rental density. The median home purchase price recently hovered around $179,900, reflecting affordability tied to unique design and proximity to parklands.

Proximity to key institutions such as the Baltimore Polytechnic Institute and Western High School anchors Cold Spring as a long-standing family-oriented community with excellent schooling options and civic engagement. The presence of the Cold Spring Lane Light Rail Station further enhances connectivity, making the neighborhood attractive to commuters.

Despite these strengths, homeowners can face insurance challenges stemming from the deck-house architecture—concrete decks are prone to leaking, mold, and repair disputes. Woodland adjacency occasionally means trees falling in storms, while older structures may show signs of deferred roof or foundation maintenance, all potential grounds for denials under wear-and-tear or maintenance exclusions.

This context makes a Denied Insurance Claim Lawyer well-versed in Cold Spring’s architecture, storm risks, and policy pitfalls invaluable to residents. A local expert can anticipate insurer tactics—like denying claims for deck moisture as “neglect”—and ready evidence, expert testimony, and neighborhood norms to push back effectively.

Cold Spring Resources

- Baltimore City Department of Planning – Neighborhood Maps & Profiles

- Cylburn Arboretum

- Baltimore City Public Schools

- Maryland Transit Administration – Light Rail (Cold Spring Lane)

- Maryland Courts – insurance statutes and homeowner rights

How to Challenge A Cold Spring Insurance Claim Denial – My Steps:

- Assess with Responsiveness: Immediately respond to your call—quickly answer your phone, acknowledge your loss, and open your file with urgency.

- Prepare with Legal Knowledge: Thoroughly review your policy, interpret complex deck-house provisions, and base your strategy on thorough knowledge of the relevant law and policy wording.

- Advocate through Communication & Negotiation: Present clear, transparent updates every step; negotiate fiercely with the insurer, emphasizing comparable deck-house claim precedents.

- Deliver Results-Driven Resolution: Leverage evidence and expert support to secure a fair settlement, or, if needed, bring the case to trial with the specific goal of maximum outcome.

FAQ – Cold Spring Neighborhood

A: The deck-house units are elevated over structural decks, and can be prone to moisture and foundational issues, which insurers could challenge as maintenance rather than covered loss.

Frequent is an open term, but, yes, Cold Spring’s wooded setting means falling trees or wind damage are common—but insurers may deny claims citing lack of maintenance. A denial lawyer can challenge such exclusions.

Being near Poly, Western HS, and the Light Rail can add exposure to auto liability or injuries; navigating these involves policy review and negotiation tailored to local context.

Next Steps After a Cold Spring Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example—known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—as covering a leaking roof with a giant blue tarp.

- Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

- State Farm

- Traveler’s

- Allstate

- Nationwide

- USAA

- Comply with Policy Conditions & Your Duty to Cooperate

- Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

- Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications

- Your insurance company is required to give a written reason for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking. Statute of limitations applies.

- Keep all correspondence, including emails and letters, in a dedicated file. The denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

- Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court.

- What do you do when your insurance company is in denial? An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

How Attorney Eric T. Kirk Can Help with Your Denied Cold Spring Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Cold Spring denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not—

✔ File a lawsuit. I sue insurance companies.

✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”