Unraveling Unpaid Insurance Claims in Cheswolde

Denied Insurance Claim Lawyer: Baltimore’s Cheswolde | 21209

Introduction

Denied Insurance Claim Lawyer | Baltimore’s Cheswolde

Residents of Cheswolde, 21209, often feel overwhelmed when their insurance company refuses to pay a valid claim. Insurance disputes are never just about paperwork — they’re about families, homes, and livelihoods. A denial letter can leave you with unexpected financial burdens, especially in neighborhoods like Cheswolde where many homes are mid-century and subject to weather-related issues, maintenance disputes, and property damage risks. You require legal assistance in unraveling your denied, delayed or unpaid insurance claims in Cheswolde. You are in the right place.

As an experienced insurance claim denial lawyer serving Baltimore neighborhoods I have seen how insurers often seek to exploit technicalities to avoid paying what’s rightfully owed. For policyholders in Cheswolde, these tactics can mean the difference between repairing your home and living with long-term damage.

This article explains where Cheswolde is in Baltimore, what makes the neighborhood unique, how local housing factors might influence insurance claim patterns, and what steps you should take if your claim has been denied. You’ll also find a step-by-step guide, FAQs, and links to protect your rights.

Where is Cheswolde in Baltimore?

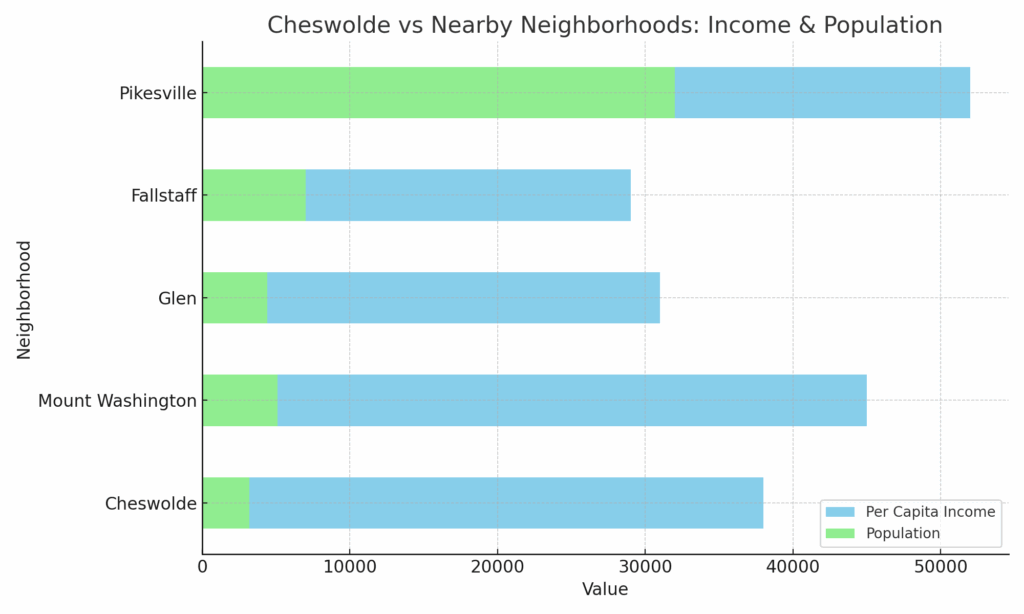

Cheswolde is located in the northwest corner of Baltimore City, bordered by Fallstaff, Glen, and Mt. Washington. It sits within ZIP code 21209, an area recognized for its stable, primarily residential character. With tree-lined streets, mid-century single-family homes, and apartment complexes, Cheswolde offers a suburban feel while still being part of Baltimore City.

Key landmarks include:

- Western Run Stream Valley — a natural green space that adds charm but also introduces stormwater runoff risks.

- Cross Country Elementary/Middle School — serving families throughout the neighborhood.

- Greenspring Shopping Center — a commercial hub just outside the neighborhood boundaries.

Insurance Implications in Cheswolde

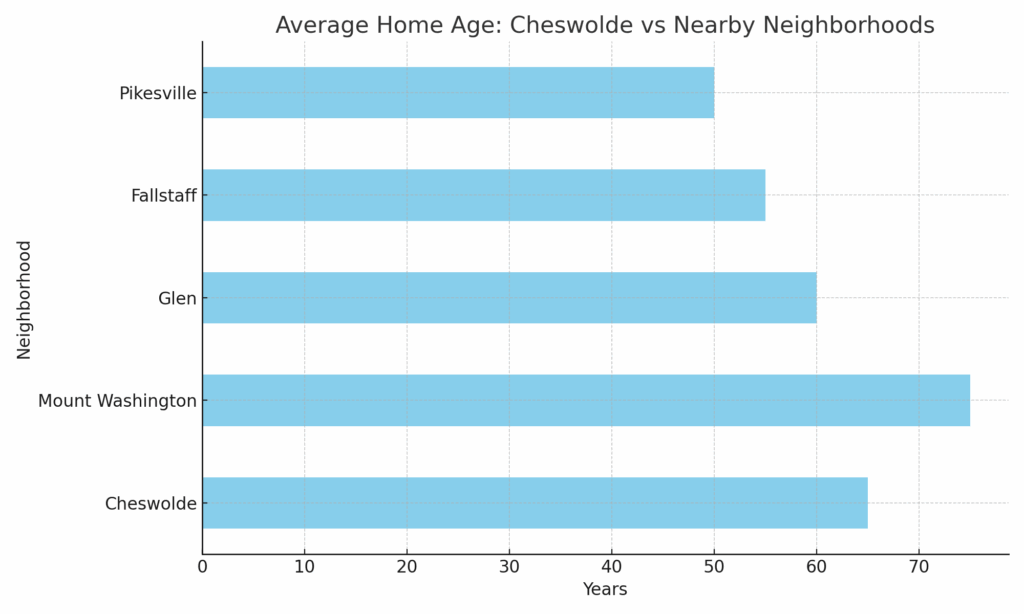

Cheswolde’s housing stock is a mix of 1940s–1960s brick homes and newer townhouses. Older roofs, plumbing, and electrical systems often lead to disputes when insurers can claim that damage stems from “wear and tear” rather than a covered peril.

Flooding and water damage are also significant issues. Proximity to Western Run may mean some low-lying properties are susceptible to stormwater intrusion. Insurance companies can deny these claims by citing policy exclusions for groundwater or flood damage.

Another common issue in 21209 is storm-related damage to mature trees. Fallen trees may cause roof collapses or block access, and insurers sometimes dispute whether the policyholder took “reasonable steps” to maintain their property.

For residents of Cheswolde, having a skilled insurance claim denial lawyer review your denial letter is the most important step you can take toward protecting your home and your rights.

WHY WAS MY CHESWOLDE HOMEOWNER’S INSURANCE CLAIM DENIED?

Common Reasons for Cheswolde Homeowners Insurance Claim Denials

Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

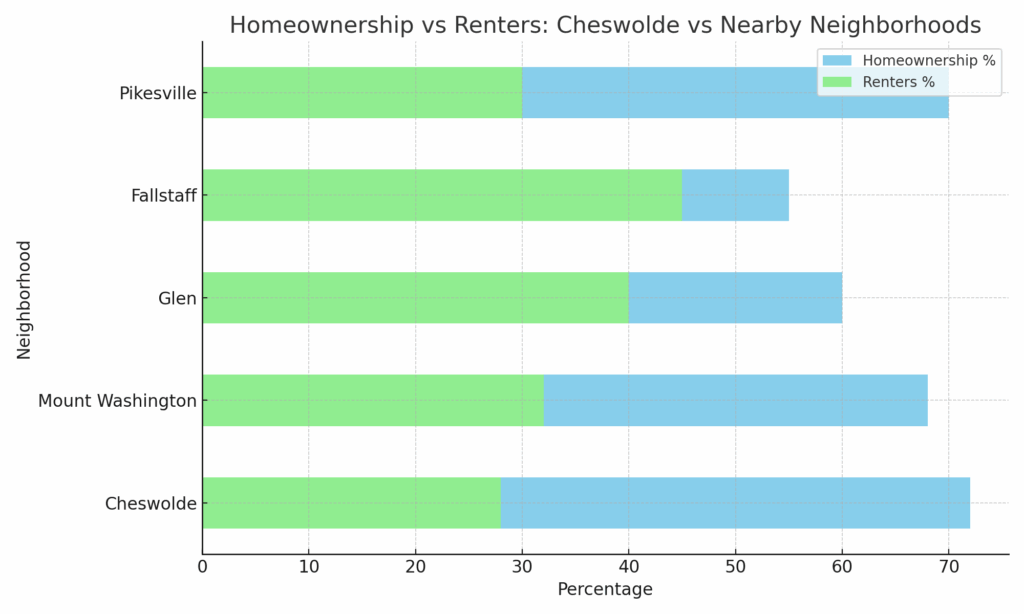

Homeownership in Baltimore’s Cheswolde Neighborhood

Cheswolde is a neighborhood with strong homeownership rates. Many families have lived here for generations, creating a sense of continuity and stability. The homes are generally detached or semi-detached brick houses, built mid-20th century, with an average age of 60–70 years.

Unraveling Unpaid Insurance Claims in Chesolde? Because of this, insurers can scrutinize claims closely, attributing damage to “age” rather than covered causes. Common issues in 21209 include:

- Roof deterioration after heavy storms.

- Basement flooding from aging drainage systems.

- Fire and smoke damage in older electrical systems.

- Disputes over tree-related property damage.

The community also has an active network of religious institutions, schools, and civic associations. This social infrastructure strengthens Cheswolde but does not shield residents from the risk of unfair denials.

How to Challenge A Cheswolde Insurance Claim Denial?

For homeowners, the most important step is to act quickly after a denial: preserve evidence, document communication, and seek legal guidance.

- Respond & Communication

Every lawsuit begins with a consultation. Schedule yours now.

- Collect and Gather

Information is vital. I will give you guidance on collecting and preserving yours.

- Advocacy & Negotiation

I develop legal arguments tailored to local risks in Cheswolde, and negotiate firmly, but fairly, with insurers to secure fair settlements

- Legal Knowledge. The law as it is applied in Cheswolde, Baltimore.

I thoroughly review your policy and apply decades of courtroom experience to prepare for litigation if necessary.

Next Steps After A Cheswolde Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

o State Farm

o Traveler’s

o Allstate

o Nationwide

o USAA - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations.

• Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance. - Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Cheswolde Resources

- Baltimore City Department of Housing & Community Development

- Baltimore City Department of Public Works

- Baltimore City Department of Transportation

- Baltimore City Schools

- Western Run Stream Valley Park (Baltimore City Recreation & Parks)

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Cheswolde Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Cheswolde denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”

So Should You.

TL;DR

- Baltimore’s Cheswolde (21209) residents often face insurance claim denials tied to older housing stock, stormwater drainage, and property damage disputes.

- This guide explains why insurance companies deny claims, what steps to take after a denial, and how an insurance claim denial lawyer can help.

- Includes local resources, a step-by-step explanation of Cheswolde homeownership challenges, and FAQs tailored to the neighborhood.

- Features Eric T. Kirk, a Baltimore attorney with 30 years of experience holding insurers accountable.