Walking Through Denied Insurance Claims: Baltimore’s Orangeville | 21205

TL;DR

For homeowners in Baltimore’s Orangeville (ZIP 21205), facing an unfair homeowners insurance claim denial can be a stressful and costly experience. If your insurer has rejected your claim, you need a trusted insurance claim denial lawyer who understands how to challenge rigorous policy interpretations, navigate local housing-stock issues, and stand up to large insurers. This article explains how an experienced attorney approaches your case step-by-step, how Orangeville’s housing and industrial mix may raise specific insurance pitfalls, why denials often happen, and what you should do at once when your claim is turned down.

Estimated reading time: 14 minutes

Introduction

As a dedicated insurance claim denial lawyer navigating Baltimore’s complex insurance landscape, I know how families in Orangeville face uphill battles when their homeowners insurance claims are rejected. The title “Denied Insurance Claim Lawyer | Baltimore’s Orangeville” reflects both the neighborhood you live in and the ZIP 21205 community I serve. If you own property in Orangeville 21205 and your insurance company said “no,” you’re listening to someone who has spent decades confronting the nation’s largest insurance companies to hold them accountable. Many Orangeville homeowners don’t realize that the mix of older row-homes, proximity to industrial areas, and a high rental-to-ownership ratio create exposures insurers love to use as reasons to deny claims. An insurer’s rejection doesn’t mean you must surrender your rights — it may just mean you need someone who knows how to thoroughly analyze the policy, preserve evidence, and push back. In summary: you don’t have to accept an unfair denial simply because the insurer says you have no rights left.

Where is Orangeville in Baltimore, Maryland?

Orangeville is a compact residential neighborhood in Northeast Baltimore, anchored by the ZIP 21205 (and partially 21224) codes. Statistical Atlas+2Live Baltimore+2 Its boundaries place it adjacent to industrial zones and heavy transportation corridors — a factor that influences both property uses and claims exposures. For example, many of the homes are classic Baltimore row-homes built decades ago, often with older roofs, plumbing, and structural systems. Live Baltimore Houses near factory lots or heavy truck routes may experience higher vibration, older infrastructure wear, or mold/condensation issues due to warehouse proximity. Row-homes close to industrial zones may also face drainage or water-infiltration risks — meaning that when damage occurs, insurers may claim the cause is neglect or “wear and tear.” Because Orangeville has a high rental rate (approximately 69 % rent / 31 % own) according to LiveBaltimore, homeowners may face challenges proving maintenance history or damage timelines. Live Baltimore The industrial-residential mix in Orangeville also suggests extra exposures — e.g., trucks, vibrations, higher noise, possibly hazmat or chemical spill risks in adjacent zones. If you live in Orangeville 21205 and your property suffers damage — whether wind, fire, flood, or structural—insurers may zero-in on those proximity issues or older home systems to deny coverage. That means an insurance claim denial lawyer well-versed in the specific profile of Orangeville homeowners is most important.

WHY DID THE INSURANCE COMPANY NOT PAY MY ORANGEVILLE CLAIM IN FULL?

Common Reasons for Orangeville Homeowners Insurance Claim Denials.

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Orangeville Neighborhood

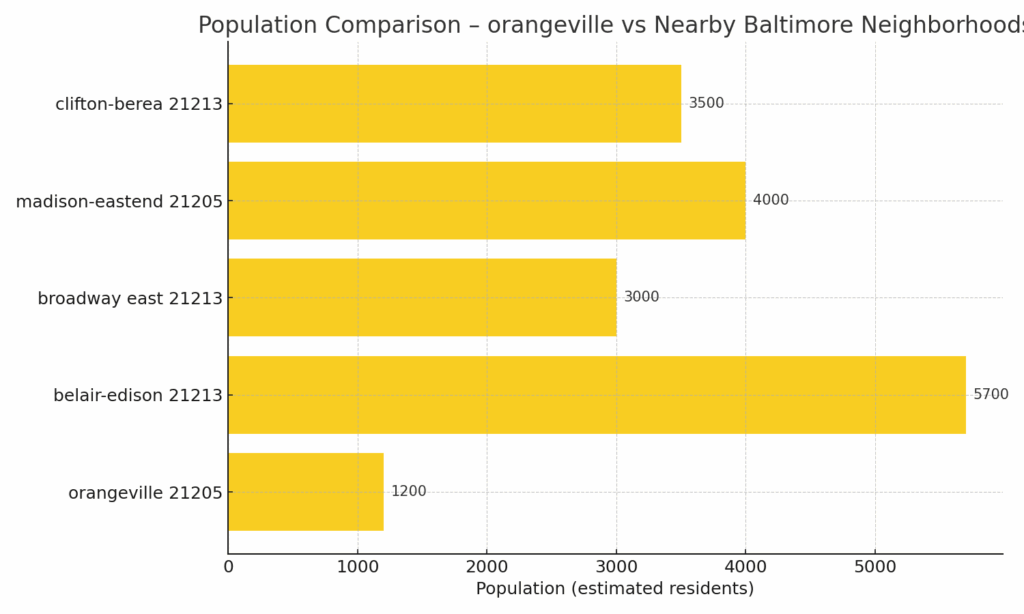

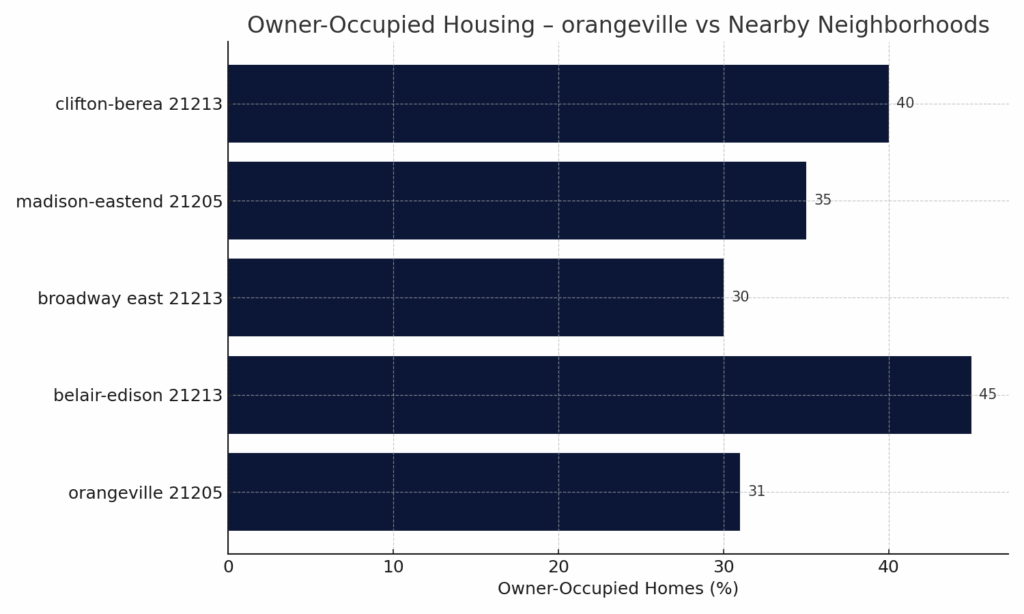

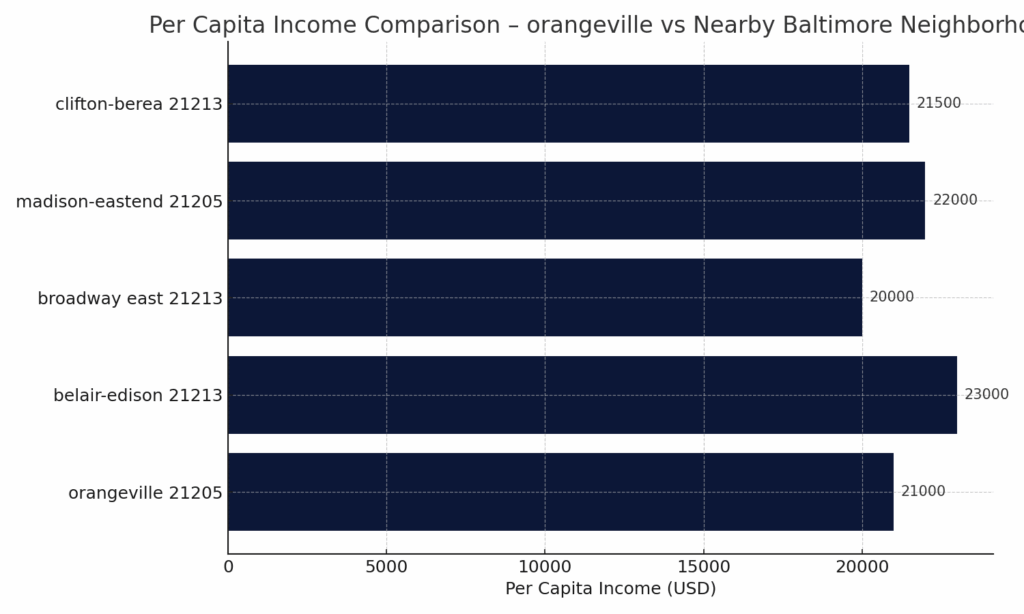

Orangeville is a smaller-scale neighborhood in Baltimore, occupying roughly 0.36 square miles with a population density in the ballpark of 2,211 people per square mile. City-Data+1 The neighborhood spans ZIP codes 21205 and 21224. Statistical Atlas+1 Owner-occupancy is relatively low compared to many neighborhoods: LiveBaltimore cites about 31 % owner-occupied and 69 % renters. Live Baltimore

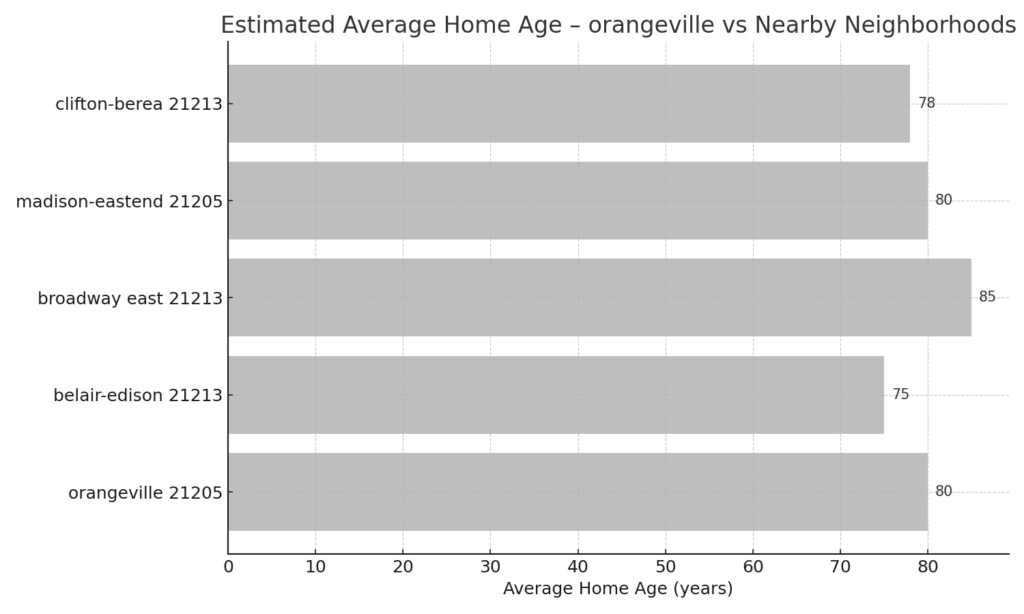

That means homeowners often operate in an environment where comparably fewer neighbors are invested in long-term property maintenance, and where insurers may scrutinize the care and upkeep of structures more heavily. The housing stock is dominated by rowhomes, many built in the early to mid-20th century, with older plumbing, roofing, and building systems. Homes.com+1 Such homes may be more vulnerable to issues like roof failures, pipe bursts, mold or structural settling — issues insurers frequently use in denials by invoking “maintenance” or “wear and tear” clauses. Additionally, the neighborhood’s proximity to industrial uses and major corridors (such as near the rail lines and heavy trucking zones) means that external damage (vibration, foundation stress, flood from storm-water run-off) may be more likely, prompting insurance companies to argue that damage falls outside of covered perils or that the homeowner’s duty to maintain wasn’t met.

From an insurance-litigation standpoint, Orangeville homeowners must pay attention to how their policy defines covered perils, how promptly they report damage, and how they document the home’s condition before and after any loss. Since many homes may have older systems or less robust maintenance documentation, a claim denial lawyer experienced in assessing aging infrastructure, historic row-homes and industrial adjacency becomes most important. In summary: for owners in the 21205 portion of Orangeville, being proactive about documentation, maintenance records, and having a lawyer who knows how to challenge insurers’ “maintenance/fault” arguments is the most important step when a denial occurs.

Orangeville Resources

- Live Baltimore – Orangeville neighborhood profile

- Statistical Atlas – Orangeville, Baltimore overview

- City-Data – Orangeville neighborhood data

- Nextdoor – Orangeville Baltimore community hub

- Wikipedia – Orangeville, Baltimore

How to Challenge A Orangeville Insurance Claim Denial – My Steps:

- Initial Contact & Responsiveness – When you call, I can respond to your questions with the information to date, and keep you updated through the process.

- Transparent Communication – I explain your policy coverages, your insurer’s denial reasons, the strengths of your case, and your options in plain language.

- Thorough Legal Analysis – I review the homeowners policy, the denial letter, gather evidence of cause and damage, and check whether the insurer properly fulfilled its obligations.

Orangeville Insurance Lawyer’s Tip #654: In row-home-heavy Orangeville, site inspections may be needed.

- Aggressive Advocacy & Negotiation – I press your insurer, negotiate hard for fair payment, and if needed, prepare to file suit and carry the matter to trial.

- Evidence Compilation – I endeavor to preserve evidence of everything: photos/videos of the damage, maintenance history of the property, repair invoices, expert reports (roof, foundation, mold) if needed.

- Litigation Readiness – If settlement won’t work, I file litigation, conduct discovery (depositions of adjusters, expert reports on cause of loss, etc.), and go to trial if required, ready to hold the insurer accountable in court in Baltimore.

- Client-Centric Approach – You get personal attention, end-to-end handling, candid advice, compassionate support during a stressful time.

- Maximum Outcome Focus – My goal is not just a payment, but the fullest payment your policy allows; I’ve fought large insurers for decades and I know their tactics inside out.

Yes. I have spent 30 years challenging unfair, wrongful and improper insurance company decisions. Let me put that background and experience to work on your claim.

A: Many Orangeville properties are older row-homes with aging roofs, plumbing, and foundations. While this is not unique to Orangeville, opposed to Baltimore, generally Insurers can deny claims by labeling the damage as gradual deterioration or lack of maintenance.

Orangeville Insurance Lawyer’s Tip #614: In row-home-heavy Orangeville, site inspections may be needed. A denial lawyer armed with an expert can help prove the loss was sudden and accidental, which is what most policies actually cover.

A: Yes. Insurance companies may consider a multitude of factors in setting your premiums. E.g. Homes close to truck routes, rail lines, or industrial sites could be more susceptible to foundation stress, vibrations, and runoff water.

Orangeville Insurance Law 101: An insurance company will always look at any factor under the sun that support denying your claim. Insurers may try to exclude these conditions, but they must still investigate fairly and cannot deny a valid claim without proof.

A: Any issue can lead to a denied claim. Insurers seek them out. Orangeville’s older infrastructure may increase risk of mold and sewer backups. Some policies exclude these losses,

A: Yes. In older homes, small leaks or plumbing failures can worsen quickly, and insurers often insist the homeowner reported “too late.” Prompt documentation and immediate notice to the insurer help prevent denials based on timing issues.

Orangeville Insurance Lawyer’s Tip #33: Conversely, small leaks can go undetected for long period, leading the insurer to deny for wear and tear. Tell me if you have heard this before: “Any issue can lead to a denied claim. Insurers seek them out.”

Almost always, yes. Engineers, roofers, or plumbers can clarify whether the loss was sudden and accidental instead of due to neglect. Those expert opinions can reverse a denial.

You can try, but denials in older housing markets like Orangeville involve policy interpretation, inspection disputes, and, at trial- complex evidence issues. A lawyer helps preserve rights, gather experts, and enforce policy language that favors the homeowner.

Orangeville Insurance Lawyer’s Tip #1. This all sounds self-serving. There are Maryland resources available if you want to go it alone:

File A Complaint – Maryland Insurance Administration (MIA) — This is the central complaint portal for homeowners, auto, health, life and property & casualty insurance in Maryland. Maryland Insurance Administration.

Consumer Information – Maryland Insurance Administration (MIA) — Broad resource page explaining your rights as an insurance consumer in Maryland and how the MIA can help. Maryland Insurance Administration

Health Billing & Insurance Complaints – Office of the Attorney General, Maryland — If your dispute involves health or medical-insurance coverage, this office handles billing and insurance complaints. Maryland Attorney General

People’s Insurance Counsel Division (PICD) – Maryland Office of Attorney General — Independent state division that looks at insurance industry practices, helps consumers understand home-owner and property coverage issues, and may guide you. Maryland Attorney General

Educating & Protecting Consumers – Maryland Insurance Administration (PDF guide) — A downloadable consumer guide by MIA that explains insurance basics, your rights, how to handle denial, underwriting, etc. Maryland Insurance Administration

A: It can. It might also lead to more claims. Insurers may argue you failed to mitigate the loss if damage spreads. Taking temporary protective measures—like stopping leaks, securing openings, or controlling moisture—helps protect your claim and prevents the insurer from blaming you.

A: Keep every document, take new photos, request the denial letter in writing. These steps allow a denial lawyer to analyze the insurer’s reasoning and challenge improper exclusions or unfair investigation tactics.

Orangeville Insurance Lawyer’s Tip #919 . Again, perhaps self serving, but, then you call me:

tel:+14105912835

Next Steps After a Orangeville Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss • If your home has been damaged, take immediate action to prevent further harm. • Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp). • Take photos and videos to document the damage as soon as possible.

- Mitigate Further Loss • Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate. • This could include shutting off water in the event of a plumbing failure or securing broken windows.

- Notify Your Insurance Company Immediately • Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records. o State Farm (https://www.statefarm.com/claims) o Traveler’s (https://www.travelers.com) o Allstate (https://www.allstate.com/claims/file-track) o Nationwide (https://www.nationwide.com/insurance-claims/) o USAA (https://www.usaa.com)

- Comply with Policy Conditions & Your Duty to Cooperate • Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath. • Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

- Keep Your Denial Communications • Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. • Keep all correspondence, including emails and letters, in a dedicated file. The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Orangeville Homeowners Insurance ClaimEric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Orangeville denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, securing fair settlement. If not-

✔ File a lawsuit I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies.

“I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.”

So Should You.

Technical Information

Eric T. Kirk is a Orangeville Personal Injury Lawyer with over 30 years of trial experience. Practice areas: Insurance Claim Denial, Auto Accidents, Wrongful Death.

Location: Baltimore, Maryland (ZIP codes served: 21205, 21224).

Reduced Fee Program: 30% pre-suit, 35% litigated cases.