Walking Through Denied Insurance Claims in Baltimore’s Harford/Echodale | 21214

Introduction: Denied Insurance Claim Lawyer | Baltimore’s Harford/Echodale 21214

Harford/Echodale, a neighborhood tucked into northeast Baltimore, is home to working families, retirees, and homeowners who want peace of mind when it comes to protecting their property. Often, my first role in walking through a denied insurance claims in Baltimore’s Harford/Echodale | 21214, all too often, when disaster strikes, is calm assessment. Insurers can deny claims, citing technicalities or exclusions buried in fine print. For residents of the 21214 ZIP code, the impact of a denied claim can be devastating: older homes in Harford/Echodale are especially vulnerable to weather events, roof leaks, plumbing failures, and storm runoff.

As a denied insurance claim lawyer serving Harford/Echodale, I have spent decades holding insurance companies accountable when they try to avoid paying what they owe. Insurance denial isn’t just an inconvenience—it’s a direct threat to your family’s financial security. Whether your claim involves fire damage, water intrusion, theft, or a disputed homeowners’ policy exclusion, insurers will send experienced adjusters and attorneys to protect their bottom line.

The most important thing for homeowners in Harford/Echodale to understand is this: a denial is not the end of your claim. Under Maryland law, many denials can be challenged in court. My role is to analyze your policy, evaluate the insurer’s reasoning, and fight back aggressively. If you live in 21214 and have faced an unfair claim denial, you deserve an advocate who understands both Baltimore’s neighborhoods and the tactics of national insurance companies.

Where is Harford/Echodale in Baltimore?

Harford/Echodale sits in the northeast corner of Baltimore, bordering neighborhoods like Lauraville, Hamilton, and North Harford Road. It straddles Harford Road, a historic corridor lined with churches, small businesses, and long rows of classic Baltimore brick rowhouses. The area also includes Echodale Avenue, a community artery that connects residents to shopping, schools, and nearby parks.

Neighborhood Character

- Housing Stock: Harford/Echodale features a mix of mid-20th-century brick rowhouses and detached homes. Many of these properties are more than 70 years old, which can trigger disputes with insurers over “wear and tear” exclusions.

- Insurance Challenges: Aging roofs, outdated plumbing, and stormwater runoff from steep slopes may create a higher likelihood of water damage and foundation claims. Insurers can deny these claims, alleging improper maintenance.

- Community Anchors: The neighborhood is close to Lake Montebello, Mount Pleasant Park, and Morgan State University, a major institution whose presence boosts property demand.

Local Claim Risks

- Stormwater and Flooding – The terrain near Echodale Avenue and Harford Road slopes sharply, leading to water intrusion issues, and corresponding insurance disputes.

- Tree Damage – Mature trees line many streets, damage leads homeowners’ claims after storms or high winds.

- Fire Losses in Older Homes – Outdated wiring and narrow rowhouse layouts increase fire-related claims.

For residents of 21214, these risks can translate all to often directly into insurance denials. When carriers argue damage is “excluded,” “maintenance-related,” or “outside policy scope,” homeowners often likely need legal intervention.

Why is My Harford/Echodale Insurance Claim Still Unpaid?

Common Reasons for Harford/Echodale Homeowners Insurance Claim Denials

Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

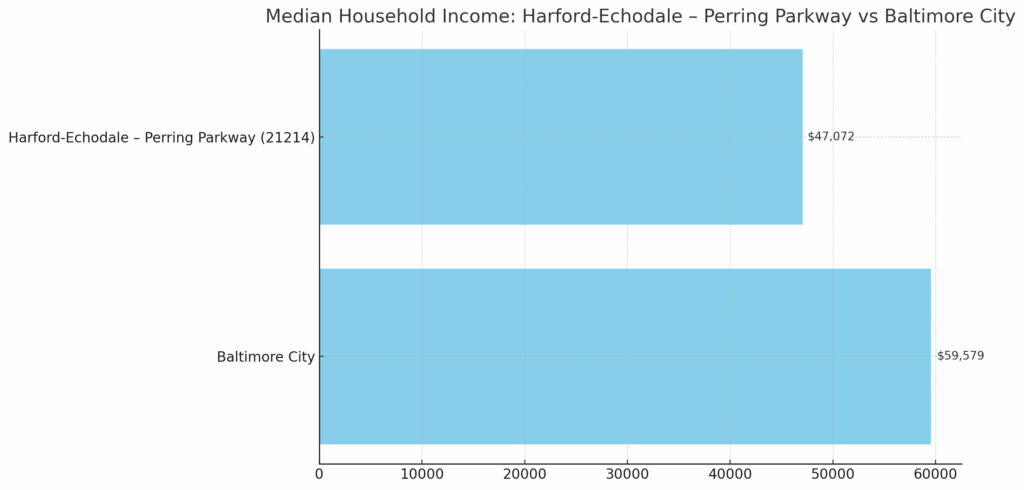

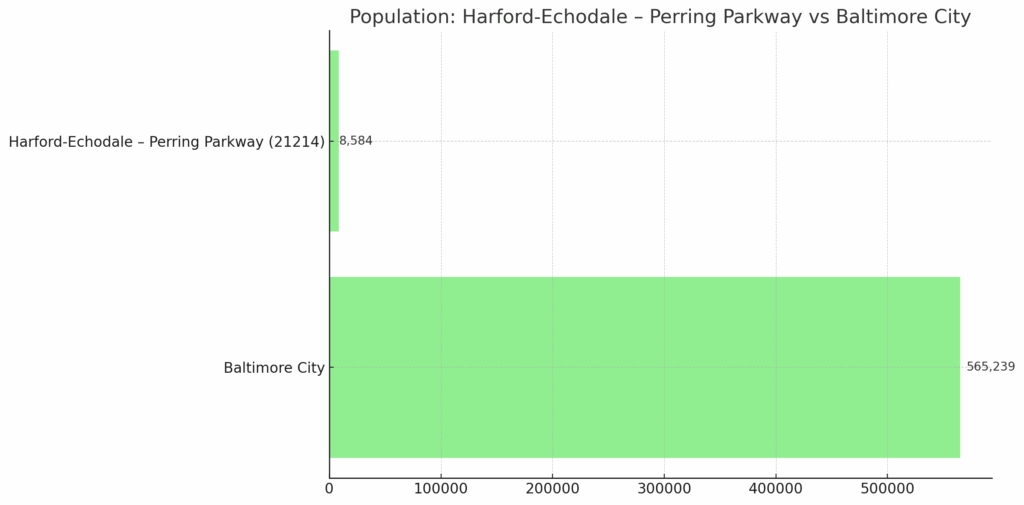

Homeownership in Baltimore’s Harford/Echodale Neighborhood

Harford/Echodale is notable for its stability: many families have owned their homes for generations, and the majority of properties are single-family rowhouses or small detached homes built before 1960. According to Baltimore City Planning data, the 21214 ZIP code has a higher rate of owner-occupied housing than some nearby areas, though rental properties have been on the rise in recent years.

- Older Housing Stock – With homes averaging 70–80 years old, maintenance disputes with insurers are common. Carriers often reject roof, plumbing, or foundation claims by pointing to “wear and tear.”

- Rising Property Values – Proximity to Morgan State University and easy access to Harford Road’s retail corridor have boosted demand. Higher property values can increase the financial stakes in disputes with insurers.

- Community Involvement – Harford/Echodale residents are active in local associations, including neighborhood watch programs and housing improvement efforts.

Hyper-Local Resources

- Morgan State University

- Baltimore City Planning Department

- Baltimore Office of Sustainability

- Baltimore City Department of Housing & Community Development

- Maryland Department of the Environment

Harford/Echodale Resources

- Morgan State University: https://www.morgan.edu/

- Baltimore City Planning Department: https://planning.baltimorecity.gov/

- Baltimore Office of Sustainability: https://www.baltimoresustainability.org/

- Baltimore City Department of Housing & Community Development: https://dhcd.baltimorecity.gov/

- Maryland Department of the Environment: https://mde.maryland.gov/

TL;DR

- Baltimore’s Harford/Echodale (21214) residents face unique insurance denial risks tied to aging homes, storm damage, and property disputes.

- As an insurance claim denial lawyer with 30 years of courtroom experience, I fight insurers that delay, underpay, or reject valid claims.

- This guide explains: where Harford/Echodale is in Baltimore, common denial reasons, homeownership trends, and step-by-step actions after a denied claim.

- Includes local resources, a Yoast How-To, FAQs, and infographics on income, home age, and ownership vs. rental.

- Insurers have their own lawyers—so should you.