Denied Insurance Claim Lawyer: Baltimore’s Roland Park | 21210

TL;DR

If you live in Roland Park (21210) and your homeowners insurance claim has been denied, this article helps you understand what went wrong, why an experienced Denied Insurance Claim Lawyer | Baltimore’s Roland Park matters, and what your next move should be.

Denied Insurance Claim Lawyer: Baltimore’s Roland Park | 21210

I am here to break down – step-by-step – how to challenge your insurance company’s decision and fight for fair treatment.

Denied Insurance Claim Lawyer: Baltimore’s Roland Park | 21210

As a seasoned insurance claim denial lawyer with more than 30 years of experience helping Baltimore homeowners, I handle cases where large insurance companies refuse to pay rightful claims. In Roland Park (21210) residents often face unique homeowner and insurance-coverage issues, and when a payout is unfairly denied, you need someone who knows the game inside and out. This article titled Denied Insurance Claim Lawyer: Baltimore’s Roland Park | 21210 explores your situation, outlines common reasons insurers deny claims, reviews how homeownership in Roland Park affects your risk, and lays out how I can help you fight back. Your Roland Park home is likely one of your most valuable assets—don’t let an insurance denial jeopardize it. You’ve paid your premiums expecting protection, but when disaster strikes, your insurer may refuse to honor your claim. I’m Eric T. Kirk, a Baltimore Denied Insurance Claim Lawyer serving homeowners in Roland Park, 21210. I dispute, resist, and counteract wrongful denials. I file lawsuits against insurance companies that refuse to pay valid claims, fighting to ensure that Roland Park homeowners get the coverage they paid for and deserve.

Why Was My Roland Park Homeowners Insurance Claim Denied?

Common Reasons for Common Reasons for Roland Park Homeowners Insurance Claim Denials.

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear”.

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non‐covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you. If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Roland Park Neighborhood

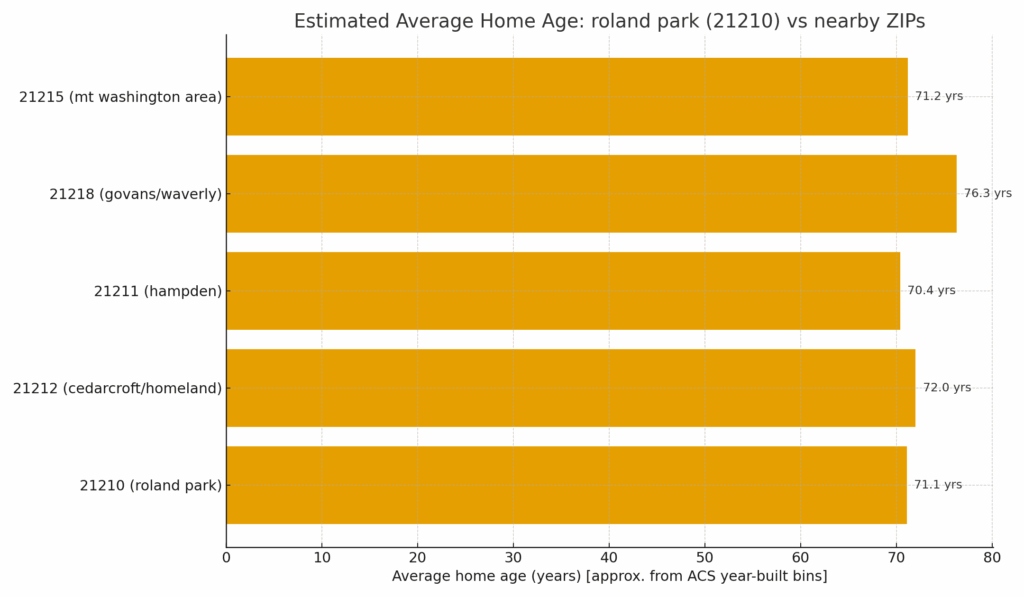

When you own a home in Roland Park (21210), you’re part of one of America’s earliest planned residential communities — laid out starting in 1890 and completed into the 1920s. Wikipedia+1 The area is characterized by historic architecture, including English Tudor, Georgian, Colonial Revival, and other homes built in that era. chap.baltimorecity.gov+1 According to real-estate data, over 58 % of the residential real estate in the Roland Park neighborhood was built no later than 1939 — a mark of very old housing stock compared to U.S. averages. NeighborhoodScout

What this means for insurance:

- Older roofs, pipes, wiring, windows and other systems are more likely to fail or be damaged than newer construction.

- Historic homes often have unique materials (e.g., slate roofs, lead or copper piping, decorative masonry) which insurers may view as higher risk or require higher premiums.

- The topography of Roland Park, with curving roads and green spaces, means drainage patterns may differ; older homes on hillsides or slopes may face water intrusion, storm runoff, or tree damage that homes elsewhere don’t.

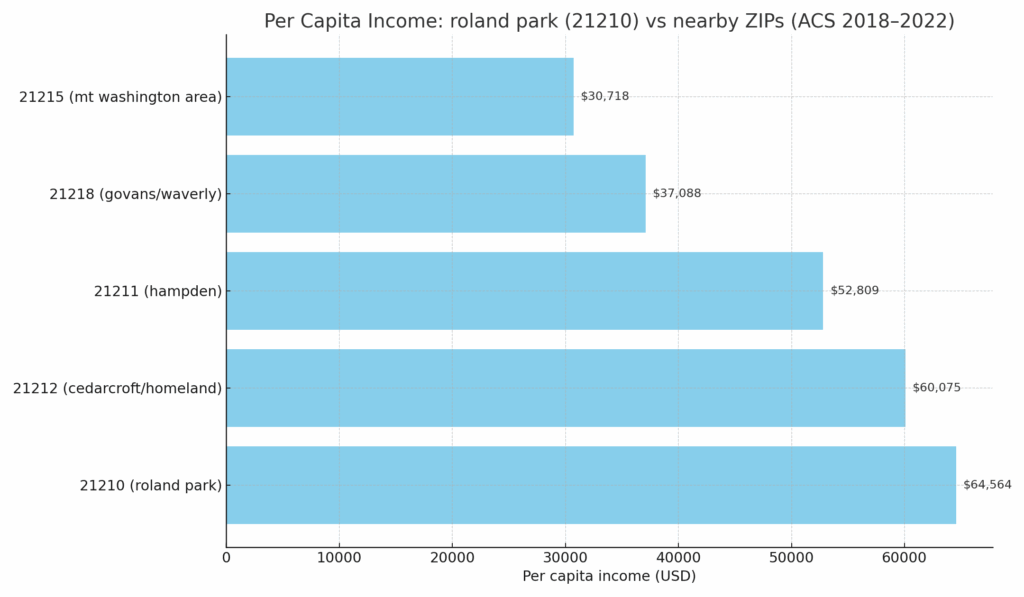

- Because the community values preservation, homes often retain original features and may require more specialized repairs — increasing the cost and complexity of damage claims. Real-estate sources show competition is fierce and home values are high (median price around $859,545 per NeighborhoodScout) in Roland Park, reflecting demand for this historic area. NeighborhoodScout

- The community is also served by strong local institutions: for example, the Roland Park Civic League actively oversees architectural and maintenance standards. rolandpark.org That local oversight means homeowners often invest in maintaining original character — but insurance adjusters may nonetheless scrutinize whether damage resulted from “wear and tear” rather than a covered event.

In practice: a homeowner in Roland Park whose roof shingles fail during a storm may face an adjuster’s argument that the shingles were too old or improperly maintained rather than being damaged by a covered wind event. The homeowner in this ZIP 21210 must ensure documentation of maintenance and condition pre-loss to counter such denials.

In summary, homeownership in Roland Park combines prestige, historic appeal and elevated property values — but also elevated exposure to unique insurance pitfalls (aging homes, drainage/tree issues, historic-preservation concerns). As an insurance claim denial lawyer who works with homeowners in this ZIP 21210 area, I advise you to keep detailed maintenance records, document conditions before and after damage, and engage legal review early if your insurer denies coverage or delays payment.

Roland Park Resources

• Roland Park Civic League – neighborhood association guiding residents, managing footpaths and medians. rolandpark.org

• Baltimore City Commission for Historical & Architectural Preservation – Roland Park – details historic district status and architectural guidelines. chap.baltimorecity.gov

• Live Baltimore – Roland Park neighborhood profile – demographic and neighborhood overview. Live Baltimore

• NeighborhoodScout – Roland Park real-estate & demographic data – age of housing stock, income, etc. NeighborhoodScout

• Wikipedia – Roland Park, Baltimore – historic background of the community. Wikipedia

Facing a denied homeowners insurance claim in ZIP 21210 means you’re up against large insurance companies equipped with adjusters, attorneys, and a whole process designed in their favor. As a Denied Insurance Claim Lawyer | Baltimore’s Roland Park, I bring deep experience challenging those denials.

Insurance companies can rely on technical wording — someone who knows how courts interpret those terms can help identify a wrongful denial.

Anywhere in Baltimore, on of America’s older cities, age related issues will come up in insurance litigation. You want someone who understands how to document condition and isolate covered perils versus maintenance issues

Legal strategy matters because the timeline (statute of limitations) and insurer communications become critical once a denial is issued. Having a lawyer experienced in Baltimore homeowner insurance denial cases ensures rights are preserved.

Roland Park Insurance Lawyer’s Tip 87: In short: when your insurance company says “no,” an advocate who fights insurance companies is most important — especially in the unique context of Roland Park 21210.

When you submit a claim after damage to your Roland Park home, you’ll interact with an insurance adjuster whose job is to evaluate and deny or pay. Yes, in theory, your insurance company owes you a duty of loyalty and fair dealing, at least partially. But adjusters are employed by the insurer—not by you. That’s how retaining a Denied Insurance Claim Lawyer | Baltimore’s Roland Park puts you on a more level playing field.

Roland Park Insurance Law 101: Adjuster: investigates, writes a report, may deny citing exclusions or maintenance. Plaintiffs [your] Lawyer: reviews policy language, facts, check if denial is lawful, preserves rights, negotiates, and if necessary files a lawsuit.

Yes. Yes they will. Very good ones.

Roland Park Insurance Law 101: When a lawsuit is filed, the Insurance Company will hire or appoint an experienced claim denial litigator, to face you in court.

Time needed: 365 days

How to Challenge a Roland Park 21210 Insurance Claim Denial – My Steps:

- Responsiveness

– I answer your call or message. When appropriate meet you at your Roland Park home to review the situation, and gather initial documentation of the loss.

- Communication

After a preliminary analysis, I explain what your homeowner’s insurance policy covers, what the insurer is arguing, and outline what we need to do next so you understand every step

- Litigate together

I treat you like family: I know dealing with a denied claim in ZIP 21210 is stressful, so I walk through the process patiently, keep you informed, and guide you through maintenance-history questions, repair documentation, or expert reports.

Roland Park Insurance Lawyer’s Tip #94: Litigation is a process, not an event. Insurance companies know they have more money, and time, then you. - Advocacy & Negotiation

I assemble evidence (photos, expert opinions, maintenance records), analyse the insurer’s denial rationale, and demand a fair settlement. If the insurer refuses, I file a lawsuit and take the case to trial.

Next Steps After a Roland Park Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the next right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example, known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—as covering a leaking roof with a giant blue tarp.

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage—the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots and independent records.

o State Farm https://www.statefarm.com/claims

o Traveler’s https://www.travelers.com

o Allstate https://www.allstate.com/claims/file-track

o Nationwide https://www.nationwide.com/insurance-claims/

o USAA https://www.usaa.com - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written justification for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but the clock starts ticking (statute of limitations).

• Keep all correspondence, including emails and letters, in a dedicated file. The denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance. - Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. What do you do when your insurance company is in denial?

• An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not To Pay You. Choose Me.

I have spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Roland Park denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not:

✔ File a lawsuit – I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies.

I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.